Triple Top

was formed on 21.03 at 17:40:24 (UTC+0)

signal strength 1 of 5

The Triple Top pattern has formed on the chart of the GBPAUD M5. Features of the pattern: borders have an ascending angle; the lower line of the pattern has the coordinates 2.0592/2.0597 with the upper limit 2.0615/2.0616; the projection of the width is 23 points. The formation of the Triple Top figure most likely indicates a change in the trend from upward to downward. This means that in the event of a breakdown of the support level of 2.0592, the price is most likely to continue the downward movement.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

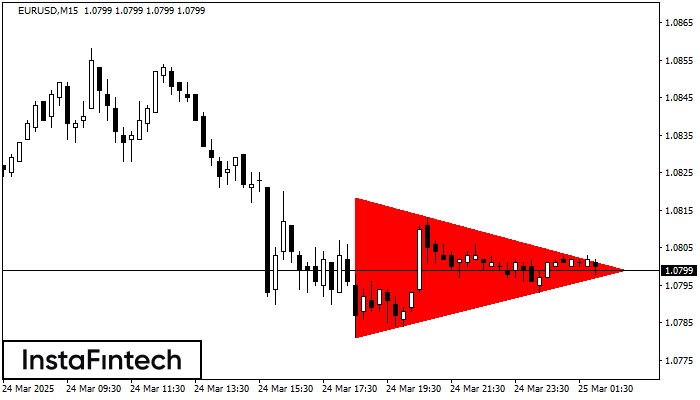

Bearish Symmetrical Triangle

was formed on 25.03 at 02:15:36 (UTC+0)

signal strength 2 of 5

According to the chart of M15, EURUSD formed the Bearish Symmetrical Triangle pattern. Description: The lower border is 1.0781/1.0799 and upper border is 1.0818/1.0799. The pattern width is measured

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

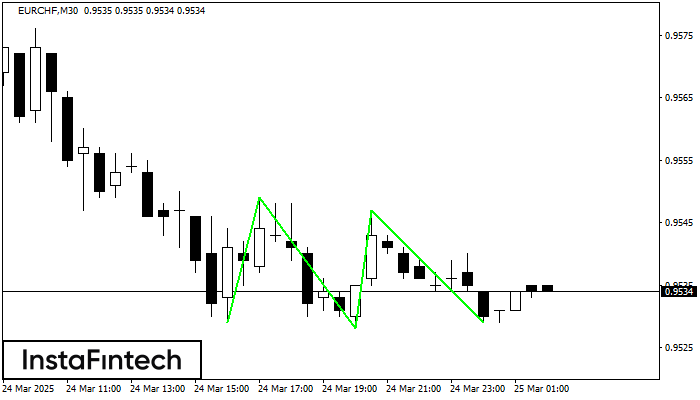

Triple Bottom

was formed on 25.03 at 02:00:36 (UTC+0)

signal strength 3 of 5

The Triple Bottom pattern has formed on the chart of the EURCHF M30 trading instrument. The pattern signals a change in the trend from downwards to upwards in the case

Open chart in a new window

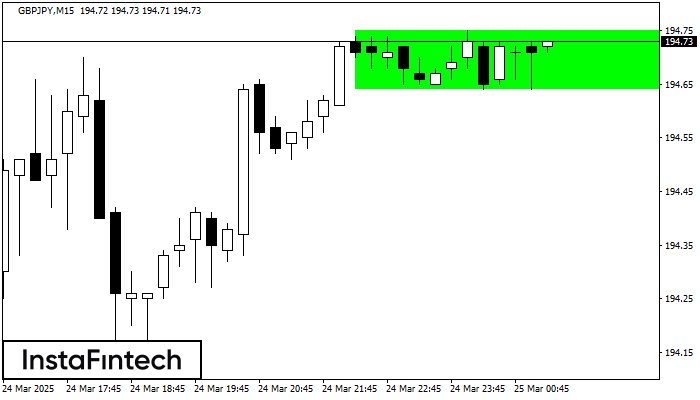

Bullish Rectangle

was formed on 25.03 at 01:16:00 (UTC+0)

signal strength 2 of 5

According to the chart of M15, GBPJPY formed the Bullish Rectangle. This type of a pattern indicates a trend continuation. It consists of two levels: resistance 194.75 and support 194.64

The M5 and M15 time frames may have more false entry points.

Open chart in a new window