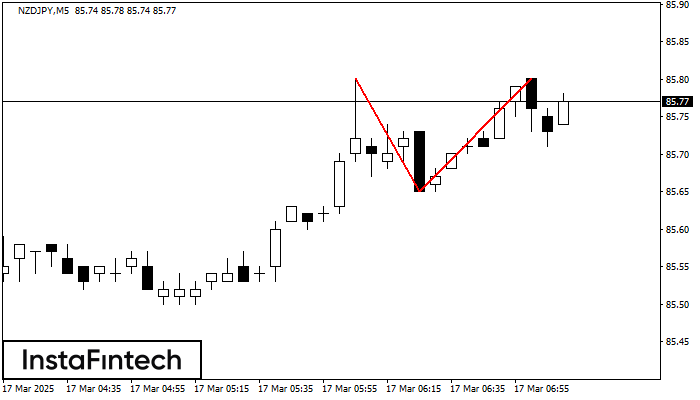

Double Top

was formed on 17.03 at 07:10:32 (UTC+0)

signal strength 1 of 5

The Double Top reversal pattern has been formed on NZDJPY M5. Characteristics: the upper boundary 85.80; the lower boundary 85.65; the width of the pattern is 15 points. Sell trades are better to be opened below the lower boundary 85.65 with a possible movements towards the 85.50 level.

The M5 and M15 time frames may have more false entry points.

ดูเพิ่มเติม

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

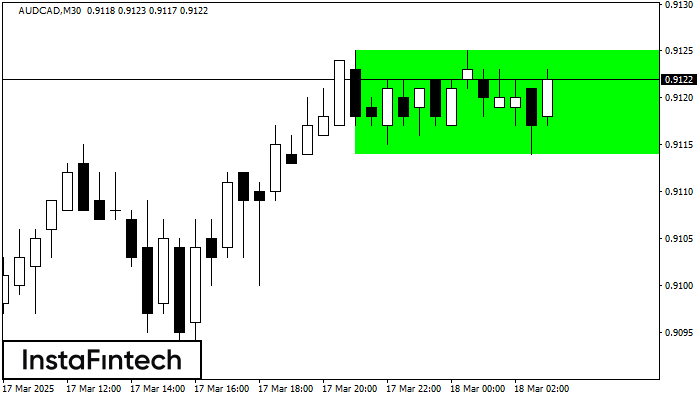

Bullish Rectangle

was formed on 18.03 at 03:13:05 (UTC+0)

signal strength 3 of 5

According to the chart of M30, AUDCAD formed the Bullish Rectangle which is a pattern of a trend continuation. The pattern is contained within the following borders: the lower border

Open chart in a new window

Bullish Rectangle

was formed on 18.03 at 03:05:12 (UTC+0)

signal strength 2 of 5

According to the chart of M15, AUDCAD formed the Bullish Rectangle which is a pattern of a trend continuation. The pattern is contained within the following borders: the lower border

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Bullish Symmetrical Triangle

was formed on 18.03 at 03:00:24 (UTC+0)

signal strength 2 of 5

According to the chart of M15, AUDCHF formed the Bullish Symmetrical Triangle pattern. Description: This is the pattern of a trend continuation. 0.5628 and 0.5619 are the coordinates

The M5 and M15 time frames may have more false entry points.

Open chart in a new window