Vea también

14.02.2025 09:09 AM

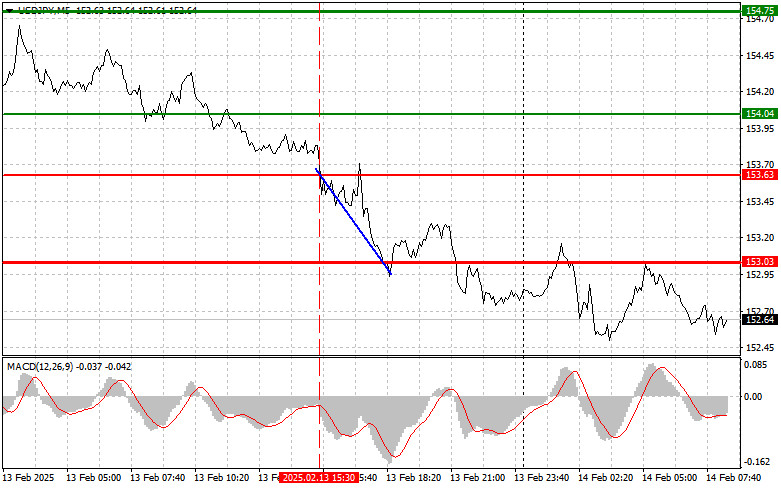

14.02.2025 09:09 AMThe price test at 153.63 coincided with the moment when the MACD indicator began to move downward from the zero mark, confirming an ideal entry point for selling the dollar. As a result, the pair dropped toward the target level of 153.03. Buying on a rebound from that level generated a profit of approximately 20 pips, after which selling pressure on the pair returned.

Despite U.S. President Donald Trump instructing his administration to consider imposing retaliatory tariffs on various trading partners—an action that raises the likelihood of a broader trade war—the dollar weakened against the yen throughout the day. Japanese authorities have reached out to the Trump administration for clarification on trade restrictions, indicating Japan's willingness to engage in dialogue. This may have helped the yen maintain its strength against the dollar.

Japan is likely to advocate for a review of trade conditions that they believe disadvantage Japanese manufacturers. The primary focus is on the automotive industry, where export tariffs could significantly affect the competitiveness of Japanese companies in the U.S. market. Meanwhile, the Bank of Japan continues its monetary tightening policy, which supports demand for the yen.

Thus, the situation regarding the yen remains complex and multifaceted. On one hand, there is pressure from the U.S. on trade issues; on the other, there is support from Japan's tight monetary policy and readiness for negotiations. The future movement of the USD/JPY pair will depend on how effectively Japan defends its economic interests in talks with American counterparts.

Regarding the intraday strategy, I will primarily rely on Scenarios #1 and #2.

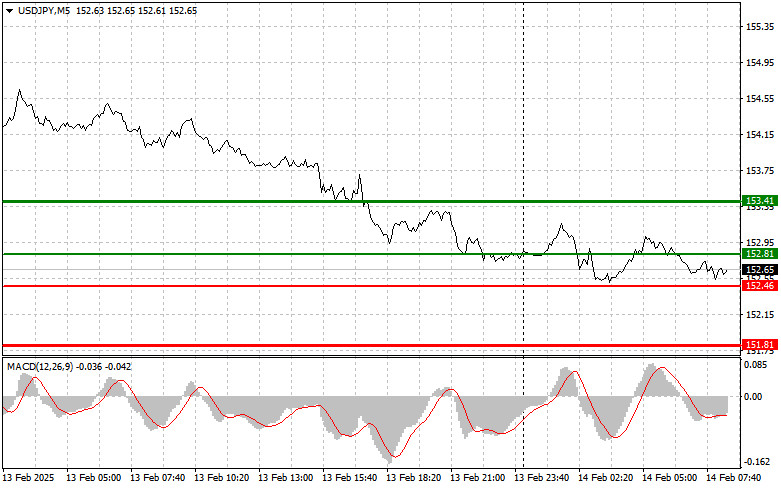

Scenario #1: I plan to buy USD/JPY at 152.81 (green line on the chart) with a target of 153.41 (thicker green line). Around 153.41, I plan to exit long positions and initiate short positions in anticipation of a 30-35 pip retracement. It is preferable to return to buying the pair during corrections and significant pullbacks in USD/JPY. Important! Before entering a buy trade, ensure that the MACD indicator is above the zero mark and starting to rise.

Scenario #2: Buying USD/JPY is also an option if the price tests 152.46 twice while the MACD indicator is in the oversold zone. This setup would limit the pair's downside potential and trigger a market reversal to the upside. A rise toward the opposite levels, 152.81 and 153.41, is expected.

Scenario #1: Selling USD/JPY is planned after breaking below 152.46 (red line on the chart), which could lead to a rapid decline in the pair. The key target for sellers will be 151.81, where I intend to exit short positions and immediately enter long positions (expecting a 20-25 pip retracement from the level). Selling pressure on the pair could return at any moment in the first half of the day. Important! Before selling, ensure that the MACD indicator is below the zero mark and beginning to decline.

Scenario #2: Selling USD/JPY is also an option if the price tests 152.81 twice while the MACD indicator is in the overbought zone. This setup would limit the pair's upside potential and trigger a market reversal to the downside. A decline toward 152.46 and 151.81 can be expected.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

El petróleo respira cambios. La política y la economía vuelven a entrelazarse en un nudo apretado, y los activos de materias primas —especialmente el petróleo y el gas— se convierten

Los futuros del petróleo Brent subieron a aproximadamente $71,3 por barril el martes, marcando la tercera sesión consecutiva de crecimiento, ya que la tensión en Medio Oriente eclipsó otros acontecimientos

El mercado bursátil vuelve a subir, con el S&P 500 en la cúspide de la euforia. ¿Qué será lo próximo? ¿Los aranceles y la política de la Reserva Federal reforzarán

El jueves, los futuros de las acciones estadounidenses permanecen prácticamente sin cambios después de un impresionante rally en la sesión de trading anterior, cuando el S&P 500 alcanzó máximos históricos

Análisis de operaciones y consejos para operar con el yen japonés La prueba del precio 155.96 coincidió con el momento en que el indicador MACD apenas comenzaba a moverse hacia

Análisis de operaciones y consejos para operar con la libra esterlina. La primera prueba del precio 1.2184 en la segunda mitad del día coincidió con el momento

Análisis de las operaciones y consejos para operar con el euro. La prueba del precio 1.0282 en la segunda mitad del día coincidió con el momento en que el indicador

Análisis de las operaciones y consejos para operar con el yen japonés La prueba del nivel de precio 157.98 coincidió con el momento en que el indicador MACD había descendido

cuentas PAMM

InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.