Vea también

21.08.2023 08:25 AM

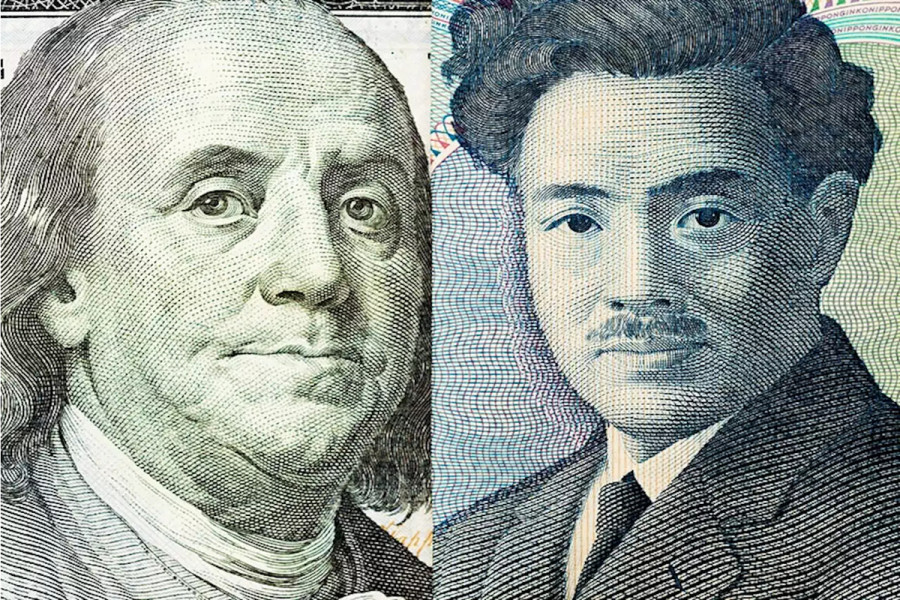

21.08.2023 08:25 AMAs we embark on a new trading week, the USD/JPY currency pair has taken a neutral stance, signaling a cautious sentiment among investors ahead of the Federal Reserve symposium in Jackson Hole scheduled for August 24-26. All eyes are on the Federal Reserve's Chairman, Jerome Powell, whose speech will likely be a pivotal factor affecting the USD/JPY's trajectory. What can we expect from Powell's statement and how might it sway the greenback?

USD/JPY trapped in a sideways channel

The onset of Monday saw the USD/JPY pair settle into a neutral zone, with both currencies evenly matched and displaying little momentum.

Several factors currently serve as drivers for the yen:

Worries about decelerating global growth also buoy the US dollar, given its reputation as a haven asset. Yet, the central divergence in the monetary policies of the Fed and the Bank of Japan (BOJ) remains the strongest catalyst influencing the greenback's movements against the yen.

Speculations have long surrounded the BOJ's monetary approach. Still, the regulator sticks to its dovish strategy, hinting that no change is coming anytime soon.

Regarding the Federal Reserve, most investors anticipate a pause in its rate-hiking cycle in September. Yet, there's growing chatter about another tightening episode by year-end.

The recently released minutes from the FOMC's July meeting suggest that a significant chunk of Fed officials perceive an escalation in inflation risks, potentially warranting more hawkish measures.

Strong US macroeconomic indicators further underscore the robustness of its economy. A consensus among experts posits that these factors might allow the Federal Reserve to maintain its hawkish stance longer than was previously expected.

The burning question traders grapple with is the time the Federal Reserve will need to sustain elevated rates. Until a clear answer emerges, the greenback's consolidation phase is likely to persist.

Forecasts suggest that significant volatility in the USD majors, including the USD/JPY pair, is expected this Friday following Jerome Powell's speech at the Jackson Hole symposium. The direction the US currency takes will largely depend on Powell's tone. If the market interprets his speech as hawkish, the dollar might receive a boost.

On the other hand, a dovish tone from the Fed Chair could send the greenback tumbling across the board, including against the yen.

What's the likely scenario?

The majority of economists surveyed by Bloomberg believe Powell won't declare the Fed's anti-inflation mission as accomplished on Friday.

Nearly 80% of respondents asserted that US consumer price growth will remain above target levels in the coming years, necessitating the Fed to maintain its hawkish stance, which typically implies higher interest rates.

Analyst Jerome Schneider believes that persistent inflation will leave the Federal Reserve with no choice but to keep rates above the 5% mark for several months to come. He predicts the regulator might only commence rate reductions around mid-2024 or later.

It's probable that Powell won't specify any exact timelines during his Jackson Hole symposium speech. However, he might subtly indicate that the Fed's tightening cycle is far from over.

"We expect the Fed Chair to strike a more balanced tone in Wyoming. He'll likely hint at the end of the tightening cycle but emphasize the need to keep interest rates elevated for longer," commented Anna Wong for Bloomberg Economics.

If investors receive compelling evidence suggesting prolonged high interest rates in the US, the dollar could gain strength across all fronts, with USD/JPY being the main winner.

In an optimistic scenario, the greenback might strengthen against the yen to 147 by the week's end, provided there's no intervention warning from the Japanese government.

Technical outlook

The daily chart reveals a bullish exhaustion for the USD/JPY pair. The fading momentum is evident in the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) indicator.

However, the pair remains above the 20-, 100-, and 200-day simple moving averages, indicating that buyers still dominate the market on a broader scale.

The most crucial zones to monitor now are support levels at 145.00, 144.00, and 143.20, and resistance levels at 145.50, 146.00, and 146.30.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

El metal amarillo ha ocupado un lugar de honor entre los activos más demandados y no piensa detenerse en lo logrado. El precio del oro sigue creciendo con seguridad, superando

La primera criptomoneda se encuentra en un estado de "descomposición": no logra encontrar un punto de apoyo. El Bitcoin está experimentando una volatilidad significativa, habiendo mostrado una caída esta semana

Ayer se supo que, a partir de la próxima semana, el presidente de Estados Unidos, Donald Trump, impondrá aranceles del 25% a la importación de automóviles. Esta noticia provocó turbulencias

La sesión de negociación en EE. UU. del martes trajo noticias interesantes para los participantes del mercado: los futuros de gas natural subieron repentinamente, mientras que el petróleo decidió tomarse

El Bitcoin lucha actualmente por un lugar bajo el sol, defendiendo su estatus de primera criptomoneda. Actualmente, el activo estrella no pasa por su mejor momento, aunque muchos expertos

InstaForex en cifras

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.