Bearish Rectangle

was formed on 21.03 at 18:55:39 (UTC+0)

signal strength 1 of 5

According to the chart of M5, #KO formed the Bearish Rectangle. This type of a pattern indicates a trend continuation. It consists of two levels: resistance 68.83 - 0.00 and support 68.57 – 68.57. In case the resistance level 68.57 - 68.57 is broken, the instrument is likely to follow the bearish trend.

The M5 and M15 time frames may have more false entry points.

See Also

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Bearish Rectangle

was formed on 24.03 at 21:46:19 (UTC+0)

signal strength 2 of 5

According to the chart of M15, EURCHF formed the Bearish Rectangle which is a pattern of a trend continuation. The pattern is contained within the following borders: lower border 0.9528

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Bullish pennant

was formed on 24.03 at 21:30:30 (UTC+0)

signal strength 4 of 5

The Bullish pennant pattern is formed on the #MA H1 chart. It is a type of the continuation pattern. Supposedly, in case the price is fixed above the pennant’s high

Open chart in a new window

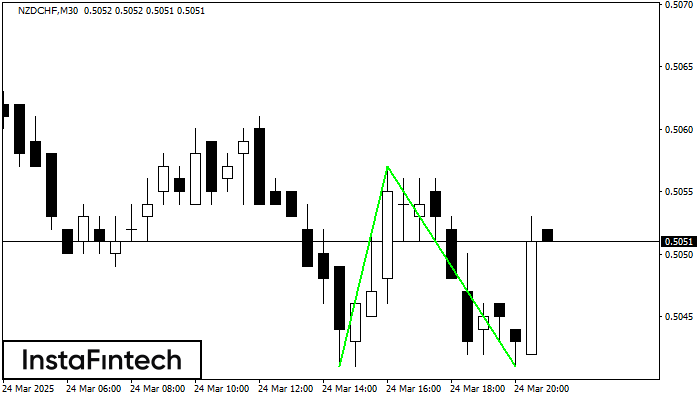

Double Bottom

was formed on 24.03 at 21:01:22 (UTC+0)

signal strength 3 of 5

The Double Bottom pattern has been formed on NZDCHF M30. This formation signals a reversal of the trend from downwards to upwards. The signal is that a buy trade should

Open chart in a new window