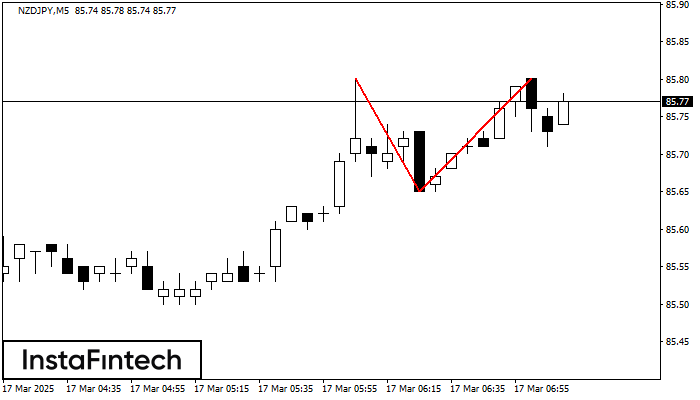

Double Top

was formed on 17.03 at 07:10:32 (UTC+0)

signal strength 1 of 5

The Double Top reversal pattern has been formed on NZDJPY M5. Characteristics: the upper boundary 85.80; the lower boundary 85.65; the width of the pattern is 15 points. Sell trades are better to be opened below the lower boundary 85.65 with a possible movements towards the 85.50 level.

The M5 and M15 time frames may have more false entry points.

See Also

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Bearish Symmetrical Triangle

was formed on 18.03 at 08:42:54 (UTC+0)

signal strength 1 of 5

According to the chart of M5, EURNZD formed the Bearish Symmetrical Triangle pattern. Description: The lower border is 1.8733/1.8748 and upper border is 1.8770/1.8748. The pattern width is measured

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

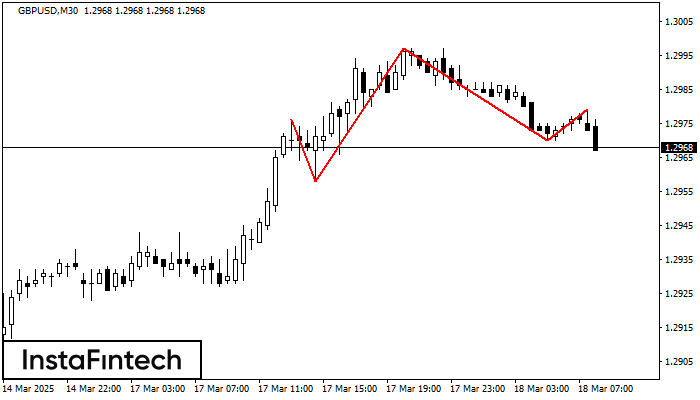

Head and Shoulders

was formed on 18.03 at 08:30:10 (UTC+0)

signal strength 3 of 5

The technical pattern called Head and Shoulders has appeared on the chart of GBPUSD M30. There are weighty reasons to suggest that the price will surpass the Neckline 1.2958/1.2970 after

Open chart in a new window

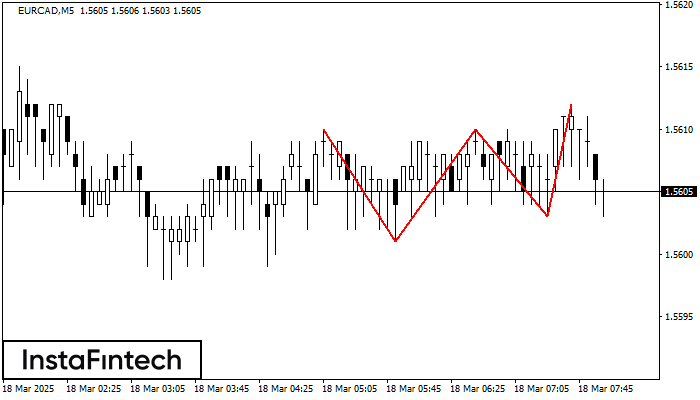

Triple Top

was formed on 18.03 at 08:01:01 (UTC+0)

signal strength 1 of 5

The Triple Top pattern has formed on the chart of the EURCAD M5. Features of the pattern: borders have an ascending angle; the lower line of the pattern

The M5 and M15 time frames may have more false entry points.

Open chart in a new window