#HSI (Hang Seng Index). Exchange rate and online charts.

Currency converter

16 Apr 2025 21:59

(0.02%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The Hang Seng Index (abbreviated HSI) is a benchmark stock market index of the Hong Kong Stock Exchange. It comprises 34 largest companies in Hong Kong which account for almost 65% of capitalization of the Hong Kong financial hub. HSI was introduced in 1969 by HSI Services Limited which is still dealing with analysis of information and compilation of ratings. The index records and monitors daily changes of stock prices of these companies. So, HSI is the main barometer of the overall market performance in Hong Kong. HSI embraces four sectors of the economy such as commerce and industry, finance, utilities, and land properties.

Besides, Hang Seng Index is a convenient instrument to invest in Hong Kong’s stock market which is one of major financial hubs not only in Asia, but on the global scale. Importantly, the economies of Hong Kong and China are closely connected as Hong Kong has the status of the special administrative region of the People’s Republic of China. So this indicator of Hong Kong’s stock market enables investors to put up capital for China’s economy which is considered to be one of the booming economies in the world. Last but not least, high liquidity of HSI makes it possible to use it for speculative trading.

Trading Hang Seng Index is available through different financial instruments including Exchange-Traded Funds (ETF), contracts for differences (CFDs), and futures contracts. Futures are the most convenient and liquid means of implementing medium- and long-term strategies as well as speculative trading.

See Also

- Gold continues to draw investor attention, particularly in times of heightened uncertainty in financial markets.

Author: Irina Yanina

11:50 2025-04-16 UTC+2

1273

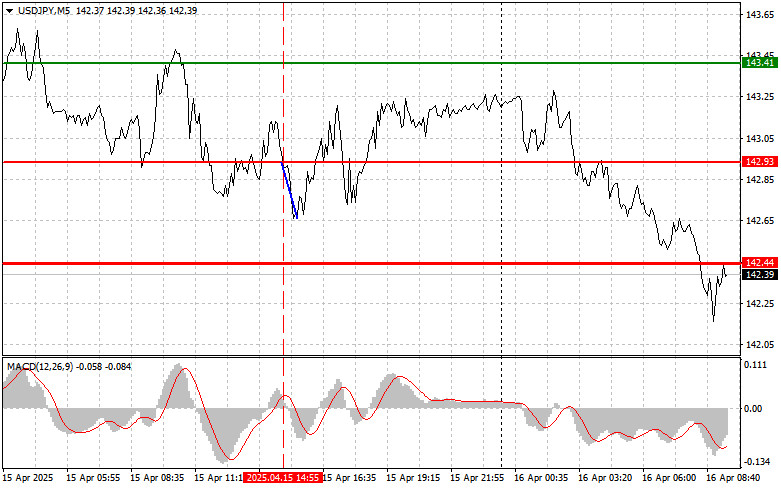

Type of analysisUSD/JPY: Simple Trading Tips for Beginner Traders on April 16. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 16. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:46 2025-04-16 UTC+2

1123

Technical analysis / Video analyticsForex forecast 16/04/2025: EUR/USD, GBP/USD, USD/CAD, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/CAD, Oil and BitcoinAuthor: Sebastian Seliga

09:55 2025-04-16 UTC+2

1108

- USD/CHF. Analysis and Forecast

Author: Irina Yanina

11:41 2025-04-16 UTC+2

958

Trading Recommendations for the Cryptocurrency Market on April 16Author: Miroslaw Bawulski

09:01 2025-04-16 UTC+2

958

Wall Street ended the session in the red. Shares of giants Boeing and Johnson & Johnson took the biggest hit as uncertainty around tariff policy continues to weigh on investor sentiment. While the banking sector posted gains, buoyed by strong earnings from major players, it was not enough to.Author: Ekaterina Kiseleva

11:12 2025-04-16 UTC+2

928

- Fundamental analysis

Confrontation Between the U.S. and China Will Negatively Impact Markets (Potential for Renewed Declines in #NDX and Litecoin)

Confrontation Between the U.S. and China Will Negatively Impact Markets (Potential for Renewed Declines in #NDX and Litecoin)Author: Pati Gani

11:34 2025-04-16 UTC+2

883

US stock market on April 16: the S&P 500 and NASDAQ resume their slideAuthor: Jakub Novak

12:22 2025-04-16 UTC+2

793

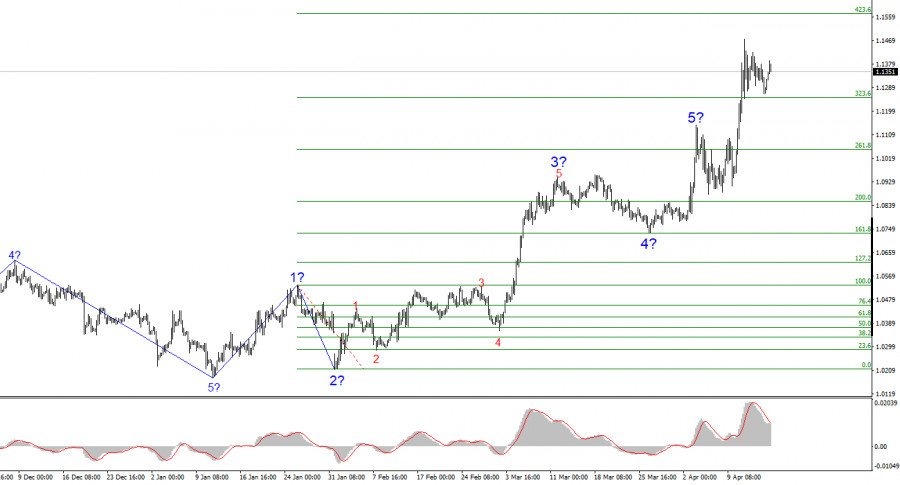

The EUR/USD pair rose by several dozen points during Wednesday's session.Author: Chin Zhao

18:56 2025-04-16 UTC+2

778

- Gold continues to draw investor attention, particularly in times of heightened uncertainty in financial markets.

Author: Irina Yanina

11:50 2025-04-16 UTC+2

1273

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on April 16. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 16. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:46 2025-04-16 UTC+2

1123

- Technical analysis / Video analytics

Forex forecast 16/04/2025: EUR/USD, GBP/USD, USD/CAD, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/CAD, Oil and BitcoinAuthor: Sebastian Seliga

09:55 2025-04-16 UTC+2

1108

- USD/CHF. Analysis and Forecast

Author: Irina Yanina

11:41 2025-04-16 UTC+2

958

- Trading Recommendations for the Cryptocurrency Market on April 16

Author: Miroslaw Bawulski

09:01 2025-04-16 UTC+2

958

- Wall Street ended the session in the red. Shares of giants Boeing and Johnson & Johnson took the biggest hit as uncertainty around tariff policy continues to weigh on investor sentiment. While the banking sector posted gains, buoyed by strong earnings from major players, it was not enough to.

Author: Ekaterina Kiseleva

11:12 2025-04-16 UTC+2

928

- Fundamental analysis

Confrontation Between the U.S. and China Will Negatively Impact Markets (Potential for Renewed Declines in #NDX and Litecoin)

Confrontation Between the U.S. and China Will Negatively Impact Markets (Potential for Renewed Declines in #NDX and Litecoin)Author: Pati Gani

11:34 2025-04-16 UTC+2

883

- US stock market on April 16: the S&P 500 and NASDAQ resume their slide

Author: Jakub Novak

12:22 2025-04-16 UTC+2

793

- The EUR/USD pair rose by several dozen points during Wednesday's session.

Author: Chin Zhao

18:56 2025-04-16 UTC+2

778