CHFCZK (Swiss Franc vs Czech Koruna). Exchange rate and online charts.

Currency converter

24 Mar 2025 12:46

(0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

CHF/CZK is not the most popular trading instrument in the forex market. However, this currency pair may well diversify the portfolio of any trader, as well as bring its holder a profit.

CHF/CZK is a cross rate against the US dollar. A cross rate is a forex market price made in two currencies that are both valued against a third currency – USD. In other words, the greenback is not included in the currency pair but its exchange rate is greatly affected by it. For example, if we compare USD/CHF and USD/CZK charts, they can predict a possible movement of CHF/CZK.

Features of CHF/CZK

Switzerland’s economy has been stable for years. For that reason, the Swiss franc is considered one of the world’s most reliable and trustworthy currencies.

The Swiss franc is the safe-haven asset investors turn to at the time of financial upheaval.

Therefore, at the time of crises, when investors rush to transfer their capital to Switzerland, CHF shows an exponential increase against the basket of currencies. Traders should always keep in mind this feature of the Swiss economy when trading the instrument.

The Czech Republic is one of the most developed industrial countries in Central Europe. Its residents enjoy high incomes thanks to the country’s buoyant economy.

The Czech Republic has achieved impressive results in sectors such as mechanical engineering, steel and cast iron production, chemical, electronics, brewing, and agriculture. However, its automotive industry is considered the most developed economic field (cars are mainly exported). Above all else, the Czech Republic is one of the leading exporters of beer and footwear.

Aspects of trading CHF/CZK

Speaking of CHF/CZK, the trading instrument is relatively illiquid compared to the major currency pairs (EUR/USD, USD/CHF, GBP/USD, and USD/JPY). For that reason, to make an accurate forecast for CHF/CZK, it is important to pay attention to the currency pairs where each currency of the instrument is traded against USD.

In addition, it is also essential to analyze the US economic indicators, like interest rates, GDP, unemployment, Nonfarm Payrolls, etc.

Importantly, when trading cross currency pairs, traders should carefully consider the broker’s trading conditions on the given financial instrument. The spread for cross currency pairs is usually higher.

See Also

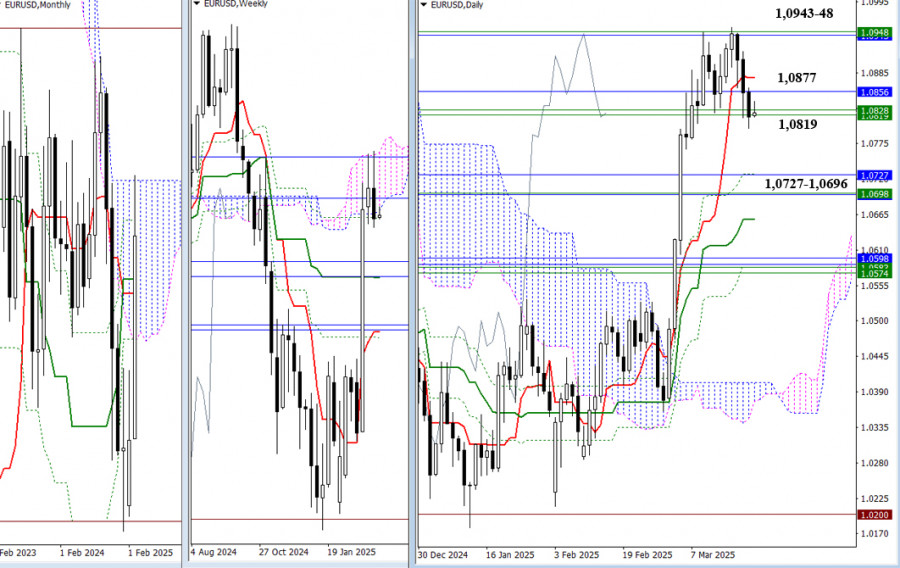

- Recently, the pair has been testing resistance levels from the weekly Ichimoku cloud (1.0946–1.0825) and monthly levels (1.0943–1.0856). Last week, sellers initiated a rejection and closed below these resistance zones. As a result, the main task for the bears now is to confirm and extend this.

Author: Evangelos Poulakis

08:55 2025-03-24 UTC+2

898

Fundamental analysisWhat to Pay Attention to on March 24? A Breakdown of Fundamental Events for Beginners

Eight macroeconomic events are scheduled for MondayAuthor: Paolo Greco

07:08 2025-03-24 UTC+2

778

Technical analysisTechnical Analysis of Intraday Price Movement of Natural Gas Commodity Instrument, Monday March 24, 2025

From what is seen on the 4-hour chart, the Natural Gas commodity instrument appearsAuthor: Arief Makmur

08:09 2025-03-24 UTC+2

763

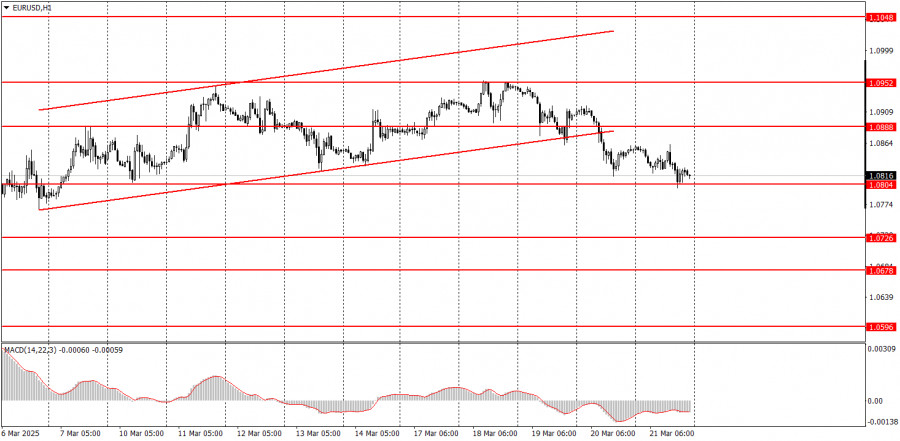

- The upcoming week's economic calendar is packed with important fundamental events. Macroeconomic reports will either help EUR/USD sellers consolidate within the 1.07 range or enable buyers to hold above the 1.0800 target.

Author: Irina Manzenko

07:52 2025-03-24 UTC+2

748

Technical analysisTechnical Analysis of Daily Price Movement of USD/IDR Exotic Currency Pairs, Monday March 24, 2025.

On the daily chart, the exotic currency pair USD/IDR appearsAuthor: Arief Makmur

08:09 2025-03-24 UTC+2

748

Intraday Strategies for Beginner Traders on March 24Author: Miroslaw Bawulski

08:22 2025-03-24 UTC+2

703

- Today, gold prices remain low but are holding above the psychological level of $3000, which serves as an important support.

Author: Irina Yanina

11:25 2025-03-24 UTC+2

673

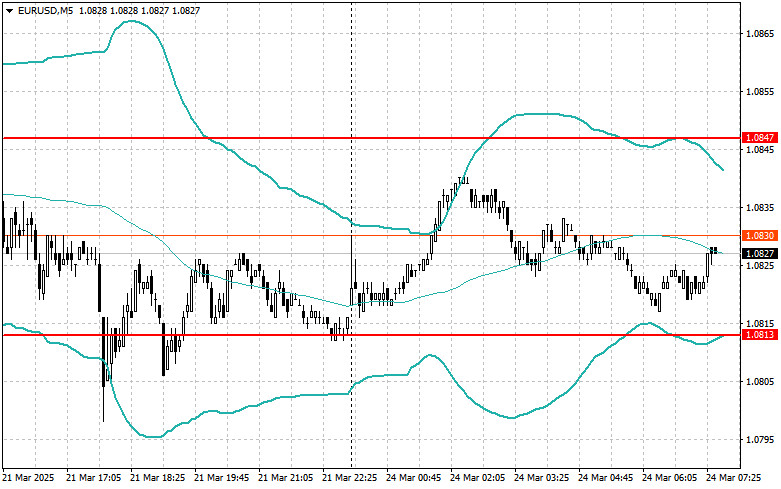

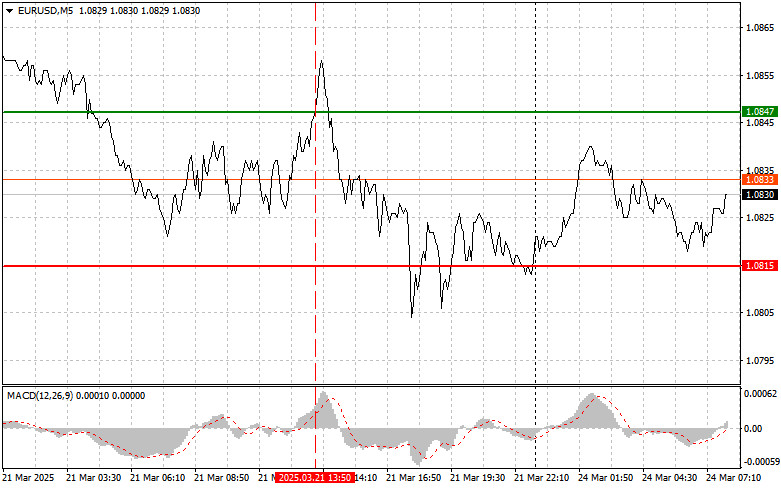

Type of analysisEUR/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:12 2025-03-24 UTC+2

658

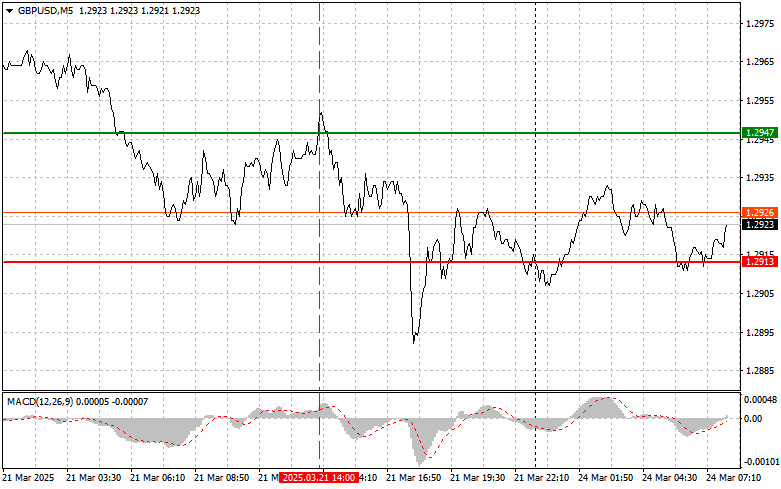

Type of analysisGBP/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:13 2025-03-24 UTC+2

613

- Recently, the pair has been testing resistance levels from the weekly Ichimoku cloud (1.0946–1.0825) and monthly levels (1.0943–1.0856). Last week, sellers initiated a rejection and closed below these resistance zones. As a result, the main task for the bears now is to confirm and extend this.

Author: Evangelos Poulakis

08:55 2025-03-24 UTC+2

898

- Fundamental analysis

What to Pay Attention to on March 24? A Breakdown of Fundamental Events for Beginners

Eight macroeconomic events are scheduled for MondayAuthor: Paolo Greco

07:08 2025-03-24 UTC+2

778

- Technical analysis

Technical Analysis of Intraday Price Movement of Natural Gas Commodity Instrument, Monday March 24, 2025

From what is seen on the 4-hour chart, the Natural Gas commodity instrument appearsAuthor: Arief Makmur

08:09 2025-03-24 UTC+2

763

- The upcoming week's economic calendar is packed with important fundamental events. Macroeconomic reports will either help EUR/USD sellers consolidate within the 1.07 range or enable buyers to hold above the 1.0800 target.

Author: Irina Manzenko

07:52 2025-03-24 UTC+2

748

- Technical analysis

Technical Analysis of Daily Price Movement of USD/IDR Exotic Currency Pairs, Monday March 24, 2025.

On the daily chart, the exotic currency pair USD/IDR appearsAuthor: Arief Makmur

08:09 2025-03-24 UTC+2

748

- Intraday Strategies for Beginner Traders on March 24

Author: Miroslaw Bawulski

08:22 2025-03-24 UTC+2

703

- Today, gold prices remain low but are holding above the psychological level of $3000, which serves as an important support.

Author: Irina Yanina

11:25 2025-03-24 UTC+2

673

- Type of analysis

EUR/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:12 2025-03-24 UTC+2

658

- Type of analysis

GBP/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:13 2025-03-24 UTC+2

613