AUDNZD (Australian Dollar vs New Zealand Dollar). Exchange rate and online charts.

Currency converter

18 Mar 2025 15:42

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

AUD/NZD is a cross rate of the Australian dollar to the New Zealand dollar that has a high liquidity.

Australia and New Zealand have tight economic interrelation and are situated rather close to each other. That is why the AUD/NZD pair is sought-after by many traders. The most intense trade between these currencies happens during the Asian session.

When trading the AUD/NZD currency pair, a market participant has to take into account lots of economic factors of New Zealand such us GDP level, business activities, trading volume with other countries, discount rate, and other. It is crucial to remember that the New Zealand economy highly depends on exports of wool and its products. Moreover, the country’s economy is influenced by the United States, Australia and Asia-Pacific countries because they are the main partners of New Zealand. So, one should also allow for their economic indicators while trading AUD/NZD.

In order to forecast the price movement of this financial instrument correctly, it is important to consider the influence of the US dollar on each of the currencies of the pair. Therefore, you should keep in mind main US economic indicators that are GDP level, unemployment rate, interest rates and number of new vacancies.

See Also

- Fundamental analysis

No Major Surprises Expected from the Fed Meeting (Anticipating a Sharp Drop in EUR/USD and Continued Cautious Gold Price Growth)

Markets are experiencing turmoil due to the risk of a U.S. economic recession. Although Treasury Secretary Bessent attempts to reassure investors by calling the market "correction" a healthy processAuthor: Pati Gani

09:48 2025-03-18 UTC+2

868

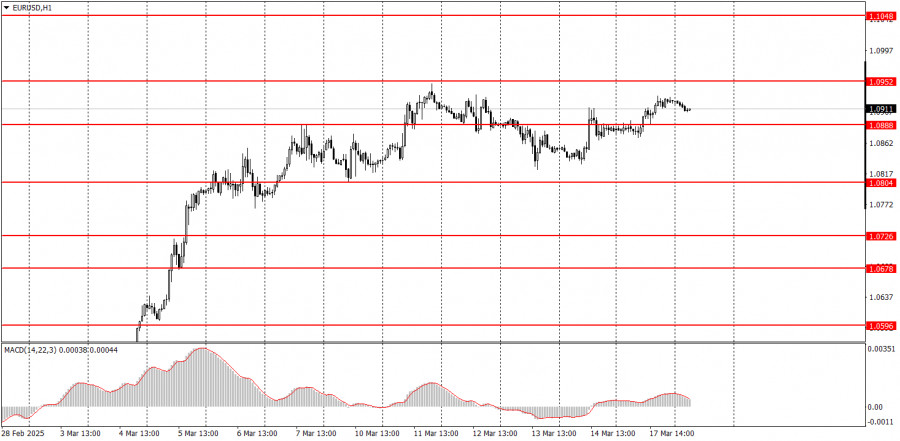

Type of analysisEUR/USD: Simple Trading Tips for Beginner Traders on March 18. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on March 18. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:00 2025-03-18 UTC+2

808

Type of analysisUSD/JPY: Simple Trading Tips for Beginner Traders on March 18. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on March 18. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:00 2025-03-18 UTC+2

778

- Technical analysis

Technical Analysis of Intraday Price Movement of Gold Commodity Instrument, Tuesday March 18, 2025.

In the 4-hour chart of the Gold commodity instrument, Convergence is visible, whichAuthor: Arief Makmur

09:17 2025-03-18 UTC+2

778

Intel rises after a report that the new CEO plans to reorganize manufacturing and artificial intelligence operations. February retail sales rise 0.2%. New York manufacturing activity fell in March. Hong Kong stocks and Kiwis rise amid a positive China outlook. Hang Seng hits a three-year high..Author: Gleb Frank

06:16 2025-03-18 UTC+2

763

Intraday Strategies for Beginner Traders on March 18Author: Miroslaw Bawulski

07:52 2025-03-18 UTC+2

748

- Fundamental analysis

What to Pay Attention to on March 18? A Breakdown of Fundamental Events for Beginners

A large number of macroeconomic events are scheduled for Tuesday, but none of them are significantAuthor: Paolo Greco

07:08 2025-03-18 UTC+2

733

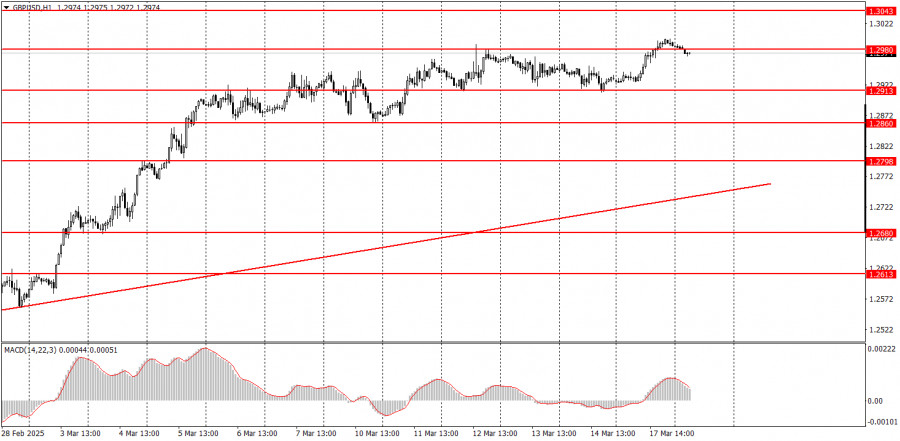

Trading planHow to Trade the GBP/USD Pair on March 18? Simple Tips and Trade Analysis for Beginners

On Monday, the GBP/USD pair also attempted to resume its upward movement and even broke through the latest local highAuthor: Paolo Greco

07:08 2025-03-18 UTC+2

718

Technical analysis / Video analyticsForex forecast 18/03/2025: EUR/USD, GBP/USD, USD/CAD, SP500 and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/CAD, SP500 and BitcoinAuthor: Sebastian Seliga

11:16 2025-03-18 UTC+2

718

- Fundamental analysis

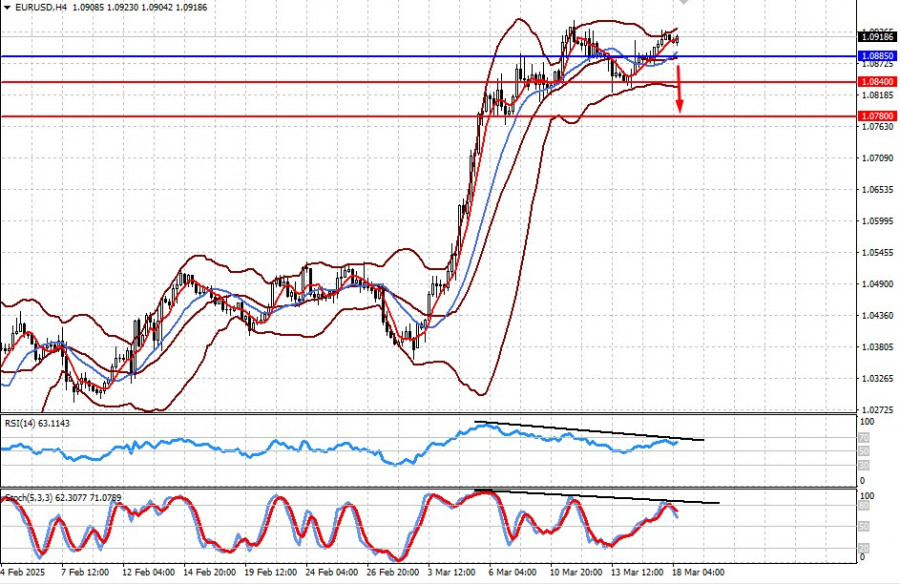

No Major Surprises Expected from the Fed Meeting (Anticipating a Sharp Drop in EUR/USD and Continued Cautious Gold Price Growth)

Markets are experiencing turmoil due to the risk of a U.S. economic recession. Although Treasury Secretary Bessent attempts to reassure investors by calling the market "correction" a healthy processAuthor: Pati Gani

09:48 2025-03-18 UTC+2

868

- Type of analysis

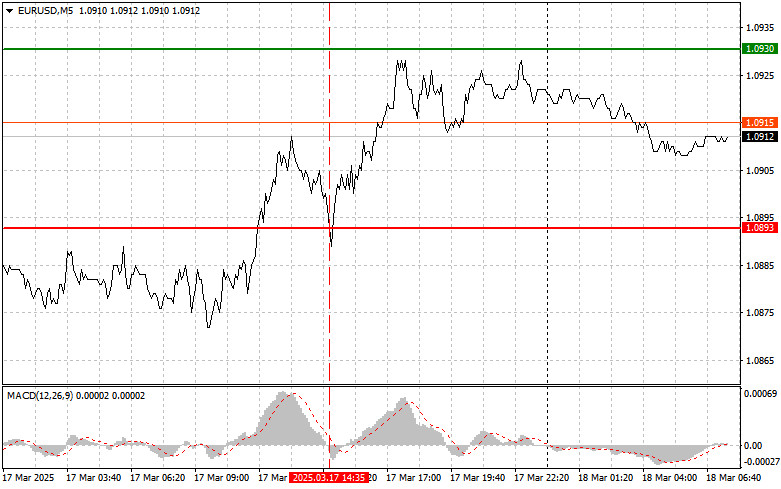

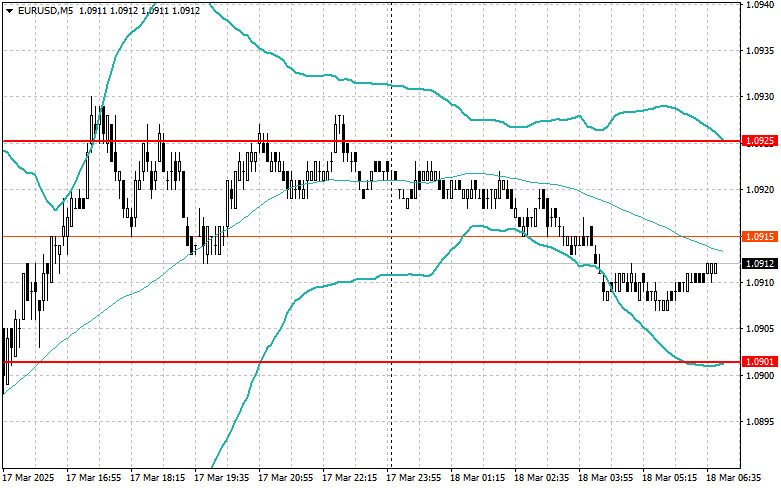

EUR/USD: Simple Trading Tips for Beginner Traders on March 18. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on March 18. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:00 2025-03-18 UTC+2

808

- Type of analysis

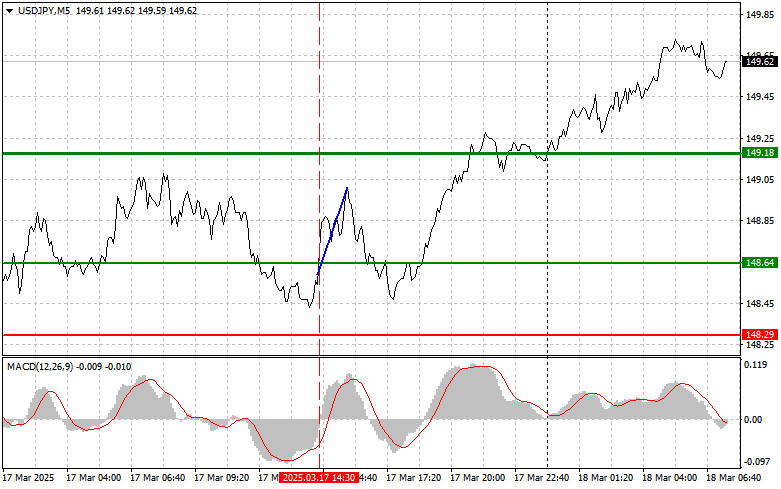

USD/JPY: Simple Trading Tips for Beginner Traders on March 18. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on March 18. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:00 2025-03-18 UTC+2

778

- Technical analysis

Technical Analysis of Intraday Price Movement of Gold Commodity Instrument, Tuesday March 18, 2025.

In the 4-hour chart of the Gold commodity instrument, Convergence is visible, whichAuthor: Arief Makmur

09:17 2025-03-18 UTC+2

778

- Intel rises after a report that the new CEO plans to reorganize manufacturing and artificial intelligence operations. February retail sales rise 0.2%. New York manufacturing activity fell in March. Hong Kong stocks and Kiwis rise amid a positive China outlook. Hang Seng hits a three-year high..

Author: Gleb Frank

06:16 2025-03-18 UTC+2

763

- Intraday Strategies for Beginner Traders on March 18

Author: Miroslaw Bawulski

07:52 2025-03-18 UTC+2

748

- Fundamental analysis

What to Pay Attention to on March 18? A Breakdown of Fundamental Events for Beginners

A large number of macroeconomic events are scheduled for Tuesday, but none of them are significantAuthor: Paolo Greco

07:08 2025-03-18 UTC+2

733

- Trading plan

How to Trade the GBP/USD Pair on March 18? Simple Tips and Trade Analysis for Beginners

On Monday, the GBP/USD pair also attempted to resume its upward movement and even broke through the latest local highAuthor: Paolo Greco

07:08 2025-03-18 UTC+2

718

- Technical analysis / Video analytics

Forex forecast 18/03/2025: EUR/USD, GBP/USD, USD/CAD, SP500 and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/CAD, SP500 and BitcoinAuthor: Sebastian Seliga

11:16 2025-03-18 UTC+2

718