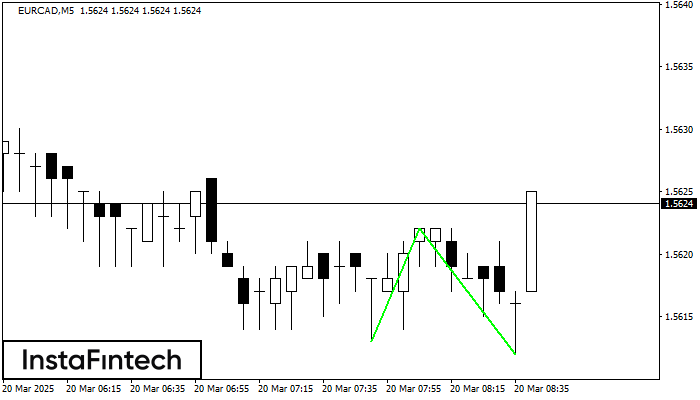

Double Bottom

was formed on 20.03 at 08:45:21 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on EURCAD M5. This formation signals a reversal of the trend from downwards to upwards. The signal is that a buy trade should be opened after the upper boundary of the pattern 1.5622 is broken. The further movements will rely on the width of the current pattern 9 points.

The M5 and M15 time frames may have more false entry points.

See Also

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Bullish Symmetrical Triangle

was formed on 25.03 at 05:33:06 (UTC+0)

signal strength 1 of 5

According to the chart of M5, USDJPY formed the Bullish Symmetrical Triangle pattern, which signals the trend will continue. Description. The upper border of the pattern touches the coordinates 150.95/150.72

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

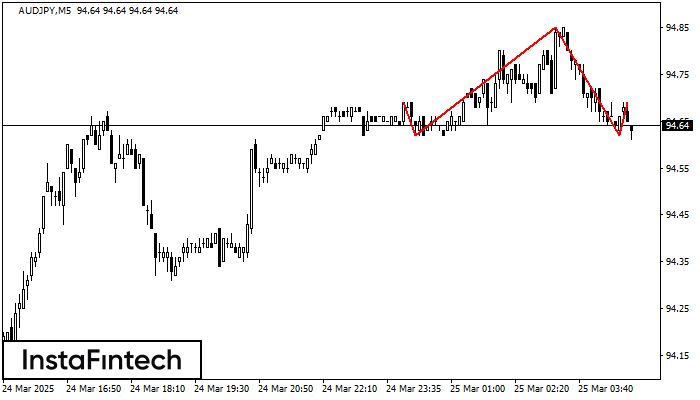

Head and Shoulders

was formed on 25.03 at 04:50:35 (UTC+0)

signal strength 1 of 5

The technical pattern called Head and Shoulders has appeared on the chart of AUDJPY M5. There are weighty reasons to suggest that the price will surpass the Neckline 94.62/94.62 after

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

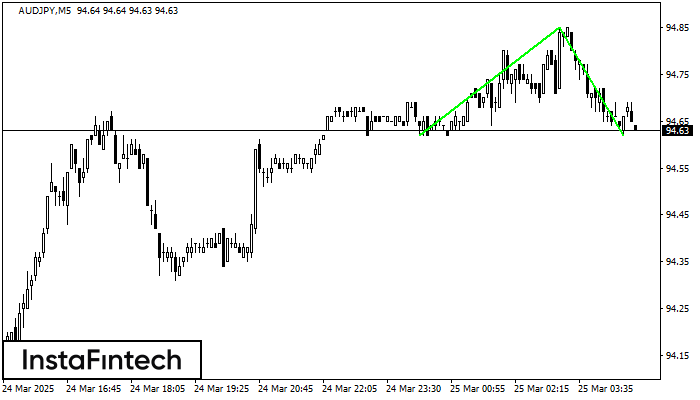

Double Bottom

was formed on 25.03 at 04:45:36 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on AUDJPY M5; the upper boundary is 94.85; the lower boundary is 94.62. The width of the pattern is 23 points. In case

The M5 and M15 time frames may have more false entry points.

Open chart in a new window