NOKJPY (Norwegian Krone vs Japanese Yen). Exchange rate and online charts.

Currency converter

24 Mar 2025 14:24

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

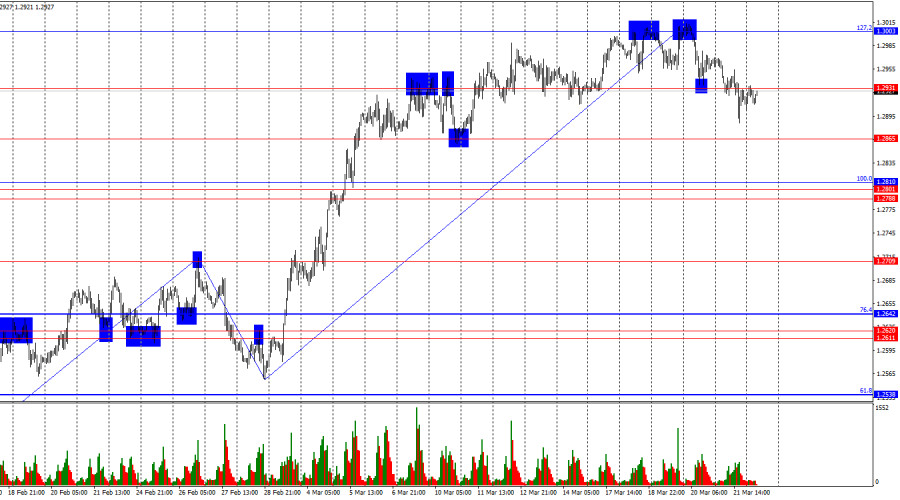

The NOK/JPY is not actively traded currency pair on the Forex market. NOK/JPY is the cross rate against the U.S. dollar. The NOK/JPY does not include the U.S. dollar and that is why called a cross currency pair. This can be seen, if you combine two charts: USD/JPY and USD/NOK. Thus, you will get an approximate NOK/JPY price chart.

Since the U.S. dollar heavily influences both currencies, it is necessary to take into account the major U.S. economic indicators for the correct projection of this financial instrument’s price movement. You should pay attention to the U.S. discount rate, GDP data, unemployment rate, new jobs figures, etc. It is worth noting that the currencies comprising the pair can respond differently to changes in the U.S. economy; therefore, the NOK/JPY can be considered as a specific indicator of these currencies.

Norway belongs to the leading group of the richest countries in the world measured by GDP per capita. The country occupies first positions on various economic indicators such as the quality of life and personal income level. Norway is the world’s third largest producer and exporter of oil and gas. The export of energy resources is the main source of income of this country. In addition, Norway has the world’s most developed electrometallurgy, electrical engineering, mechanical engineering, etc. In addition, the country is a leading maker of oil and gas offshore drilling platforms. Also, Norway is the number one producer and processor of a wide range of seafood, which is very popular all over the world, especially in EU countries.

Currency pair NOK/JPY is very responsive to a variety of major political and economic developments in the world. For this reason, the predictability power of its price chart is poor. Thus, it is a fairly common occurrence when the NOK/JPY price goes in the opposite direction to an analysis.

It is not recommended for beginners to start their currency trading with a given pair because successful NOK/JPY traders need to understand lot of subtleties and peculiarities of the price curve behaviour, which does not matter at first glance but can greatly affect the pair’s future exchange rate.

This trading instrument is considered to be illiquid as compared with the majors, such as: the EUR/USD, USD/CHF, GBP/USD and USD/JPY. Therefore, when you forecast the future trend of the currency pair, you need to pay attention to the major currency pairs that include the U.S. dollar.

If you want to trade cross currency pairs, it is necessary to bear in mind that brokers’ spread is often higher for cross rates than for majors. Thus, you’d better read and understand the trading terms offered by the broker before you start your cross rate trading.

See Also

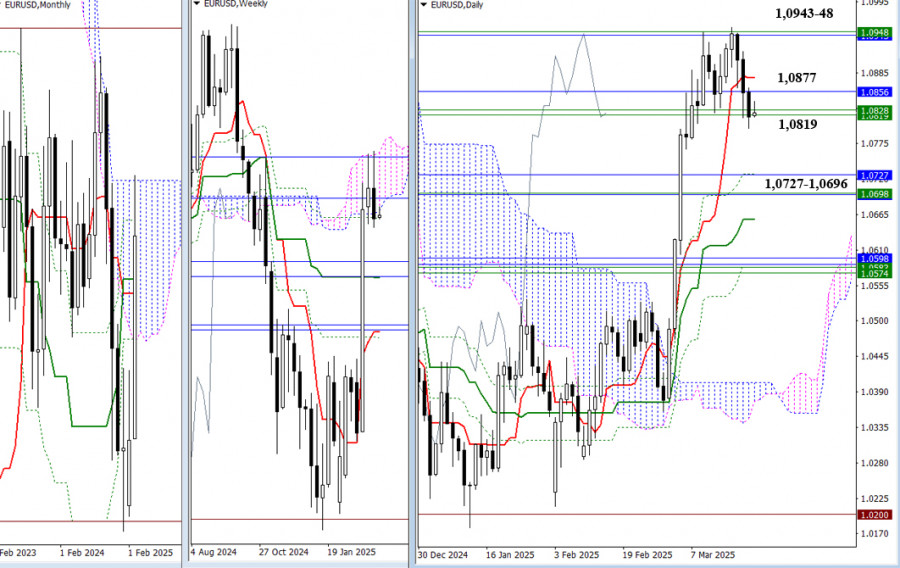

- Recently, the pair has been testing resistance levels from the weekly Ichimoku cloud (1.0946–1.0825) and monthly levels (1.0943–1.0856). Last week, sellers initiated a rejection and closed below these resistance zones. As a result, the main task for the bears now is to confirm and extend this.

Author: Evangelos Poulakis

08:55 2025-03-24 UTC+2

913

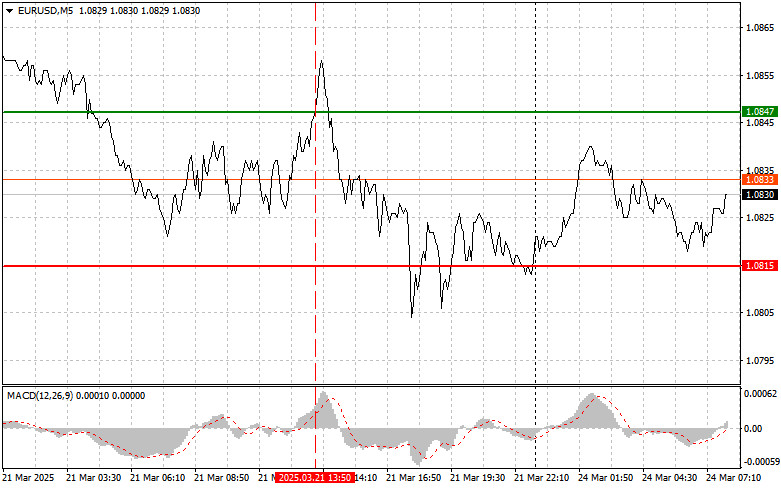

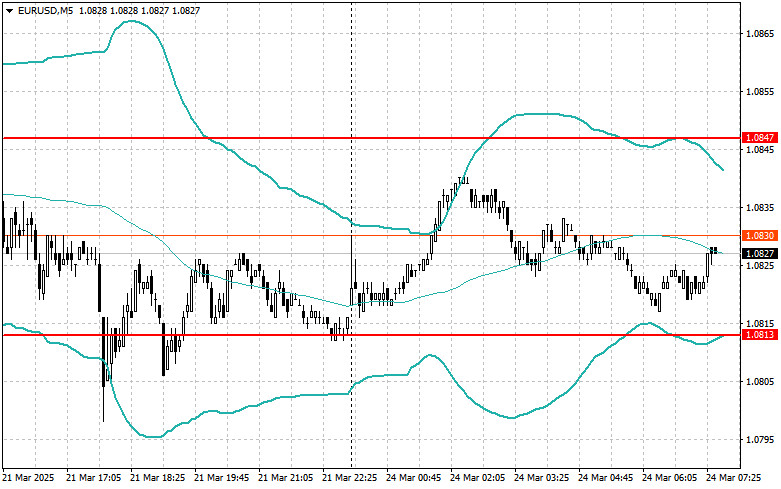

Type of analysisEUR/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:12 2025-03-24 UTC+2

763

Today, gold prices remain low but are holding above the psychological level of $3000, which serves as an important support.Author: Irina Yanina

11:25 2025-03-24 UTC+2

733

- Intraday Strategies for Beginner Traders on March 24

Author: Miroslaw Bawulski

08:22 2025-03-24 UTC+2

703

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

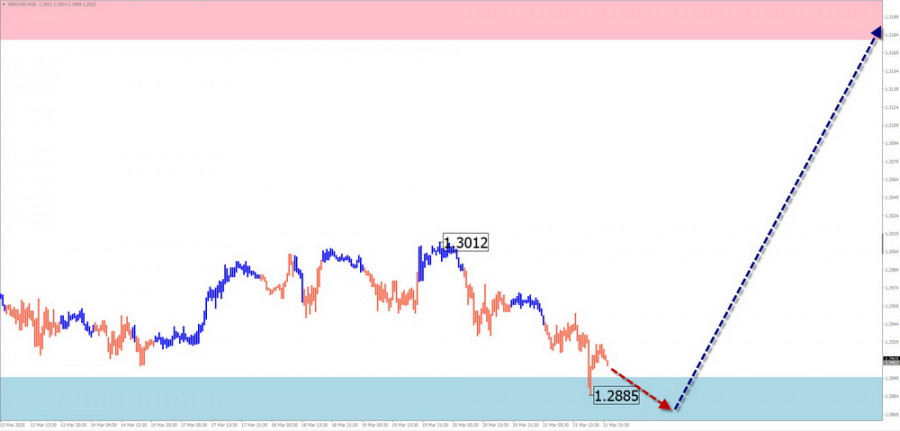

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

673

The outcomes of the Bank of England and FOMC meetings contradicted each other.Author: Samir Klishi

12:25 2025-03-24 UTC+2

658

- Type of analysis

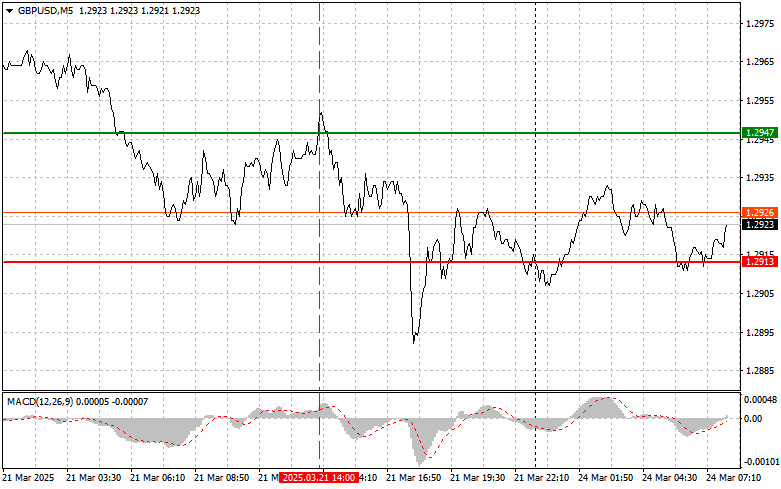

GBP/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:13 2025-03-24 UTC+2

658

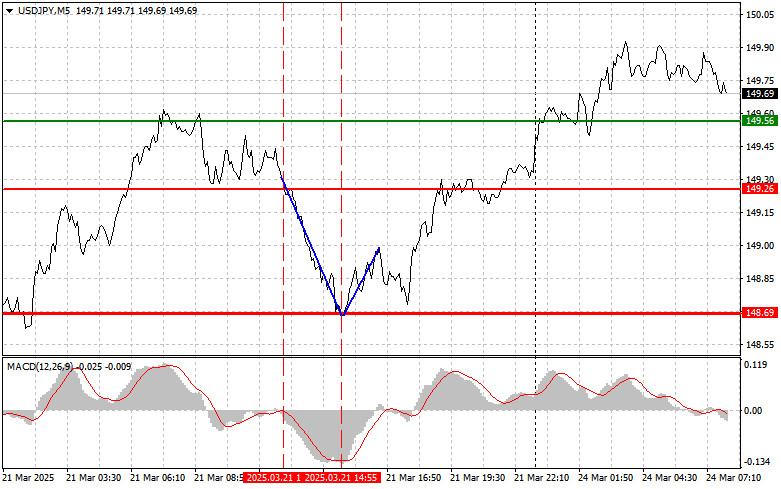

Type of analysisUSD/JPY: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:13 2025-03-24 UTC+2

658

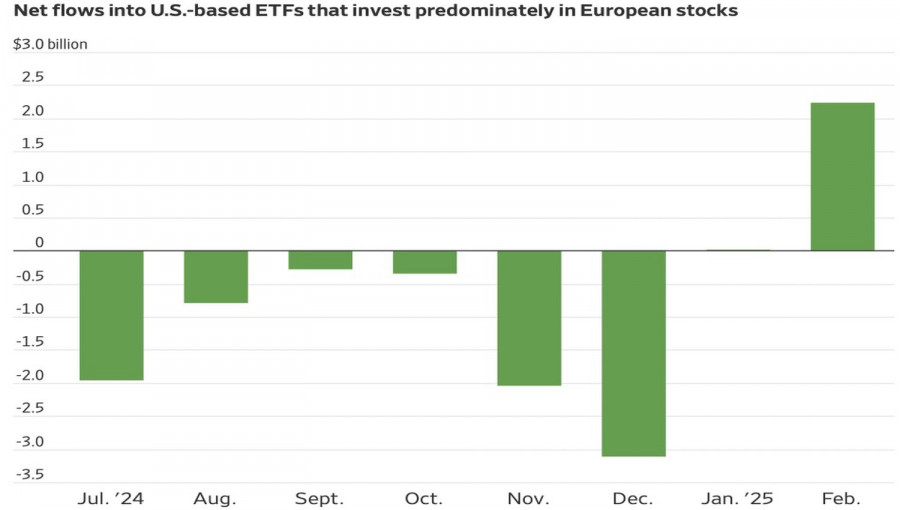

White House tariffs bring more pain to the U.S. than to other regionsAuthor: Marek Petkovich

10:23 2025-03-24 UTC+2

643

- Recently, the pair has been testing resistance levels from the weekly Ichimoku cloud (1.0946–1.0825) and monthly levels (1.0943–1.0856). Last week, sellers initiated a rejection and closed below these resistance zones. As a result, the main task for the bears now is to confirm and extend this.

Author: Evangelos Poulakis

08:55 2025-03-24 UTC+2

913

- Type of analysis

EUR/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:12 2025-03-24 UTC+2

763

- Today, gold prices remain low but are holding above the psychological level of $3000, which serves as an important support.

Author: Irina Yanina

11:25 2025-03-24 UTC+2

733

- Intraday Strategies for Beginner Traders on March 24

Author: Miroslaw Bawulski

08:22 2025-03-24 UTC+2

703

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

673

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

658

- Type of analysis

GBP/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:13 2025-03-24 UTC+2

658

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:13 2025-03-24 UTC+2

658

- White House tariffs bring more pain to the U.S. than to other regions

Author: Marek Petkovich

10:23 2025-03-24 UTC+2

643