CADJPY (Canadian Dollar vs Japanese Yen). Exchange rate and online charts.

Currency converter

18 Mar 2025 20:55

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

For the CAD/JPY pair, the Canadian dollar is the base currency while the Japanese yen is the quote currency. This instrument is one of the most unpredictable currency pairs which dynamics is hard to forecast by technical analysis.

Due to the high sensitivity of the aforesaid currencies to different political and economic events, the use of the CAD/JPY trading instrument is not recommended for beginner traders.

Each currency of the pair above is influenced by oil prices; it sets a strong dynamics for the instrument. Both currencies respond to a hike of oil price antithetically. For example, while the Canadian dollar rises, the yen falls – in such case, a strongly pronounced uptrend arises.

The Canadian dollar, also known as 'loonie', is the seventh world currency by the trade volume; and it depends highly on the economic indicators of the USA and on raw material cost.

The Japanese yen is the third world currency by the trade volume. Due to the low inflation and high stability of the Japanese economy, the yen is regarded as a safe haven currency. Low interest rates make up contribute to the low value of the yen against other major currencies.

See Also

- Fundamental analysis

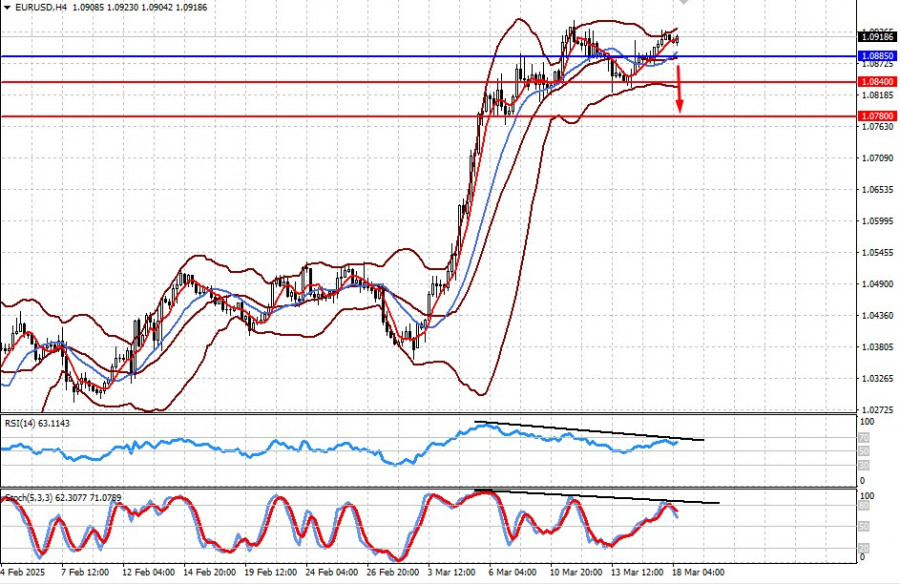

No Major Surprises Expected from the Fed Meeting (Anticipating a Sharp Drop in EUR/USD and Continued Cautious Gold Price Growth)

Markets are experiencing turmoil due to the risk of a U.S. economic recession. Although Treasury Secretary Bessent attempts to reassure investors by calling the market "correction" a healthy processAuthor: Pati Gani

09:48 2025-03-18 UTC+2

1243

Technical analysisTechnical Analysis of Intraday Price Movement of Gold Commodity Instrument, Tuesday March 18, 2025.

In the 4-hour chart of the Gold commodity instrument, Convergence is visible, whichAuthor: Arief Makmur

09:17 2025-03-18 UTC+2

1063

Bulls have been attacking for two weeks, but it's time for a pause.Author: Samir Klishi

11:30 2025-03-18 UTC+2

1048

- Fundamental analysis

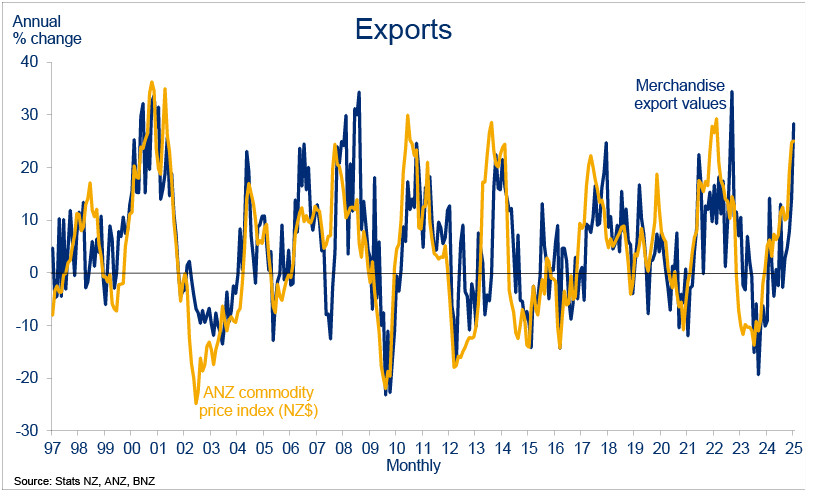

Positive Data from China and Rising Risk Appetite Support a Bullish Outlook for the Kiwi – NZD/USD Analysis

Positive Data from China and Rising Risk Appetite Support a Bullish Outlook for the Kiwi – NZD/USD AnalysisAuthor: Kuvat Raharjo

11:36 2025-03-18 UTC+2

1018

US stock market: two days of gains from support levelsAuthor: Jozef Kovach

12:18 2025-03-18 UTC+2

943

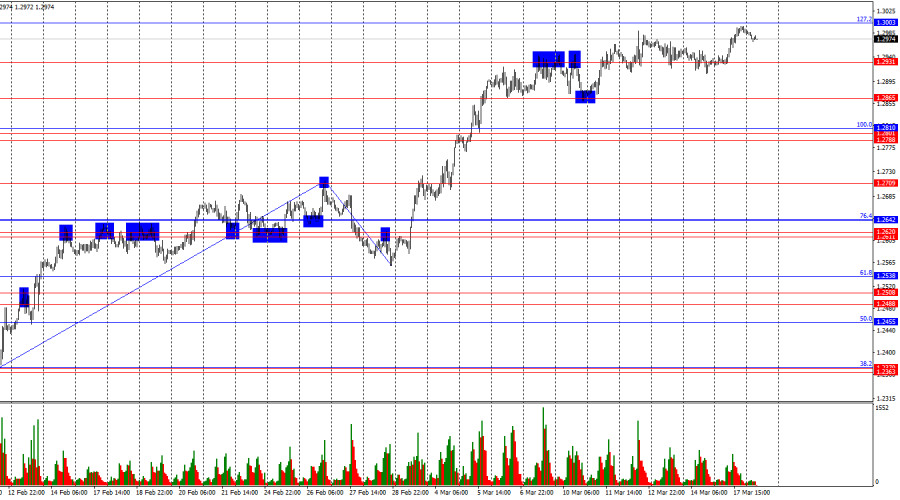

Bearish traders can do nothing—and they don't seem to want to.Author: Samir Klishi

11:03 2025-03-18 UTC+2

928

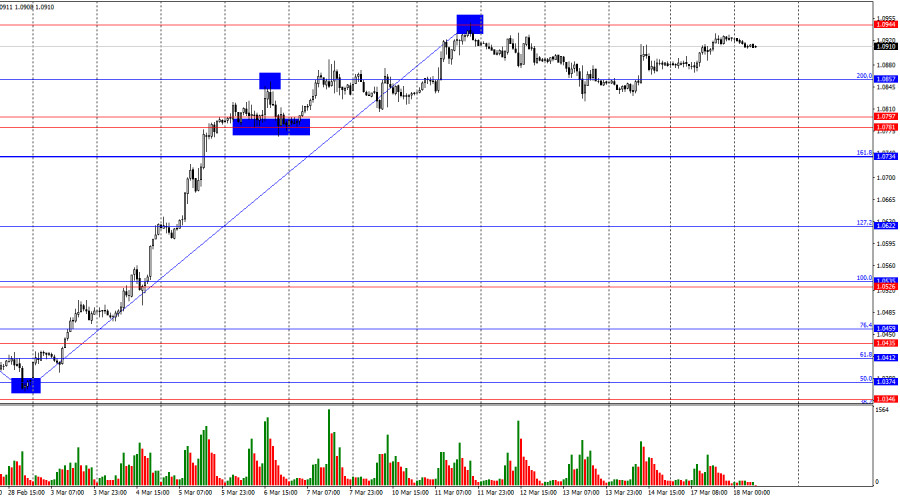

- The EUR/USD exchange rate remained virtually unchanged throughout Tuesday, as the market received both positive and negative news during the day.

Author: Chin Zhao

19:43 2025-03-18 UTC+2

928

February data shows that US retail sales are up 0.2%, while New York manufacturing activity contracts in March.Author: Ekaterina Kiseleva

14:51 2025-03-18 UTC+2

883

Technical analysis / Video analyticsForex forecast 18/03/2025: EUR/USD, GBP/USD, USD/CAD, SP500 and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/CAD, SP500 and BitcoinAuthor: Sebastian Seliga

11:16 2025-03-18 UTC+2

868

- Fundamental analysis

No Major Surprises Expected from the Fed Meeting (Anticipating a Sharp Drop in EUR/USD and Continued Cautious Gold Price Growth)

Markets are experiencing turmoil due to the risk of a U.S. economic recession. Although Treasury Secretary Bessent attempts to reassure investors by calling the market "correction" a healthy processAuthor: Pati Gani

09:48 2025-03-18 UTC+2

1243

- Technical analysis

Technical Analysis of Intraday Price Movement of Gold Commodity Instrument, Tuesday March 18, 2025.

In the 4-hour chart of the Gold commodity instrument, Convergence is visible, whichAuthor: Arief Makmur

09:17 2025-03-18 UTC+2

1063

- Bulls have been attacking for two weeks, but it's time for a pause.

Author: Samir Klishi

11:30 2025-03-18 UTC+2

1048

- Fundamental analysis

Positive Data from China and Rising Risk Appetite Support a Bullish Outlook for the Kiwi – NZD/USD Analysis

Positive Data from China and Rising Risk Appetite Support a Bullish Outlook for the Kiwi – NZD/USD AnalysisAuthor: Kuvat Raharjo

11:36 2025-03-18 UTC+2

1018

- US stock market: two days of gains from support levels

Author: Jozef Kovach

12:18 2025-03-18 UTC+2

943

- Bearish traders can do nothing—and they don't seem to want to.

Author: Samir Klishi

11:03 2025-03-18 UTC+2

928

- The EUR/USD exchange rate remained virtually unchanged throughout Tuesday, as the market received both positive and negative news during the day.

Author: Chin Zhao

19:43 2025-03-18 UTC+2

928

- February data shows that US retail sales are up 0.2%, while New York manufacturing activity contracts in March.

Author: Ekaterina Kiseleva

14:51 2025-03-18 UTC+2

883

- Technical analysis / Video analytics

Forex forecast 18/03/2025: EUR/USD, GBP/USD, USD/CAD, SP500 and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/CAD, SP500 and BitcoinAuthor: Sebastian Seliga

11:16 2025-03-18 UTC+2

868