Triple Top

was formed on 28.03 at 01:30:25 (UTC+0)

signal strength 3 of 5

The Triple Top pattern has formed on the chart of the USDJPY M30 trading instrument. It is a reversal pattern featuring the following characteristics: resistance level -2, support level -41, and pattern’s width 50. Forecast If the price breaks through the support level 150.60, it is likely to move further down to 150.86.

یہ بھی دیکھیں

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

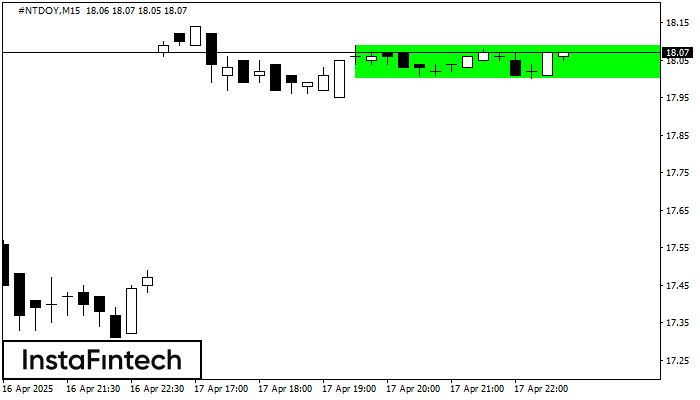

Bullish Rectangle

was formed on 17.04 at 21:47:00 (UTC+0)

signal strength 2 of 5

According to the chart of M15, #NTDOY formed the Bullish Rectangle. The pattern indicates a trend continuation. The upper border is 18.09, the lower border is 18.00. The signal means

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

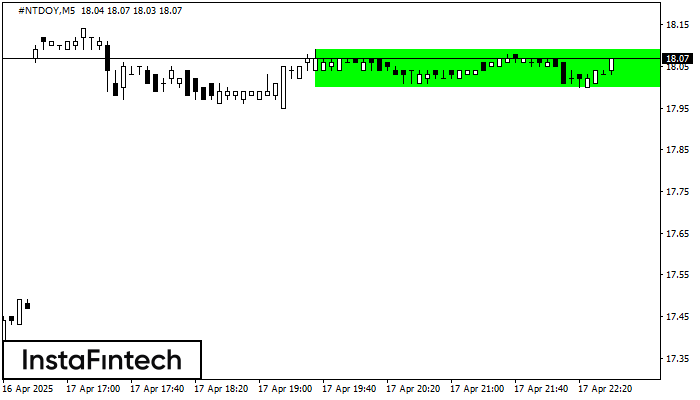

Bullish Rectangle

was formed on 17.04 at 21:45:00 (UTC+0)

signal strength 1 of 5

According to the chart of M5, #NTDOY formed the Bullish Rectangle. The pattern indicates a trend continuation. The upper border is 18.09, the lower border is 18.00. The signal means

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Bearish Symmetrical Triangle

was formed on 17.04 at 21:00:18 (UTC+0)

signal strength 2 of 5

According to the chart of M15, #AMZN formed the Bearish Symmetrical Triangle pattern. Trading recommendations: A breach of the lower border 171.36 is likely to encourage a continuation

The M5 and M15 time frames may have more false entry points.

Open chart in a new window