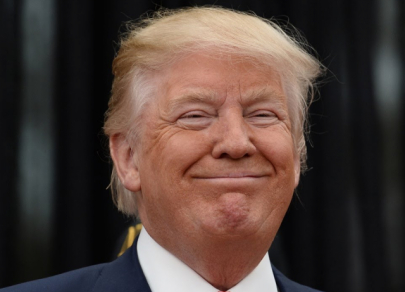

Seven billionaires to work in Trump’s team

Following his election victory, Donald Trump, a billionaire himself, once again decided to include prominent magnates in his administration, as he did during his first presidential term. As a result, Trump's current cabinet features seven billionaires, making it one of the wealthiest in US history. Let's find out who these billionaires are and the roles they have been assigned.