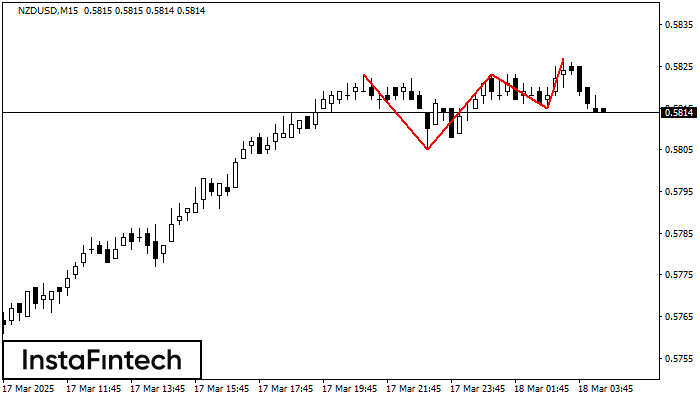

Triple Top

was formed on 18.03 at 04:30:36 (UTC+0)

signal strength 2 of 5

On the chart of the NZDUSD M15 trading instrument, the Triple Top pattern that signals a trend change has formed. It is possible that after formation of the third peak, the price will try to break through the resistance level 0.5805, where we advise to open a trading position for sale. Take profit is the projection of the pattern’s width, which is 18 points.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

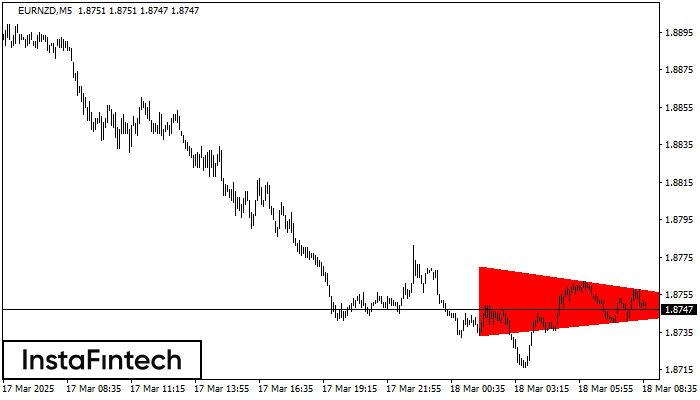

Bearish Symmetrical Triangle

was formed on 18.03 at 08:42:54 (UTC+0)

signal strength 1 of 5

According to the chart of M5, EURNZD formed the Bearish Symmetrical Triangle pattern. Description: The lower border is 1.8733/1.8748 and upper border is 1.8770/1.8748. The pattern width is measured

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

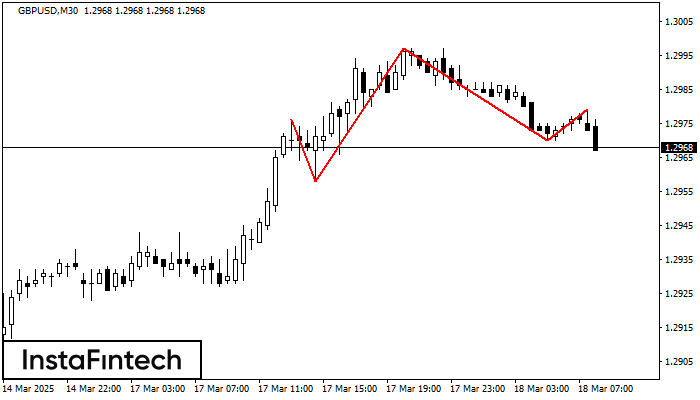

Head and Shoulders

was formed on 18.03 at 08:30:10 (UTC+0)

signal strength 3 of 5

The technical pattern called Head and Shoulders has appeared on the chart of GBPUSD M30. There are weighty reasons to suggest that the price will surpass the Neckline 1.2958/1.2970 after

Open chart in a new window

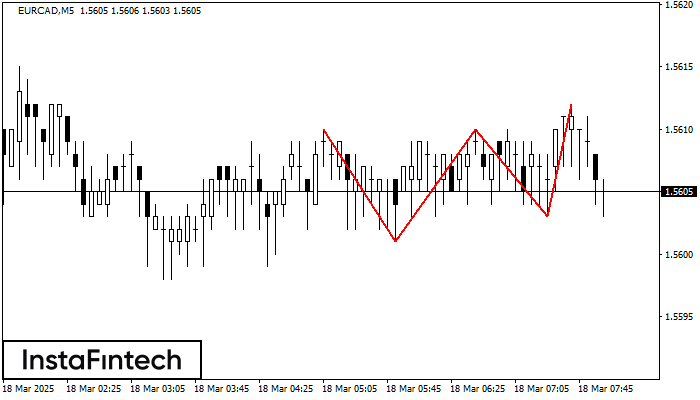

Triple Top

was formed on 18.03 at 08:01:01 (UTC+0)

signal strength 1 of 5

The Triple Top pattern has formed on the chart of the EURCAD M5. Features of the pattern: borders have an ascending angle; the lower line of the pattern

The M5 and M15 time frames may have more false entry points.

Open chart in a new window