#KHC (The Kraft Heinz Company). Exchange rate and online charts.

Currency converter

18 Mar 2025 21:59

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The Kraft Heinz Company (#KHC) is the US biggest manufacturer of food products which appeared after H.J. Heinz Company merged with Kraft Foods Inc. This amalgamation was carried out in 2015. The corporation is the fifth largest producer of food globally and the third largest company that manufactures food and drinks in the United States.

As a result of the merger which was initiated two years ago, Heinz shareholders took the controlling stake (51%) in the integrated company while shareholders of Kraft Foods Group obtained 49%. The company’s shares are listed on the NASDAQ.

In the fourth quarter of 2016 it was reported that shares in the Kraft Heinz Company depreciated significantly last year. The net sales volume, which is a rather important indicator for the company, decreased by 3.7%. Besides, the quarterly revenue of the Kraft Heinz Company plunged by $260 million from the previous year and came in at $6.86 billion. Later on, the Kraft Heinz Company managed to surmount the crisis and increased its revenue.

In late April 2017 the shares in the giant food manufacturer posted a downward dynamic. The beginning of May was quite volatile for the Kraft Heinz Company when the quarterly report was released. From the middle of May KHC shares have recovered, returning to $93 and even reaching higher levels.

The company’s revenue for the first quarter of 2017 slumped by 3.1% in annual terms from $6.57 billion to $6.364 billion. At the same time, the operating income rose by 2.5% to $1.551 billion while the net profit shrank by 0.3% to $893 million.

The revenue report of Kraft Heinz Company was disappointing as it showed a decrease in three out of four regions (a fall of 3.5% to $4.552 billion in the US, a decline of 1.2% to $443 million in Canada, and a slump of 6.8% to $543 million in Europe). According to CEO of Kraft Heinz Bernardo Hees, the company intends to pursue the current development strategy and take measures for cost saving, despite weak results and slow growth in 2017. The company’s management plans to introduce innovative solutions, renew the range of products and expand its business. Mr. Hees is sure that these measures will help the company to increase its revenue.

In early June of 2017 KHC shares were trading with moderate volatility, adding 0.84% for a week and 1.28% for a month. Experts say that under the current conditions the price is likely to reverse downwards towards the key support at $90.50. Once this level is reached, Kraft Heinz shares are better to be bought, experts advise. At the same time, the take profit level is recommended at $96 while the stop loss should be set at $88.

See Also

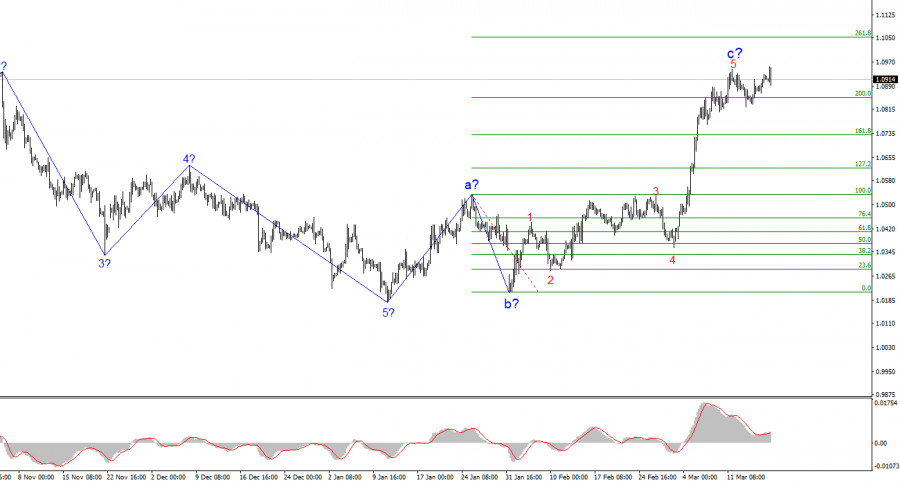

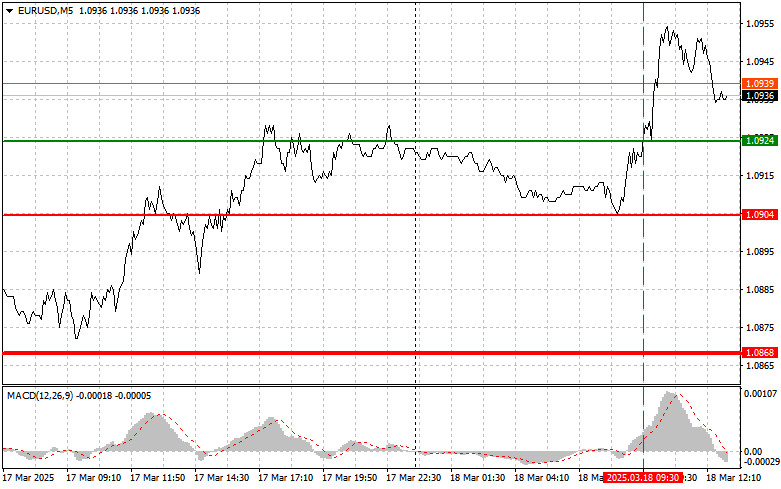

- The EUR/USD exchange rate remained virtually unchanged throughout Tuesday, as the market received both positive and negative news during the day.

Author: Chin Zhao

19:43 2025-03-18 UTC+2

1303

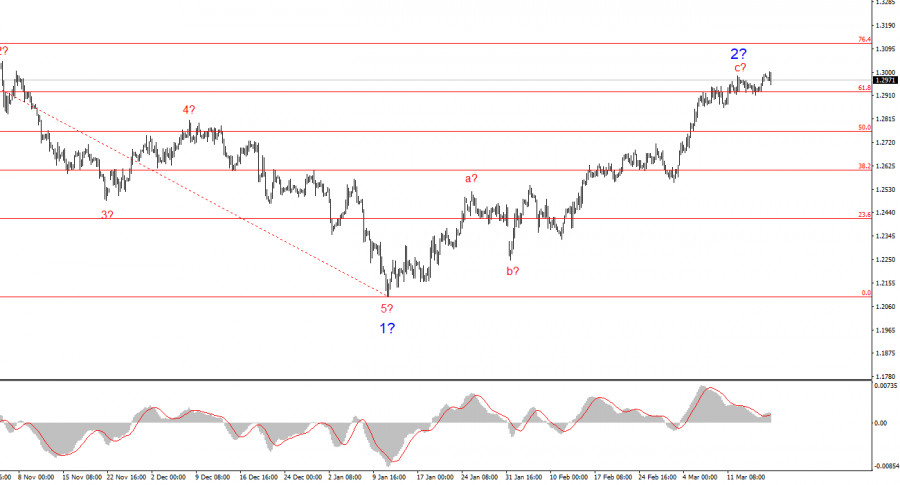

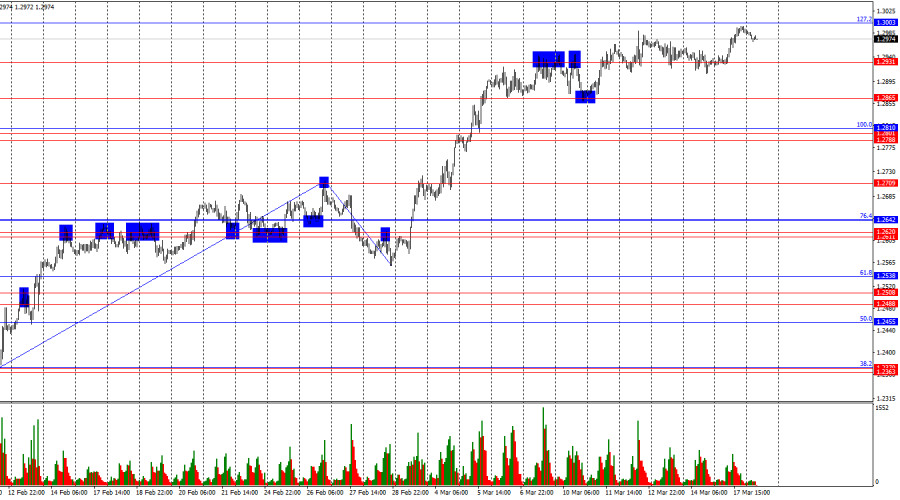

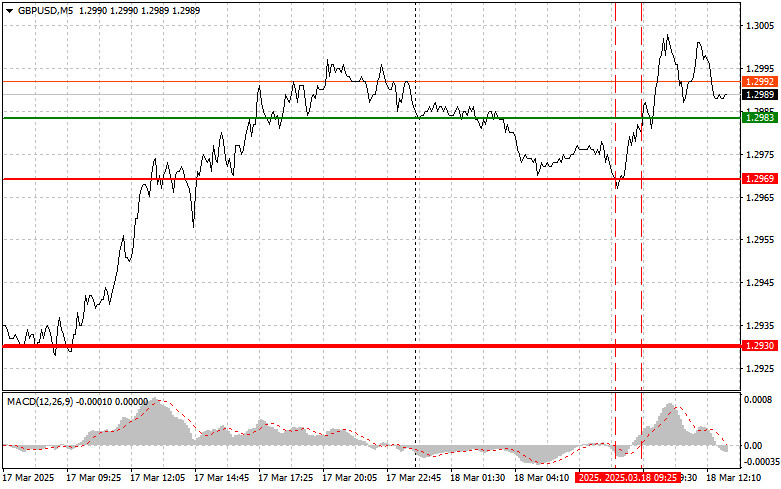

The GBP/USD exchange rate decreased by 20 basis points by the start of the U.S. session on Tuesday.Author: Chin Zhao

19:45 2025-03-18 UTC+2

1288

Bearish traders can do nothing—and they don't seem to want to.Author: Samir Klishi

11:03 2025-03-18 UTC+2

1243

- Bulls have been attacking for two weeks, but it's time for a pause.

Author: Samir Klishi

11:30 2025-03-18 UTC+2

1213

EUR/USD: Simple Trading Tips for Beginner Traders on March 18th (U.S. Session)Author: Jakub Novak

19:32 2025-03-18 UTC+2

1198

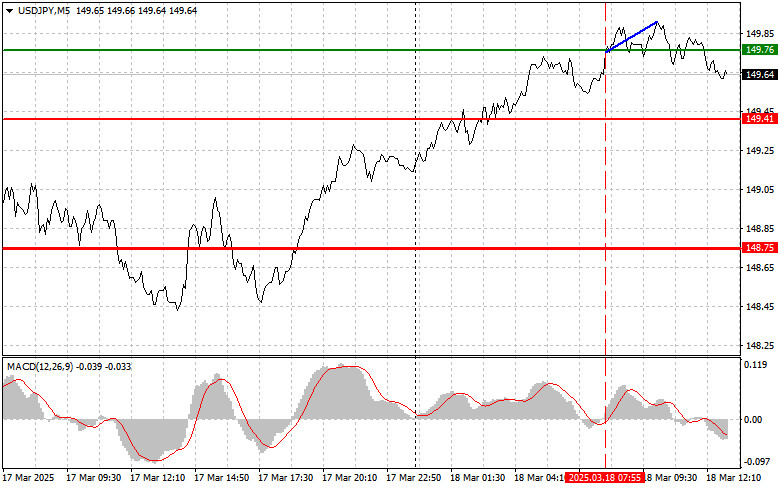

USD/JPY: Simple Trading Tips for Beginner Traders on March 18th (U.S. Session)Author: Jakub Novak

19:40 2025-03-18 UTC+2

1183

- GBP/USD: Simple Trading Tips for Beginner Traders on March 18th (U.S. Session)

Author: Jakub Novak

19:36 2025-03-18 UTC+2

1168

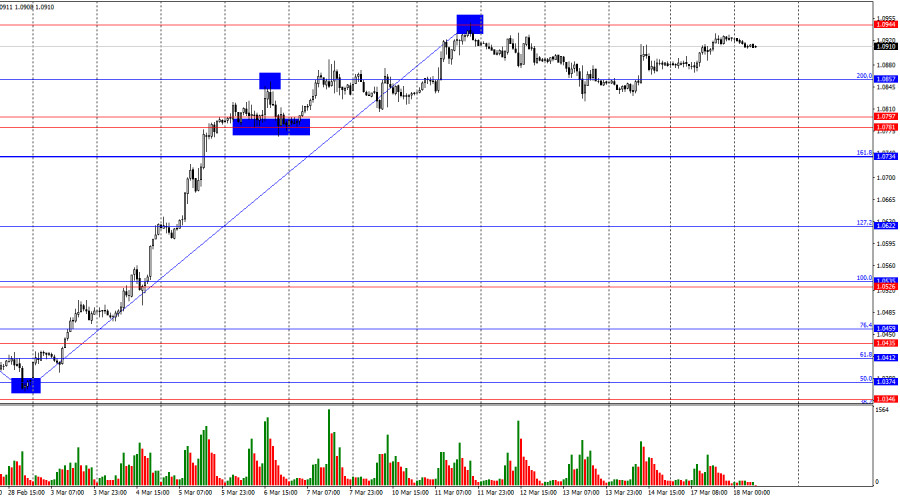

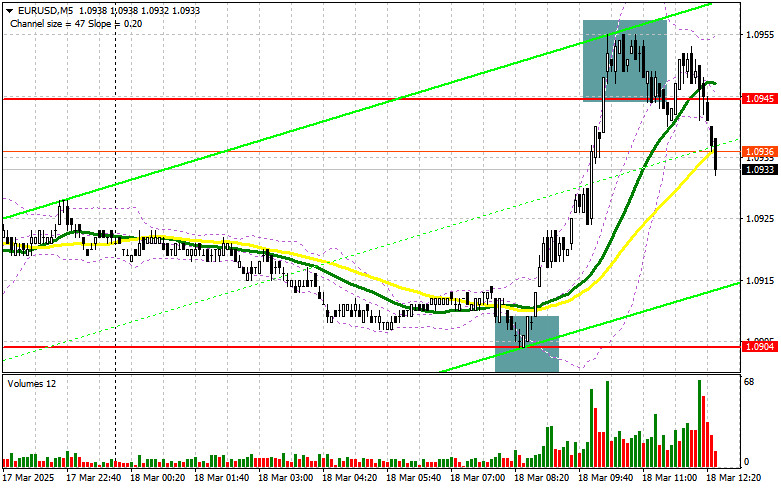

In my morning forecast, I focused on the 1.0904 level and planned to make market entry decisions based on itAuthor: Miroslaw Bawulski

19:25 2025-03-18 UTC+2

1168

Fundamental analysisPositive Data from China and Rising Risk Appetite Support a Bullish Outlook for the Kiwi – NZD/USD Analysis

Positive Data from China and Rising Risk Appetite Support a Bullish Outlook for the Kiwi – NZD/USD AnalysisAuthor: Kuvat Raharjo

11:36 2025-03-18 UTC+2

1168

- The EUR/USD exchange rate remained virtually unchanged throughout Tuesday, as the market received both positive and negative news during the day.

Author: Chin Zhao

19:43 2025-03-18 UTC+2

1303

- The GBP/USD exchange rate decreased by 20 basis points by the start of the U.S. session on Tuesday.

Author: Chin Zhao

19:45 2025-03-18 UTC+2

1288

- Bearish traders can do nothing—and they don't seem to want to.

Author: Samir Klishi

11:03 2025-03-18 UTC+2

1243

- Bulls have been attacking for two weeks, but it's time for a pause.

Author: Samir Klishi

11:30 2025-03-18 UTC+2

1213

- EUR/USD: Simple Trading Tips for Beginner Traders on March 18th (U.S. Session)

Author: Jakub Novak

19:32 2025-03-18 UTC+2

1198

- USD/JPY: Simple Trading Tips for Beginner Traders on March 18th (U.S. Session)

Author: Jakub Novak

19:40 2025-03-18 UTC+2

1183

- GBP/USD: Simple Trading Tips for Beginner Traders on March 18th (U.S. Session)

Author: Jakub Novak

19:36 2025-03-18 UTC+2

1168

- In my morning forecast, I focused on the 1.0904 level and planned to make market entry decisions based on it

Author: Miroslaw Bawulski

19:25 2025-03-18 UTC+2

1168

- Fundamental analysis

Positive Data from China and Rising Risk Appetite Support a Bullish Outlook for the Kiwi – NZD/USD Analysis

Positive Data from China and Rising Risk Appetite Support a Bullish Outlook for the Kiwi – NZD/USD AnalysisAuthor: Kuvat Raharjo

11:36 2025-03-18 UTC+2

1168