CADSEK (Canadian Dollar vs Swedish Krona). Exchange rate and online charts.

Currency converter

24 Mar 2025 13:14

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

CAD/SEK is a cross currency pair, meaning it does not contain the US dollar but its price is affected by it. CAD/SEK is quite popular among forex traders.

Despite the fact that the pair does not include USD, it has a significant impact on the pair’s exchange rate. If we compare CAD/USD and USD/SEK charts, they can show us a possible movement of CAD/SEK.

Main features

Canada is one of the world’s leading exporters of crude oil. For that reason, any changes in global oil prices affect the Canadian dollar. There is a direct correlation between fluctuations in oil prices and the loonie’s exchange rate, which is also reflected in the price of CAD/SEK.

Sweden is one of the most developed economies in Europe, leaving its neighbors Denmark, Norway, and Finland far behind. The country boasts a strong economy owing to large mineral deposits and a well-developed mechanical engineering sector.

At the same time, Sweden relies heavily on exports. A decrease in export volumes could shatter the Swedish economy. Likewise, surging energy prices could affect the exchange rate of the Swedish krona.

Aspects of trading CAD/SEK

When trading CAD/SEK, it is important to remember that the spread for transactions in cross currency pairs is often higher than for more popular forex pairs. Therefore, traders should study carefully the broker’s trading conditions before entering the market.

To make an accurate forecast for the pair, it is crucial to monitor the current economic and political situation in both countries, as well as the United States. The key economic indicators are interest rate changes, GDP, and labor market data.

Above all else, CAD/SEK can react to any economic changes in the United States in a different way.

See Also

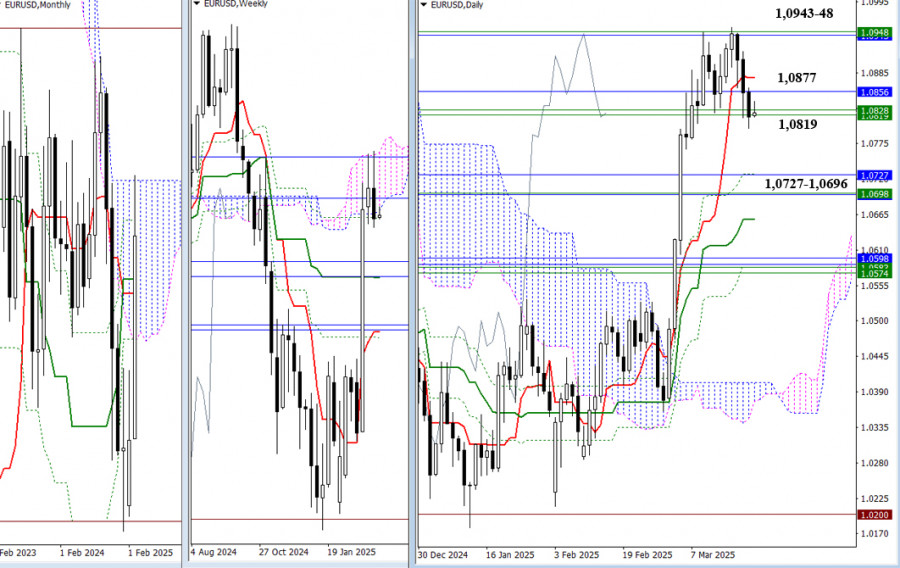

- Recently, the pair has been testing resistance levels from the weekly Ichimoku cloud (1.0946–1.0825) and monthly levels (1.0943–1.0856). Last week, sellers initiated a rejection and closed below these resistance zones. As a result, the main task for the bears now is to confirm and extend this.

Author: Evangelos Poulakis

08:55 2025-03-24 UTC+2

913

Fundamental analysisWhat to Pay Attention to on March 24? A Breakdown of Fundamental Events for Beginners

Eight macroeconomic events are scheduled for MondayAuthor: Paolo Greco

07:08 2025-03-24 UTC+2

778

Technical analysisTechnical Analysis of Intraday Price Movement of Natural Gas Commodity Instrument, Monday March 24, 2025

From what is seen on the 4-hour chart, the Natural Gas commodity instrument appearsAuthor: Arief Makmur

08:09 2025-03-24 UTC+2

778

- The upcoming week's economic calendar is packed with important fundamental events. Macroeconomic reports will either help EUR/USD sellers consolidate within the 1.07 range or enable buyers to hold above the 1.0800 target.

Author: Irina Manzenko

07:52 2025-03-24 UTC+2

763

Technical analysisTechnical Analysis of Daily Price Movement of USD/IDR Exotic Currency Pairs, Monday March 24, 2025.

On the daily chart, the exotic currency pair USD/IDR appearsAuthor: Arief Makmur

08:09 2025-03-24 UTC+2

763

Intraday Strategies for Beginner Traders on March 24Author: Miroslaw Bawulski

08:22 2025-03-24 UTC+2

703

- Today, gold prices remain low but are holding above the psychological level of $3000, which serves as an important support.

Author: Irina Yanina

11:25 2025-03-24 UTC+2

688

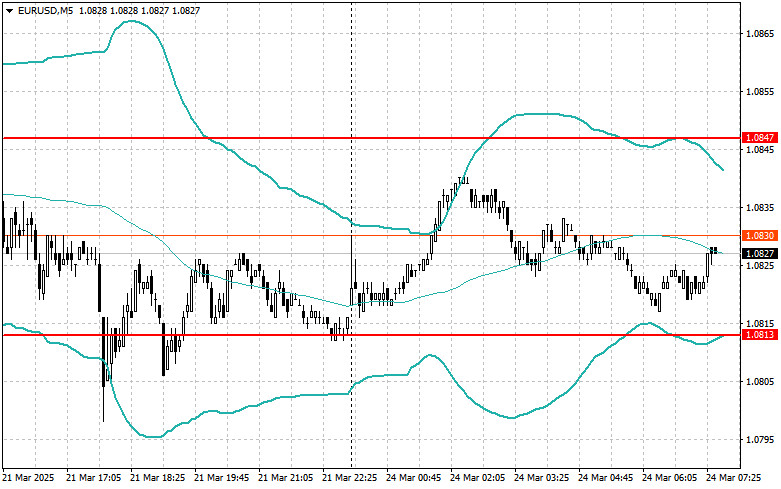

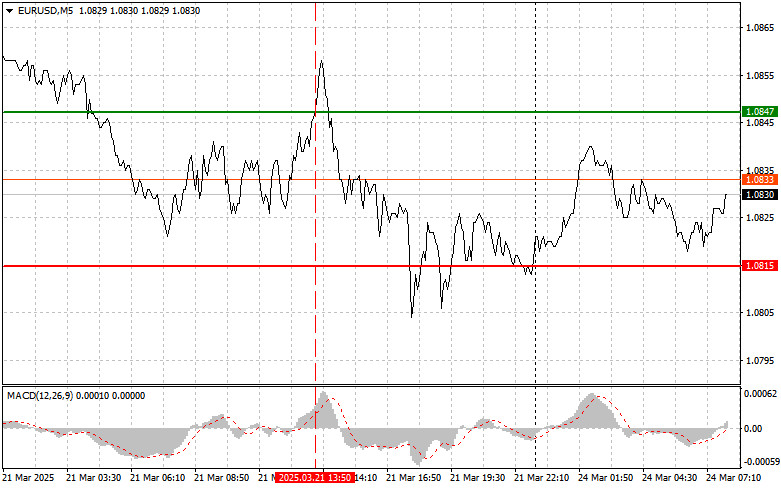

Type of analysisEUR/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:12 2025-03-24 UTC+2

688

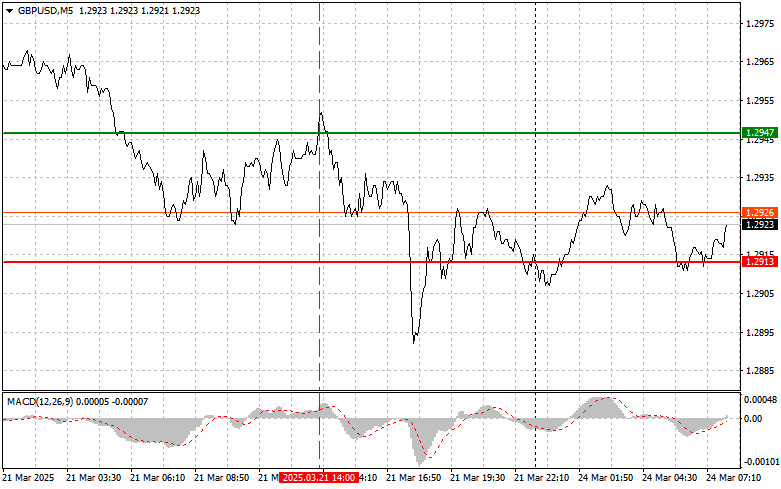

Type of analysisGBP/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:13 2025-03-24 UTC+2

628

- Recently, the pair has been testing resistance levels from the weekly Ichimoku cloud (1.0946–1.0825) and monthly levels (1.0943–1.0856). Last week, sellers initiated a rejection and closed below these resistance zones. As a result, the main task for the bears now is to confirm and extend this.

Author: Evangelos Poulakis

08:55 2025-03-24 UTC+2

913

- Fundamental analysis

What to Pay Attention to on March 24? A Breakdown of Fundamental Events for Beginners

Eight macroeconomic events are scheduled for MondayAuthor: Paolo Greco

07:08 2025-03-24 UTC+2

778

- Technical analysis

Technical Analysis of Intraday Price Movement of Natural Gas Commodity Instrument, Monday March 24, 2025

From what is seen on the 4-hour chart, the Natural Gas commodity instrument appearsAuthor: Arief Makmur

08:09 2025-03-24 UTC+2

778

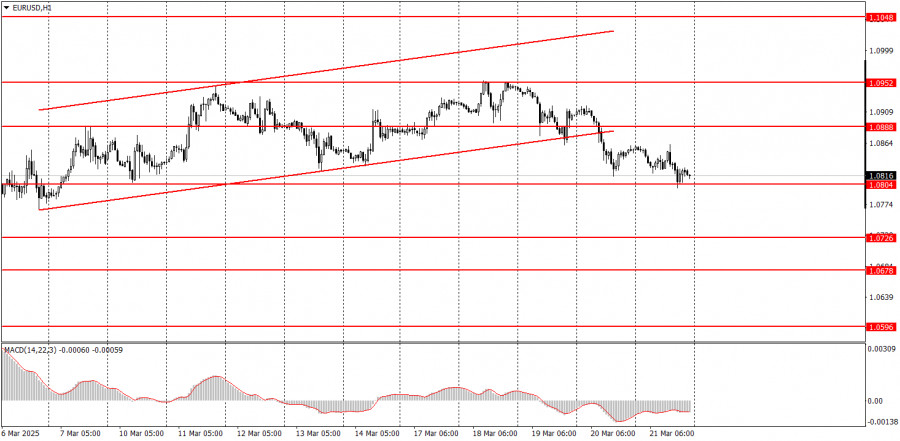

- The upcoming week's economic calendar is packed with important fundamental events. Macroeconomic reports will either help EUR/USD sellers consolidate within the 1.07 range or enable buyers to hold above the 1.0800 target.

Author: Irina Manzenko

07:52 2025-03-24 UTC+2

763

- Technical analysis

Technical Analysis of Daily Price Movement of USD/IDR Exotic Currency Pairs, Monday March 24, 2025.

On the daily chart, the exotic currency pair USD/IDR appearsAuthor: Arief Makmur

08:09 2025-03-24 UTC+2

763

- Intraday Strategies for Beginner Traders on March 24

Author: Miroslaw Bawulski

08:22 2025-03-24 UTC+2

703

- Today, gold prices remain low but are holding above the psychological level of $3000, which serves as an important support.

Author: Irina Yanina

11:25 2025-03-24 UTC+2

688

- Type of analysis

EUR/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:12 2025-03-24 UTC+2

688

- Type of analysis

GBP/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:13 2025-03-24 UTC+2

628