Lihat juga

31.03.2025 03:21 AM

31.03.2025 03:21 AMThere are very few macroeconomic events scheduled for Monday. The only somewhat interesting reports will come from Germany. Retail sales and inflation data for March will be released. However, we'd like to remind you that Germany is just one of 27 countries in the European Union, so EU-wide indicators are naturally much more important for the euro. Nevertheless, German inflation data allows for a relatively accurate forecast of eurozone inflation overall. The Consumer Price Index is expected to remain at 2.3% for March.

There are no significant fundamental events scheduled. No speeches from central bank representatives of the EU, UK, or US are planned. No other fundamental developments are expected either. As a result, Monday is shaping up to be quite uneventful. However, let's not forget that Donald Trump remains the market's most powerful driver. Last Thursday, he imposed tariffs on car imports, and on April 2, he may introduce an additional package of tariffs against several countries around the world, mainly targeting the European Union.

On the first trading day of the new week, both currency pairs may resume the declines that have been building over recent weeks. However, the upcoming week will be filled with significant news and data releases, so traders won't be able to ignore everything. On top of that, Donald Trump is planning to "liberate America." Presumably from unfair treatment — but in practice, this means new tariffs. In short, both currency pairs may experience significant volatility in the week ahead.

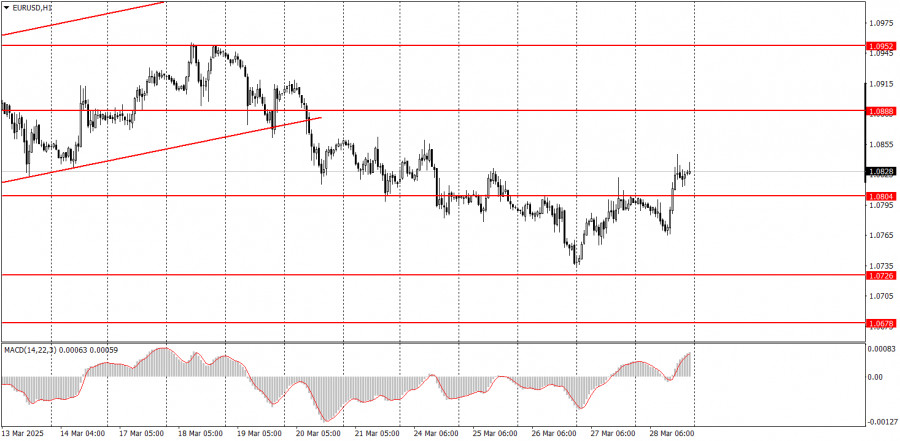

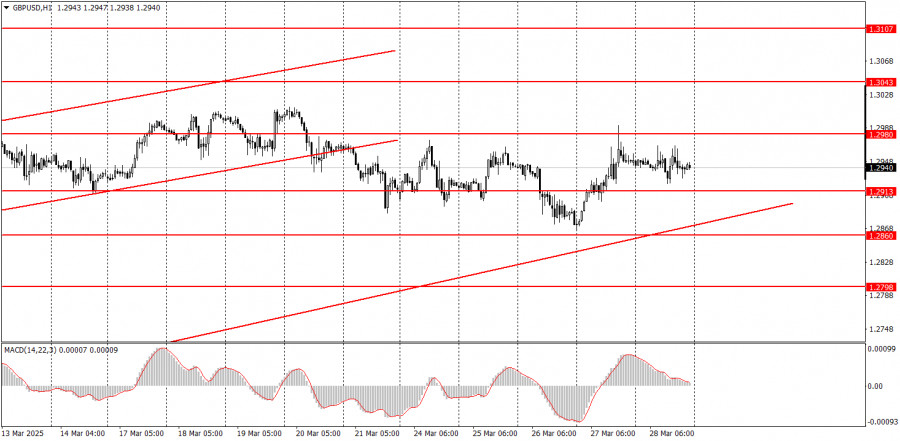

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Analisis Laporan Makroekonomi: Tiada acara makroekonomi yang dijadualkan pada hari Isnin—tidak di Amerika Syarikat, Zon Euro, Jerman, atau U.K. Oleh demikian, walaupun pasaran memberi perhatian kepada latar belakang makroekonomi, hari

Pasangan mata wang GBP/USD meneruskan pergerakan menaiknya pada hari Jumaat. Jika kita menyaksikan corak harga sebegini jauh dari paras tertinggi, mungkin tiada sebarang persoalan timbul. Secara asasnya, ia hanyalah kenaikan

Pada hari Jumaat, pasangan mata wang EUR/USD tidak menunjukkan sebarang pergerakan yang ketara. Ini tidak mengejutkan, kerana Jumaat adalah Hari Jumaat Agung, dan Ahad ialah Hari Easter. Banyak bank

Semalam, Presiden Amerika Syarikat Donald Trump menyatakan bahawa beliau boleh menyingkirkan Pengerusi Rizab Persekutuan, Jerome Powell, sekali gus menimbulkan keraguan terhadap konsep kebebasan bank pusat. Beliau turut meluahkan rasa tidak

Hari ini adalah Good Friday, hari yang diperingati oleh penganut Kristian di seluruh dunia merentasi semua denominasi. Aktiviti pasaran telah berkurangan dengan ketara menjelang cuti Easter, namun ini bukanlah sebab

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

Carta Forex

Versi-Web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.