USDNOK (US Dollar vs Norwegian Krone). Exchange rate and online charts.

Currency converter

19 Mar 2025 22:09

(-0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

USDNOK stands for the United States dollar vs. the Norwegian krone currency pair. The Norwegian krone is among the most popular non-major currencies. In 2000, the pair got significantly stronger, mostly because of oil prices flying higher. Moreover, the economic policy of Norway added much to the pair reputation, as during the global economic crisis the country got the less damage in the sector of economy due to wise investments of the country’s monetary policy makers. The following factors are of chief importance for the Norwegian krone: the oil prices, the country’s credit rating and the overall stance of the currency market.

It should be noted that Norway is one of the largest oil exporters in the Western Europe, and is strongly dependent on the energy market climate.

The rate of the Norwegian krone versus the United States dollar has demonstrated a steady climb over the last decade. For example, in 2001 the correlation between the currencies was as follows: one American dollar cost nine Norwegian kroner. However, in ten years one dollar was bought for less than 6 kroner.

The dynamics of the American dollar rate is mainly determined by the macroeconomic indicators of the country. The greenback’s unpredictable and strong fluctuations make it the most often used currency on Forex, especially by speculators who prefer short trades with the purpose of getting high yield within a narrow time.

The USDNOK pair fundamental analysis is based on the American dollar rate. If the USD confidence is low, the pair is to move downwards.

See Also

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on March 19. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on March 19. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:01 2025-03-19 UTC+2

1663

Market overview on March 19Author: Jozef Kovach

11:57 2025-03-19 UTC+2

1408

Bulls have been attacking for two weeks, but it's time for a pause.Author: Samir Klishi

11:46 2025-03-19 UTC+2

1393

- Gold has halted its upward movement as it attempts to consolidate at new all-time highs around $3,045

Author: Irina Yanina

10:41 2025-03-19 UTC+2

1393

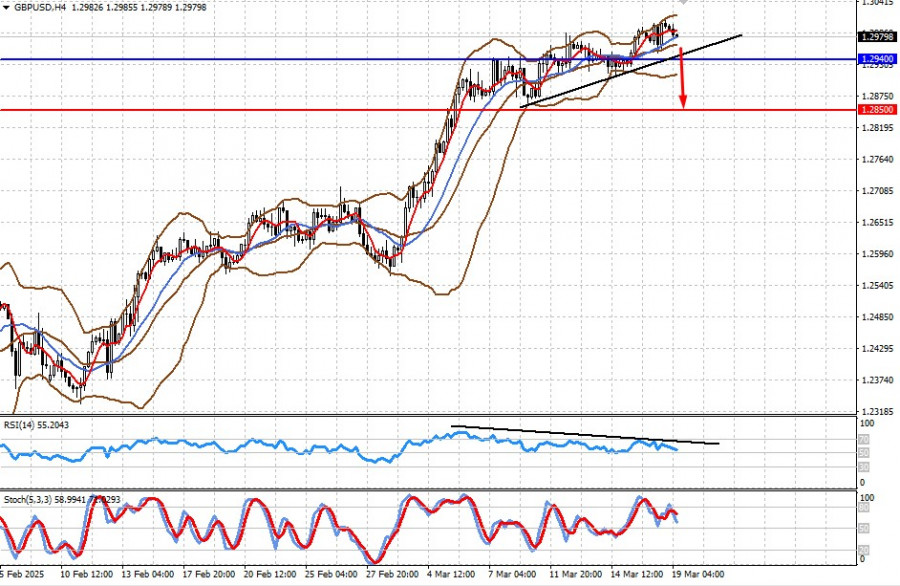

Type of analysisGBP/USD: Simple Trading Tips for Beginner Traders on March 19. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on March 19. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:01 2025-03-19 UTC+2

1318

The latest news from the US srock marketAuthor: Andreeva Natalya

11:52 2025-03-19 UTC+2

1273

- Technical analysis

Trading Signals for EUR/USD for March 19-21, 2025: sell below 1.0900 (+2/8 Murray + 21 SMA)

If the euro falls and consolidates below 1.09 and below the 21 SMA in the coming hours, this could be seen as an opportunity to sell with targets at 1.0830, the Murray 8/8 level, around 1.742, and finally 1.0642.Author: Dimitrios Zappas

15:01 2025-03-19 UTC+2

1243

Fundamental analysisHow Might Markets React After the Fed Meeting? (Expecting a Sharp Decline in GBP/USD and a Drop in #SPX)

Today, the market will focus on the Federal Reserve's final decision on monetary policy. It is expected to bring nothing new, so the main topic will remain the same as in recent months—the impact of Trump's policies on the U.S. economyAuthor: Pati Gani

09:27 2025-03-19 UTC+2

1213

Bitcoin Targets $85,000Author: Jakub Novak

11:49 2025-03-19 UTC+2

1198

- Type of analysis

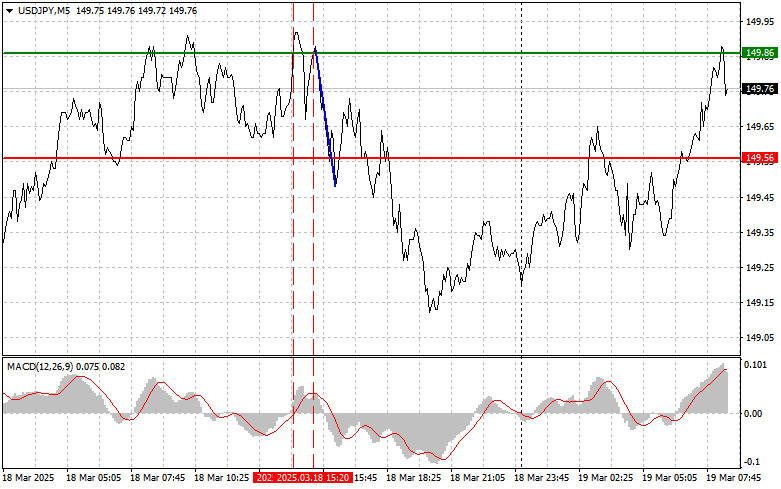

USD/JPY: Simple Trading Tips for Beginner Traders on March 19. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on March 19. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:01 2025-03-19 UTC+2

1663

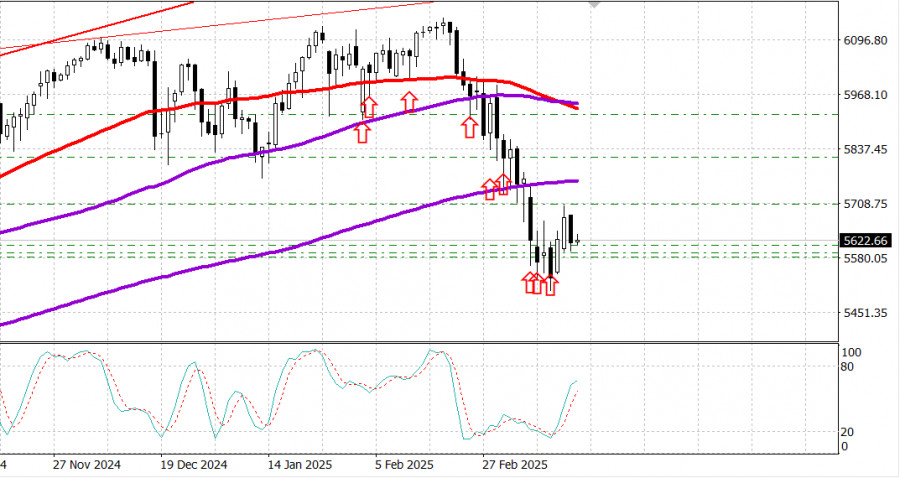

- Bulls have been attacking for two weeks, but it's time for a pause.

Author: Samir Klishi

11:46 2025-03-19 UTC+2

1393

- Gold has halted its upward movement as it attempts to consolidate at new all-time highs around $3,045

Author: Irina Yanina

10:41 2025-03-19 UTC+2

1393

- Type of analysis

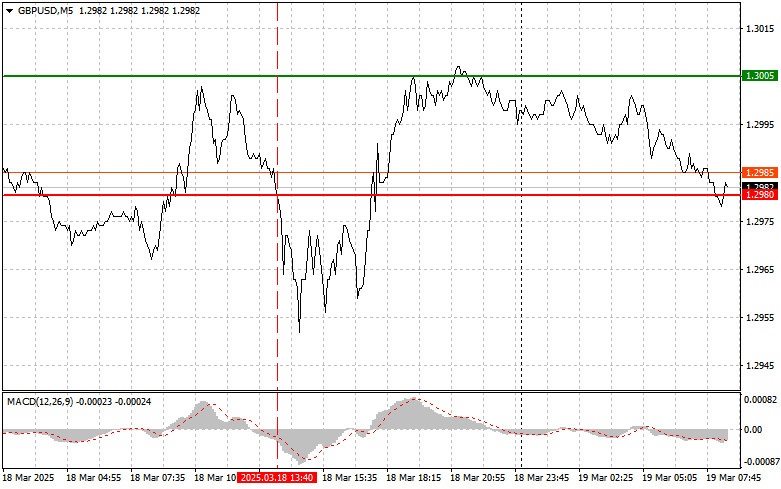

GBP/USD: Simple Trading Tips for Beginner Traders on March 19. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on March 19. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:01 2025-03-19 UTC+2

1318

- The latest news from the US srock market

Author: Andreeva Natalya

11:52 2025-03-19 UTC+2

1273

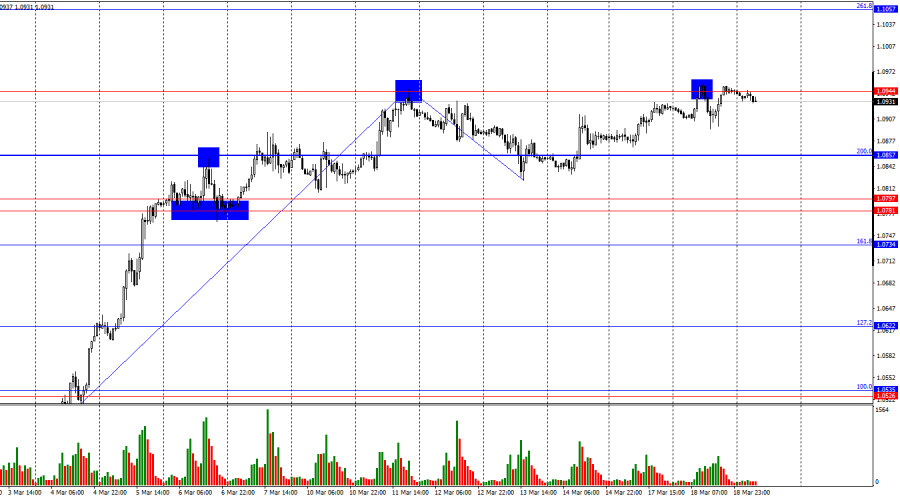

- Technical analysis

Trading Signals for EUR/USD for March 19-21, 2025: sell below 1.0900 (+2/8 Murray + 21 SMA)

If the euro falls and consolidates below 1.09 and below the 21 SMA in the coming hours, this could be seen as an opportunity to sell with targets at 1.0830, the Murray 8/8 level, around 1.742, and finally 1.0642.Author: Dimitrios Zappas

15:01 2025-03-19 UTC+2

1243

- Fundamental analysis

How Might Markets React After the Fed Meeting? (Expecting a Sharp Decline in GBP/USD and a Drop in #SPX)

Today, the market will focus on the Federal Reserve's final decision on monetary policy. It is expected to bring nothing new, so the main topic will remain the same as in recent months—the impact of Trump's policies on the U.S. economyAuthor: Pati Gani

09:27 2025-03-19 UTC+2

1213

- Bitcoin Targets $85,000

Author: Jakub Novak

11:49 2025-03-19 UTC+2

1198