यह भी देखें

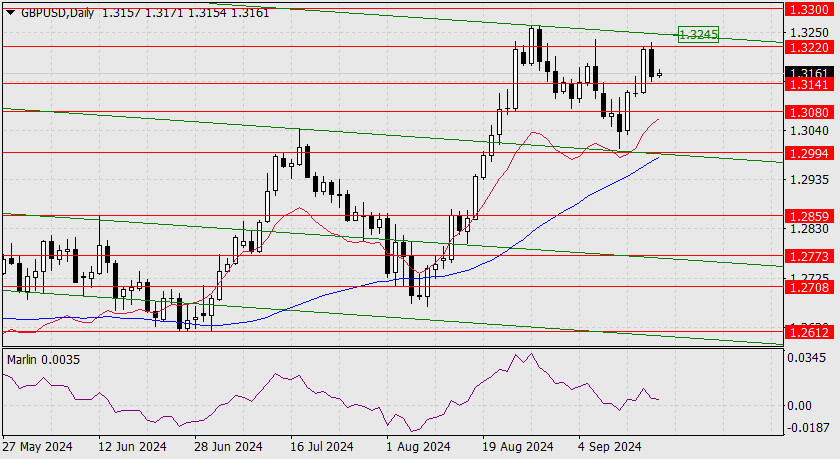

The pound's rapid growth on Monday showed its weakness yesterday, as the price returned to the support level of 1.3141. Naturally, this is a more convenient position to wait for the Federal Reserve's rate decision. Since we expect a rate cut of only 0.25% rather than the 0.50% the markets have priced in, we are waiting for the dollar to strengthen and the pound to fall to 1.3080.

Following this, the pound may continue its decline after the Bank of England's meeting. Seven members of the committee are expected to vote to keep the current rate at 5.00%, while two will vote in favor of lowering it. Today, the UK will release its August CPI report. The core index is expected to rise from 3.3% y/y to 3.6% y/y, while the overall index is forecast to remain unchanged at 2.2% y/y.

In the Eurozone, the current CPI is 2.6% y/y, and the core CPI is 2.9%, yet the refinancing rate is lower. So, even if the UK data slightly exceeds expectations, it may not impact today's vote on the rate but could significantly soften expectations. As a result, we could see the pound drop to the 1.2994 mark.

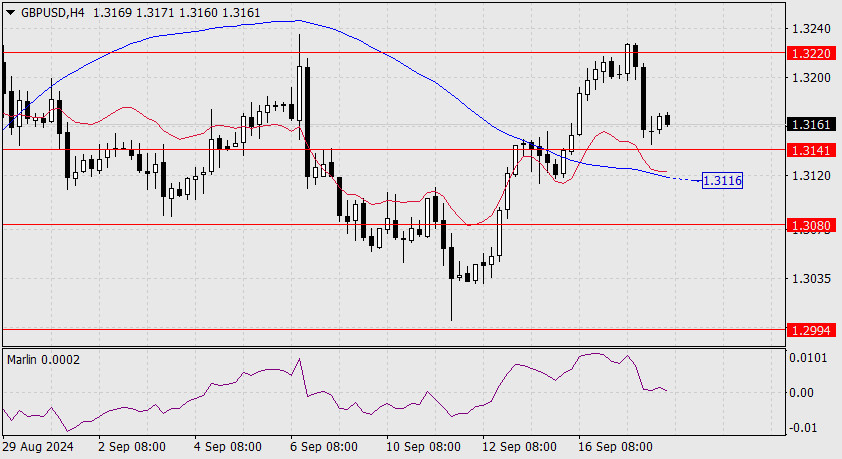

On the four-hour chart, the Marlin oscillator is on the verge of entering the downtrend territory. The price remains above the 1.3141 level and the MACD line (1.3116), indicating a wait-and-see mode.

You have already liked this post today

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |