Lihat juga

02.04.2025 08:50 AM

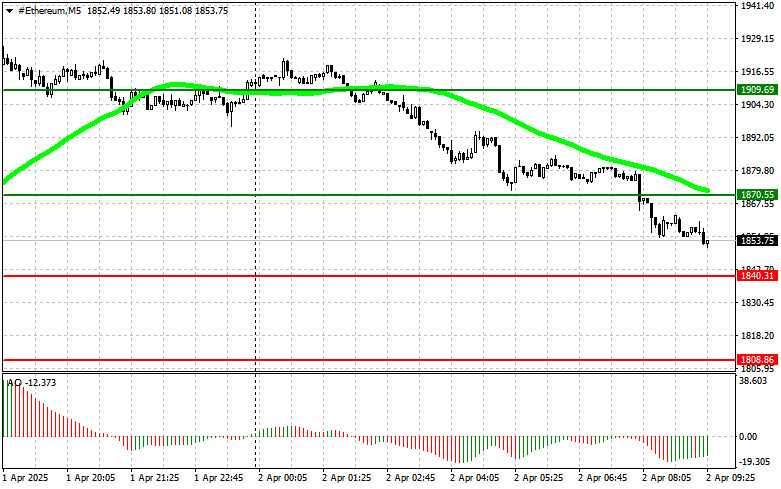

02.04.2025 08:50 AMBitcoin and Ethereum are holding their ground ahead of a major event that could reshape the global trading landscape. Another failed attempt by Bitcoin to settle above the $85,500 level led to a sell-off, with the asset now trading around $84,000. Ethereum hasn't fared much better: after briefly climbing above $1,930 during yesterday's U.S. session, it has pulled back to around $1,859.

It's difficult to predict how the cryptocurrency market will react to today's news from the U.S., but it's safe to say that no good surprises are expected. President Donald Trump is set to announce the most extensive trade restrictions imposed by the U.S. in the past century—measures that could overturn the post-war global trade system in one move and introduce unpredictable economic risks.

If measures such as steep import tariffs and export restrictions are implemented, the consequences for the global economy could be severe. These actions could heighten volatility in the cryptocurrency market, where investor confidence plays a crucial role. As a result, Bitcoin and other altcoins may face selling pressure as participants move to protect their capital. In this new reality, alternative assets, including cryptocurrencies, may become less attractive.

This could severely impact risk assets, starting with the U.S. stock market, which, as you likely know, has recently shown a strong correlation with the crypto market. So, if equities tumble, expect an active sell-off in crypto.

For this reason, it's best to remain calm today and respond to developments cautiously, hoping that Trump's tariff policies will be less aggressive than previously suggested.

For the intraday strategy, I will continue to focus on major dips in Bitcoin and Ethereum, banking on the continuation of the medium-term bullish trend—which, for now, remains intact.

For short-term trading, the strategy and conditions are outlined below.

Scenario 1: I will buy Bitcoin today if it reaches the entry point around $84,400, targeting a rise to $85,500. At $85,500, I plan to exit long positions and immediately sell on the pullback.

Before entering a breakout trade, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in the positive zone.

Scenario 2: If there is no strong downside breakout, I will also buy Bitcoin from the lower boundary at $83,000, targeting a reversal back to $84,400 and $85,500.

Scenario 1: I plan to sell Bitcoin at $83,800, targeting a drop to $82,800. I will exit short positions at $82,800 and switch to long on a rebound. Before entering a breakout sell, ensure the 50-day moving average is above the current price and the Awesome Oscillator is in the negative zone.

Scenario 2: If there's no sustained breakout, I will also sell Bitcoin from the upper boundary at $84,400, targeting a pullback to $83,800 and $82,500.

Scenario 1: I will buy Ethereum at $1,870, targeting a rise to $1,909. I'll exit longs and sell on the pullback from this level. Before buying, confirm that the 50-day moving average is below the price and the Awesome Oscillator is in positive territory.

Scenario 2: I will also buy Ethereum from the lower boundary at $1,840 if there is no breakout to the downside, targeting a move back to $1,870 and $1,909.

Scenario 1: I will sell Ethereum at $1,840, aiming for a decline to $1,808. I'll close the shorts and switch to buying on a bounce from this area. Before selling, confirm that the 50-day moving average is above the price and the Awesome Oscillator is in the negative zone.

Scenario 2: If there is no breakout, I will also sell Ethereum from the upper boundary at $1,870, targeting a move to $1,840 and $1,808.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Bitcoin dan Ethereum, setelah menghabiskan seluruh akhir pekan bergerak menyamping dalam rentang tertentu, melonjak tajam selama sesi Asia hari ini. Kenaikan ini dipicu oleh rumor bahwa Ketua Federal Reserve

Setelah berhasil keluar dari pola Ascending Broadening Wedge di chart 4 jamnya mata uang kripto Litecoin yang diikuti oleh munculnya Divergence antara pergerakan harga Litecoin dengan indikator Stochastic Oscillator serta

Tekanan pada pasar cryptocurrency kembali muncul kemarin setelah para trader dan investor memicu aksi jual di pasar saham AS. Seperti yang telah saya nyatakan berulang kali, korelasi antara kedua pasar

Bitcoin memperkuat posisinya dengan cukup baik, hampir mencapai level 86.000. Ethereum juga menunjukkan kenaikan, tetapi kehilangan keunggulan tersebut pada akhir sesi perdagangan di AS. Dengan meredanya ketegangan terkait tarif

Selama akhir pekan lalu, Bitcoin dan Ethereum menunjukkan ketahanan yang cukup baik, mempertahankan peluang untuk terus pulih. Meskipun dari sudut pandang teknikal peluang tersebut mungkin tampak agak tipis, trading dalam

Pada pekan trading terakhir, pasar menunjukkan potensi peluang bagi pihak bullish untuk kembali mengendalikan. Apakah potensi ini dapat terwujud sekarang bergantung pada apakah pihak bullish dapat keluar dari area konsolidasi

Bitcoin dan Ethereum anjlok pada penghujung hari kemarin, tetapi kemudian berhasil memulihkan posisi mereka. Untuk saat ini, bear masih memiliki kekuatan lebih dibandingkan pembeli, tetapi ini mungkin hanya sementara, sampai

Dari apa yang terlihat di chart 4 jam dari mata uang kripto Uniswap, nampak terlihat adanya divergence antara pergerakan harga Uniswap dengan indikator Stochastic Oscillator, sehingga berdasarkan hal ini, maka

Dengan munculnya divergence antara pergerakan harga mata uang kripto Polkadot dengan indikator Stochastic Oscillator di chart 4 jamnya, maka selama tidak terjadi koreksi pelemahan yang tembus dan menutup dibawah level

Klub InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.