Lihat juga

02.04.2025 04:00 AM

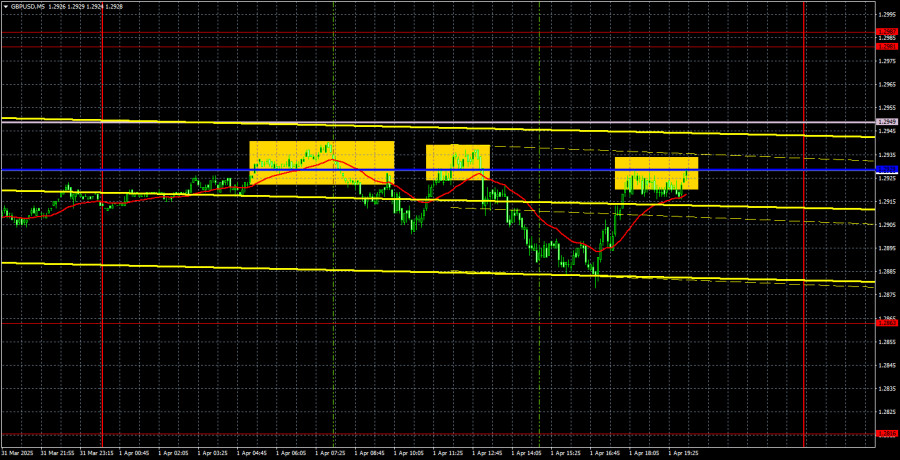

02.04.2025 04:00 AMThe GBP/USD currency pair continued to trade similarly on Tuesday, as it has over the last few weeks. All price movements have occurred between 1.2863 and 1.2981 for the past two weeks. The Ichimoku indicator lines are being ignored during this flat phase. The macroeconomic background is irrelevant as the price continues to move sideways. The current technical situation for the pound is highly favorable. Of course, the market reacts to individual reports, but such movements are practically pointless to trade.

Yesterday, the UK published its March manufacturing PMI. The figure dropped to 44.9 points, while the market expected 44.6. So, how should this report be interpreted? Business activity declined again, but not as sharply as expected... Still, there's little positive news coming out of the UK. In the U.S., aside from the ISM index, the JOLTs job openings report was released, which also had no impact. Job openings in February amounted to 7.568 million, below market expectations. So, both U.S. reports underperformed—just like the only one from the UK.

In the 5-minute timeframe, the price bounced off the Kijun-sen line three times on Tuesday. All three signals were inaccurate. Since the flat range is visible even from a mile away on the hourly chart, we believe it made no sense to open short positions based on these signals. In a flat market, trading off the range boundaries is viable. But the pair doesn't seem willing to reach those boundaries. Notably, all three signals provided at least a minor move in the correct direction, so incurring losses would have been complex.

The COT reports for the British pound show that commercial traders' sentiment has constantly shifted in recent years. The red and blue lines, which reflect the net positions of commercial and non-commercial traders, frequently cross and usually stay close to the zero line. They are again near each other, indicating a roughly equal number of long and short positions.

On the weekly timeframe, the price first broke through the 1.3154 level and then dropped to the trendline, which it successfully breached. Breaking the trendline suggests a high probability of further GBP decline. However, the bounce from the previous local low on the weekly timeframe is also worth noting. We may be looking at a broad flat.

According to the latest COT report for the British pound, the "Non-commercial" group opened 13,000 new long contracts and closed 1,800 short contracts. As a result, the net position of non-commercial traders rose again—by 14,800 contracts.

The fundamental background still provides no grounds for long-term GBP purchases, and the currency remains vulnerable to continuing the global downtrend. The pound has risen significantly recently, and the primary reason for this increase is Donald Trump's policy.

On the hourly chart, GBP/USD remains completely flat. The upward correction on the daily chart has long overstayed. We still don't see any substantial justification for a long-term GBP rally. The only supportive factor is Donald Trump, who continues to announce sanctions and tariffs left and right. However, even this factor has started to lose its impact on the market. Therefore, we must wait for the flat to end and then determine a new trend on the hourly chart.

For April 2, the following levels are highlighted for trading: 1.2331–1.2349, 1.2429–1.2445, 1.2511, 1.2605–1.2620, 1.2691–1.2701, 1.2796–1.2816, 1.2863, 1.2981–1.2987, 1.3050, 1.3119. The Senkou Span B (1.2949) and Kijun-sen (1.2929) lines may also be signal sources. Moving your Stop Loss to breakeven if the price moves 20 pips in the right direction is recommended. Ichimoku lines may shift throughout the day, which must be considered when determining trading signals.

On Wednesday, the UK's economic calendar is empty, and the only U.S. report will be the ADP employment change, which may trigger a slight intraday reaction but is unlikely to have a long-term effect. Donald Trump may announce new tariffs overnight, which is notable. However, it's worth remembering that the last tariff announcement from the U.S. president caused virtually no market reaction.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Dalam prediksi pagi saya, saya menyoroti level 1,3247 sebagai titik acuan untuk keputusan memasuki pasar. Mari kita lihat grafik 5 menit dan menganalisis apa yang terjadi. Pasangan mata uang memang

Dalam prediksi pagi, saya menyoroti level 1,1341 sebagai titik kunci untuk keputusan masuk pasar. Mari perhatikan grafik 5 menit dan analisis apa yang terjadi di sana. Penurunan diikuti oleh false

Sepanjang hari Selasa, pasangan GBP/USD terus bergerak naik. Seperti yang kita lihat, mata uang Inggris tidak memerlukan alasan khusus untuk terus naik. Kami telah beberapa kali mengatakan bahwa saat

Pada hari Selasa, pasangan mata uang EUR/USD mengalami sedikit penurunan, yang dapat dianggap sebagai koreksi teknis murni. Kemarin — dan secara umum — dolar masih belum memiliki alasan nyata untuk

Pada hari Selasa, pasangan mata uang GBP/USD melanjutkan pergerakan naiknya hampir sepanjang hari. Tidak ada alasan signifikan atau dasar fundamental untuk ini, tetapi seluruh pasar mata uang bergerak secara acak

Pada hari Selasa, pasangan mata uang EUR/USD memulai penurunan yang telah lama dinantikan, meskipun tidak jatuh terlalu jauh atau terlalu lama. Perlu diingat bahwa tidak ada alasan fundamental untuk pertumbuhan

Dalam perkiraan pagi saya, saya fokus pada level 1.3204 dan merencanakan untuk membuat keputusan trading dari level tersebut. Mari kita lihat grafik 5 menit dan lihat apa yang terjadi. Terjadi

Dalam prediksi pagi, saya menyoroti level 1,1377 dan merencanakan untuk membuat keputusan trading dari sana. Mari perhatikan grafik 5 menit dan analisis apa yang terjadi. Kenaikan diikuti oleh false breakout

Pada hari Senin, pasangan GBP/USD melanjutkan pergerakan naiknya tanpa kesulitan. Tidak ada alasan makroekonomi untuk ini, dan bahkan euro menunjukkan pergerakan yang jauh lebih tenang pada akhir hari. Namun, pound

Pada hari Senin, pasangan mata uang EUR/USD lebih banyak diperdagangkan secara mendatar daripada naik, meskipun pada akhirnya tetap mengalami kenaikan nilai. Tidak ada peristiwa makroekonomi atau fundamental besar yang dijadwalkan

Akun PAMM

InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.