Lihat juga

01.04.2025 08:56 AM

01.04.2025 08:56 AMAs a result of Friday's regular session, US stock indices closed mixed. The S&P 500 rose by 0.55%, while the Nasdaq 100 dropped by 0.14%. The industrial Dow Jones gained 1.00%.

Asian stock indices ended a multi-day losing streak amid high volatility ahead of President Donald Trump's tariff plan. European stock index futures grew, while US index futures fell, indicating a dampened market sentiment. Gold reached a record high due to demand for safe-haven assets, while the US dollar strengthened slightly against most Group of Ten currencies.

Traders received additional information about when Trump will announce his reciprocal tariff plan. This will happen at 3:00 PM on Wednesday during an event in the White House Rose Garden. However, the scale of the tariffs remains unclear. In anticipation of the upcoming announcement, investors refrained from taking large positions due to concerns about how tariffs would impact economic growth and inflation in the world's largest economy. This uncertainty led to reduced trading volumes and general nervousness in the markets.

Analysts are divided on the potential impact of tariffs. Some argue that they could stimulate domestic production and create new jobs, while others warn of the risk of retaliatory measures from other countries and disruptions to global supply chains. The impact on inflation is also a matter of debate. A tariff hike could lead to higher prices for imported goods, which would eventually affect consumers. However, some economists believe this effect will be limited, and the Federal Reserve will be able to offset it.

Many traders, despite a slight rebound in the stock market after yesterday's sharp sell-off, remain skeptical about more significant growth. Markets will stabilize if Trump's plans are viewed as a one-time event that is straightforward to execute. However, pressure will increase if Trump fails to provide clarity on these issues.

I would like to remind you that the US president called his April 2 statement "Freedom Day," announcing the beginning of a more protectionist policy aimed at taking revenge on trade partners he has long accused of deceiving the US. Trump has already imposed tariffs on Canada, Mexico, and China — the three largest US trading partners — as well as on cars, steel, and aluminum. Import tariffs on copper may be introduced within the next few weeks. Trump has also threatened tariffs on imports of pharmaceutical products, semiconductors, and lumber.

In the commodities market, oil stabilized after a surge on Monday, as Trump suggested that the US could work on reducing crude oil supplies from Russia. Gold climbed above $3,133 per ounce for the first time after a 1.4% jump in the previous session.

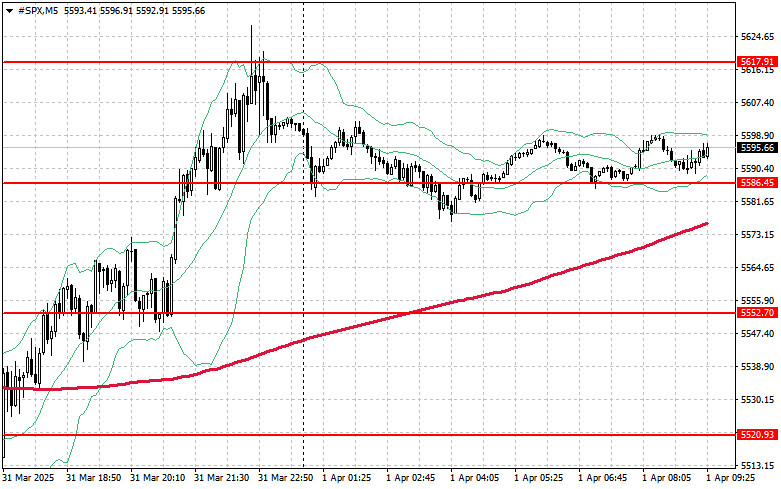

As for the technical picture of the S&P 500, the index is trading lower. The primary task for buyers today will be to overcome the nearest resistance at $5,617. This would help continue the uptrend and enable a move to the higher level of $5,645. Equally important for the bulls will be maintaining control over $5,670, which would strengthen buyers' positions. In case of a downward movement due to a decline in risk appetite, buyers must assert themselves around $5,586. A breakout would quickly send the instrument back to $5,552 and open the path to $5,520.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pembukaan pra-pasar pada hari Selasa dimulai dengan ketidakpastian, sebuah kondisi yang sering kali mendahului badai daripada ketenangan di Wall Street. Futures S&P 500 bergerak turun menuju 5.420 setelah sesi Senin

Pada penutupan sesi reguler sebelumnya, indeks saham AS berakhir di wilayah positif. S&P 500 naik sebesar 0,79%, sementara Nasdaq 100 meningkat 0,64%. Dow Jones Industrial Average naik sebesar 0,78%. Indeks

Pasar global telah tersapu dalam badai tarif, dan pusat badai tersebut sekali lagi berada di Washington. Trump, dengan satu goresan penanya, dapat membuat indeks anjlok atau memberinya pemulihan, tetapi

Indeks saham utama AS menutup sesi reguler di Amerika Utara pada hari Jumat dengan hasil positif. S&P 500 naik sebesar 1,81%, sementara Nasdaq 100 meningkat 2,06%. Dow Jones industri naik

S&P500 Gambaran singkat indeks saham acuan AS pada hari Kamis: * Dow -2,5%, * NASDAQ -4,3%, * S&P 500 -3,5% S&P 500 ditutup pada 5.268, dalam rentang 4.800 hingga 5.800

Pasar saham AS baru saja mengalami salah satu gelombang optimisme terkuat dalam beberapa tahun terakhir. Pada hari Rabu, setelah pernyataan dari Presiden Donald Trump, indeks-indeks saham utama mencatatkan kenaikan yang

S&P 500 Ringkasan untuk 10 April Pasar AS bangkit kembali dengan kuat, tetapi perang dagang Trump dengan Tiongkok tetap belum terselesaikan Indeks utama AS pada hari Rabu: Dow +8%, NASDAQ

InstaTrade dalam angka

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.