Lihat juga

31.03.2025 09:35 AM

31.03.2025 09:35 AMThe price test at 150.85 occurred when the MACD indicator had already moved significantly above the zero level, limiting the pair's upside potential. For this reason, I did not buy the dollar. Shortly after, another test of 150.85 while the MACD was in the overbought zone triggered Sell Scenario #2, which led to a drop in the pair by more than 70 pips.

Today's strong data on Japan's industrial production growth supported the yen and put additional pressure on the dollar. Output increased by 2.5%, compared to the expected 1.9%. This unexpected rise signals a recovery of the Japanese economy following recent challenges. Increased production—especially in key sectors like the auto and electronics industries—brings optimism about Japan's economic outlook. The yen's appreciation against the dollar reflects growing investor confidence in the Japanese currency, which was traditionally seen as a safe haven during economic uncertainty. Additional pressure on the dollar also stems from expectations that the Bank of Japan might continue raising interest rates, especially given the improvement in economic indicators.

Japan's retail sales data also came out quite strong. Contrary to analysts' concerns of a decline, the indicator showed a confident rise, signaling a recovery in consumer demand. This is a positive sign for the Japanese economy, which has long struggled with deflation and weak growth. While it's too early to declare a full recovery, the positive retail momentum gives hope for further improvement.

For intraday strategy, I will focus primarily on implementing Scenarios #1 and #2.

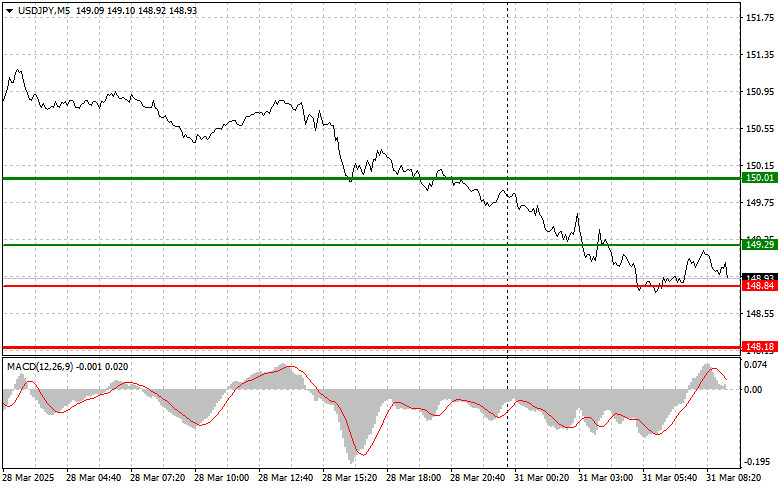

Scenario #1: I plan to buy USD/JPY today at the 149.29 entry point (green line on the chart), targeting a rise to 150.01 (thicker green line). Around 150.01, I plan to exit the long position and open a short position in the opposite direction (aiming for a 30–35 pip retracement). It's best to re-enter long positions after corrections and significant dips in USD/JPY. Important: Before buying, make sure the MACD indicator is above the zero level and just beginning to rise.

Scenario #2: I also plan to buy USD/JPY if the price tests 148.84 twice while the MACD is in the oversold zone. This would limit the pair's downside potential and lead to an upward reversal. A rise toward 149.29 and 150.01 can be expected.

Scenario #1: I plan to sell USD/JPY only after breaking below 148.84 (red line on the chart), which would lead to a quick decline. The main target for sellers will be 148.18, where I plan to exit the short position and open a long one (aiming for a 20–25 pip retracement). Selling pressure could return at any moment. Important: Before selling, ensure the MACD indicator is below zero and beginning to fall.

Scenario #2: I also plan to sell USD/JPY today if the price tests 149.29 twice while the MACD is in the overbought zone. This would limit the pair's upside potential and lead to a downward reversal. A decline toward 148.84 and 148.18 can be expected.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Analisis trading dan kiat-kiat trading untuk yen Jepang Pengujian level harga 142,51 terjadi ketika indikator MACD sudah bergerak jauh di bawah angka nol, yang membatasi potensi penurunan pasangan ini. Oleh

Analisis trading dan tips trading untuk pound Inggris Uji level harga 1.3257 terjadi ketika indikator MACD sudah bergerak jauh di bawah tanda nol, yang membatasi potensi penurunan pasangan ini. Oleh

Analisis dan Kiat-kiat Trading Euro Uji level harga 1,1344 terjadi ketika indikator MACD sudah bergerak jauh di bawah garis nol, yang membatasi potensi penurunan pasangan ini. Oleh karena itu, saya

Uji harga pada 142,69 terjadi tepat saat indikator MACD mulai bergerak naik dari garis nol, mengonfirmasi titik entri yang tepat untuk membeli dolar. Akibatnya, pasangan ini hanya naik 15 poin

Tidak ada pengujian terhadap level yang saya sebutkan pada paruh pertama hari ini. Bahkan dengan rilis data inflasi penting dari Inggris, berkurangnya volatilitas pasar mencegah pasangan ini mencapai level-level kunci

Ulasan Trading dan Panduan untuk Trading Euro Tidak ada pengujian terhadap level yang saya sebutkan di paruh pertama hari ini. Bahkan dengan rilis data inflasi penting, volatilitas pasar yang berkurang

Uji harga di 142,93 terjadi ketika indikator MACD baru saja mulai bergerak turun dari level nol, mengonfirmasi titik entri yang valid untuk menjual dolar. Akibatnya, pasangan ini turun

Uji level harga 1.3238 terjadi ketika indikator MACD baru saja mulai naik dari garis nol, yang mengonfirmasi titik masuk yang valid untuk membeli pound sesuai dengan tren. Namun, pasangan

Pengujian harga di 1,1311 terjadi ketika indikator MACD baru saja mulai bergerak turun dari level nol, mengonfirmasi titik masuk yang valid untuk menjual euro. Akibatnya, pasangan ini turun sebanyak

Euro dan pound tetap kuat terhadap dolar meskipun ada koreksi pada aset berisiko di akhir hari. Mata uang Eropa menunjukkan ketahanan terhadap faktor eksternal, seperti spekulasi mengenai pembicaraan dagang antara

Ferrari F8 TRIBUTO

dari InstaTrade

Akun PAMM

InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.