Lihat juga

31.03.2025 09:34 AM

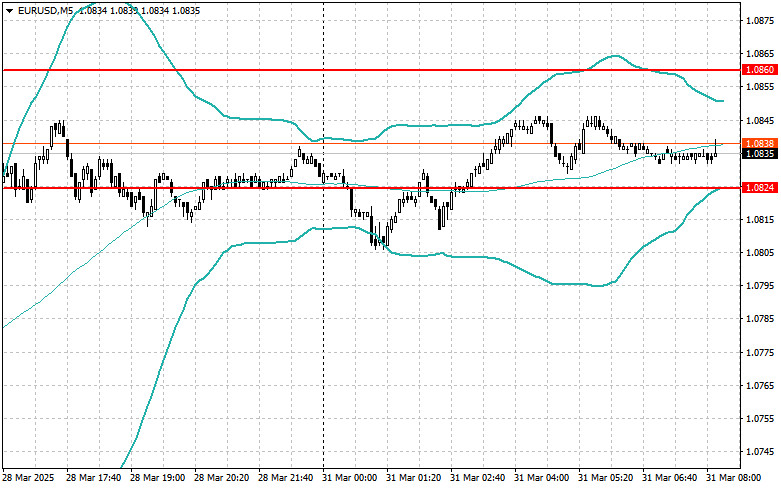

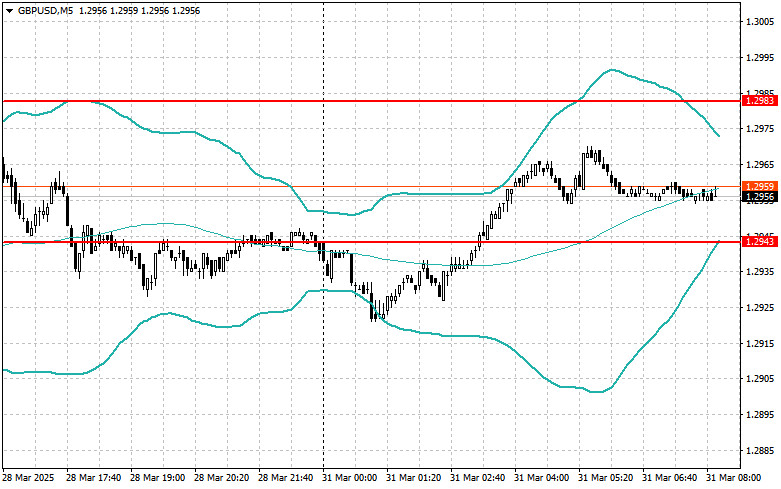

31.03.2025 09:34 AMThe euro and pound showed gains, but it's still too early to say the downward corrections are over. Buyers will need to exert more effort to alter the current technical situation.

The U.S. Personal Consumption Expenditures (PCE) index matched economists' forecasts. This indicates that the trade policy pursued by the Trump administration has not yet significantly impacted inflation, which had been one of the Federal Reserve's main concerns. This situation gives the Fed room to maintain a more flexible monetary policy. At the same time, despite moderate price growth, the U.S. economy is showing signs of slowing down, as recent data suggest.

As a result, the Fed faces a complex challenge: on the one hand, there is no clear case for maintaining a tight monetary stance; on the other, there is a need to stimulate the economy to avoid a deeper downturn. Given this context, the Fed will likely remain in wait-and-see mode, carefully analyzing economic indicators and considering geopolitical risks before making rate decisions.

Several important economic reports are scheduled for release today, including Germany's retail sales and consumer price index. Similar inflation data from Italy will also be published. These indicators are significant, as they help assess the state of consumer demand and inflationary pressure in two key eurozone economies. A decline in German retail sales may signal slower economic growth, while a rise in the CPI would indicate increasing inflation.

A similar situation applies to Italy: inflation data will reveal how much prices are rising for Italian consumers. High inflation could negatively affect household purchasing power and reduce consumer spending. This data may influence the European Central Bank's monetary policy decisions. If inflation remains high, the ECB may keep interest rates unchanged, which would support the euro.

The Mean Reversion strategy is recommended if the data aligns with economists' expectations. If the figures deviate significantly (higher or lower) from expectations, the Momentum strategy is preferred.

Buying on a breakout above 1.0860 may lead to euro rising toward 1.0892 and 1.0923.

Selling on a breakout below 1.0829 may lead to euro falling toward 1.0798 and 1.0767.

Buying on a breakout above 1.2966 may lead to the pound rising toward 1.2988 and 1.3010.

Selling on a breakout below 1.2945 may lead to the pound falling toward 1.2922 and 1.2900.

Buying on a breakout above 149.32 may lead to the dollar rising toward 149.62 and 149.92.

Selling on a breakout below 148.97 may trigger a decline toward 148.58 and 148.20.

I will look to sell after a failed breakout above 1.0860, once the price returns below this level.

I will look to buy after a failed breakout below 1.0824, once the price returns back to this level.

I will look to sell after a failed breakout above 1.2983, once the price returns below this level.

I will look to buy after a failed breakout below 1.2943, once the price returns back to this level.

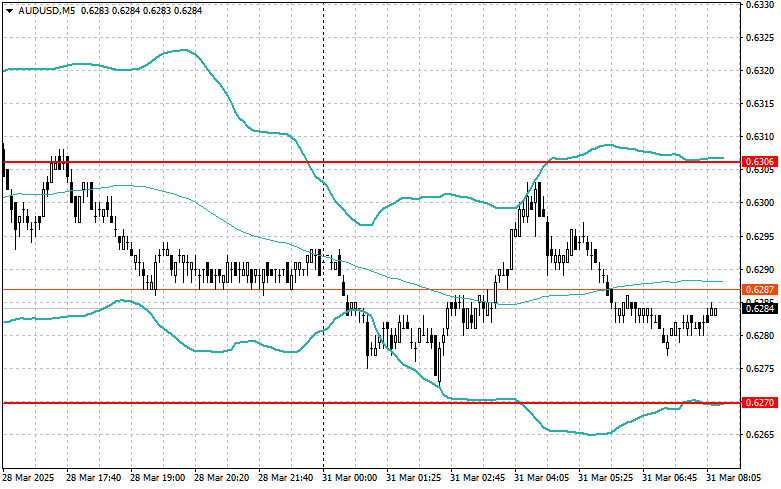

I will look to sell after a failed breakout above 0.6306, once the price returns below this level.

I will look to buy after a failed breakout below 0.6270, once the price returns back to this level.

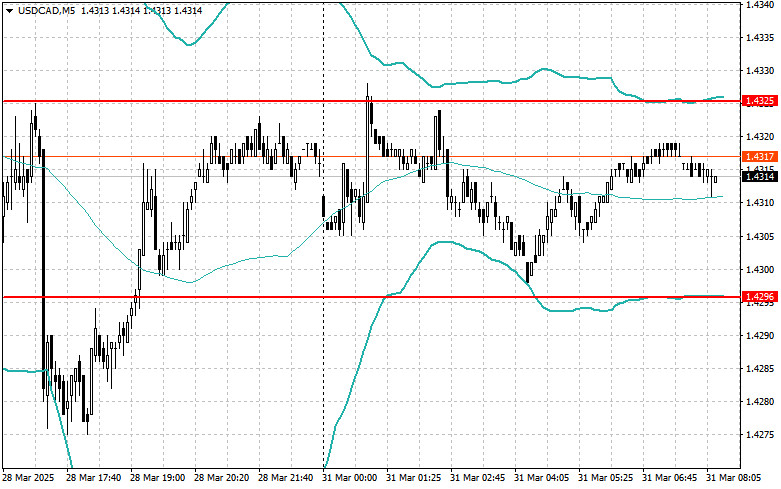

I will look to sell after a failed breakout above 1.4325, once the price returns below this level.

I will look to buy after a failed breakout below 1.4296, once the price returns back to this level.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pengujian harga pada 145.,20 terjadi ketika indikator MACD bergerak jauh di bawah garis nol, yang membatasi potensi penurunan pasangan ini. Namun, hal ini tidak mencegah penjualan dolar AS, karena pengujian

Uji harga di 1,2946 terjadi ketika indikator MACD bergerak jauh di atas garis nol. Namun, uji ini bertepatan dengan rilis data AS yang membenarkan pembelian GBP berdasarkan ekspektasi pelemahan dolar

Pengujian harga di 1,1105 terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol. Namun, setelah rilis data utama AS, ini tidak menghalangi masuknya pembelian euro dengan harapan terbentuknya

Euro dan pound melonjak setelah laporan mengungkapkan bahwa inflasi AS turun secara signifikan pada bulan Maret tahun ini. Indeks Harga Konsumen (CPI) AS menurun pada bulan Maret dibandingkan dengan Februari

Ulasan dan Kiat-kiat untuk Trading Yen Jepang Uji harga di 146,88 terjadi ketika indikator MACD baru saja mulai bergerak naik dari garis nol, mengonfirmasi titik entri yang valid ke pasar

Ulasan Trading dan Kiat-kiat Trading untuk Pound Inggris Pengujian harga di 1,2887 terjadi ketika indikator MACD baru saja mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang valid untuk

Ulasan Trading dan Kiat-kiat untuk Trading Euro Pengujian harga di 1,0974 terjadi ketika indikator MACD baru saja mulai bergerak turun dari garis nol, mengonfirmasi titik masuk yang valid untuk menjual

Pengujian level harga 144,80 terjadi ketika indikator MACD bergerak jauh di bawah titik nol, sehingga membatasi potensi penurunan pasangan ini. Pengujian kedua pada 144,80 terjadi ketika MACD berada di zona

Uji harga di 1.2803 terjadi tepat saat indikator MACD mulai bergerak turun dari garis nol, mengonfirmasi titik masuk yang valid untuk menjual pound. Akibatnya, pasangan ini turun lebih dari

Uji harga di 1,1055 terjadi tepat saat indikator MACD mulai bergerak naik dari garis nol, mengonfirmasi titik entri yang valid untuk membeli euro dan menghasilkan kenaikan 30 pip pada pasangan

Notifikasi

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.