- Bears are starting to tip the scales in their favor

Author: Samir Klishi

11:19 2025-03-27 UTC+2

1558

President Donald Trump is reportedly preparing to announce new auto tariffs in the near future. Dollar Tree shares rose following the sale of its Family Dollar business. GameStop stock surged on its Bitcoin bet and stronger fourth-quarter earnings. The Nikkei dropped by 1%.Author: Gleb Frank

12:15 2025-03-27 UTC+2

1348

US President Donald Trump imposed 25% tariffs on auto imports, triggering a sharp sell-off in equity markets. The S&P 500 and Nasdaq indices fell as investors grew concerned about escalating trade tensions with Canada, Mexico, and EuropeAuthor: Ekaterina Kiseleva

12:02 2025-03-27 UTC+2

1243

- Today, the EUR/USD pair is gaining some positive traction, breaking a six-day losing streak.

Author: Irina Yanina

10:58 2025-03-27 UTC+2

1198

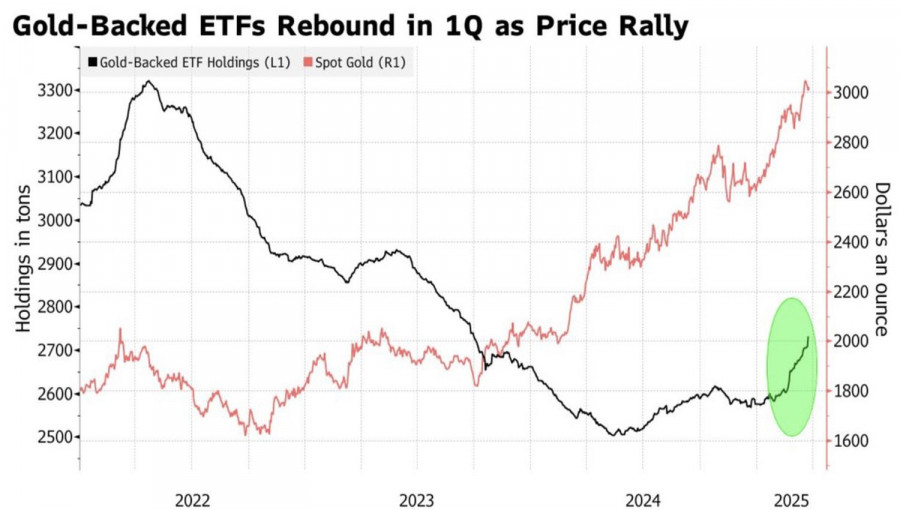

Trade tensions are driving demand for safe-haven assets.Author: Irina Yanina

11:44 2025-03-27 UTC+2

1198

Technical analysis of EUR/USD, USD/JPY, USDX and BitcoinAuthor: Sebastian Seliga

12:24 2025-03-27 UTC+2

1123

- The US crypto regulation bill is progressing rapidly through the legislative process.

Author: Jakub Novak

11:52 2025-03-27 UTC+2

1063

Once you understand how the system works, winning isn't hardAuthor: Marek Petkovich

11:55 2025-03-27 UTC+2

1033

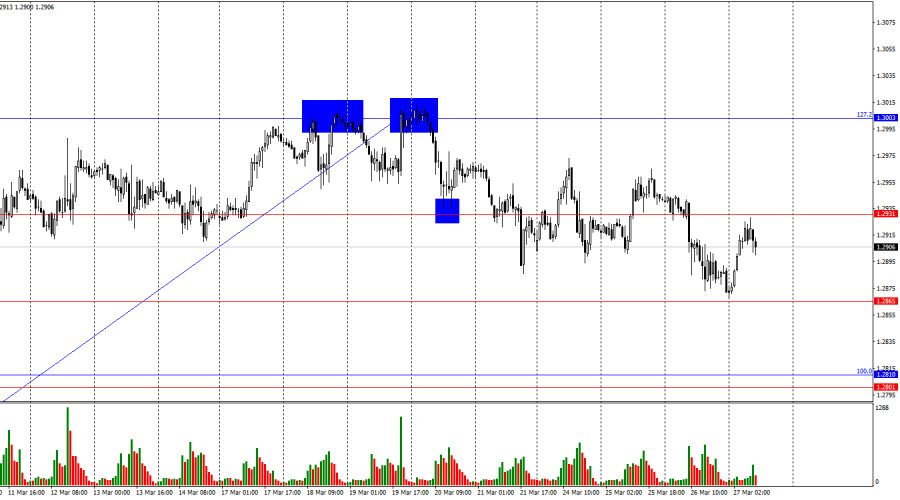

Technical analysisTrading Signals for EUR/USD for March 27-29, 2025: buy above 1.0790 (21 SMA - 8/8 Murray)

If the euro continues its rebound and consolidates above 1.0790 in the coming hours, we could expect EUR/USD to continue rising. So, the instrument could reach +2/8 Murray at 1.0986 in the short term and even the psychological level of 1.10.Author: Dimitrios Zappas

14:55 2025-03-27 UTC+2

928

See also