CADHKD (Canadian Dollar vs Hong Kong Dollar). Exchange rate and online charts.

Currency converter

24 Mar 2025 14:54

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The CAD/HKD is not a popular currency pair with Forex traders. The CAD/HKD does not involve the U.S. dollar and that is why called a cross currency pair. Despite this, the U.S. dollar still has a considerable influence on it. This can be seen when combining two price charts: the CAD/USD and USD/HKD. Thus, you will get an approximate the CAD/HKD chart.

Since the U.S. dollar heavily influences both currencies, it is necessary to take into account the major U.S. economic indicators for the correct projection of this financial instrument. Pay attention to: the discount rate, GDP data, unemployment rate, new jobs figures, etc. It is worth noting that the currencies comprising the pair can respond with different speed on changes in the U.S. economy, therefore, the CAD/HKD can be considered as a specific indicator of these currencies.

Canadian dollar is dependent on world crude oil prices. Canada is one of the largest world exporters of crude oil. That is why, when oil prices rise, the Canadian dollar rises too. On the contrary, when oil prices decrease, the Canadian dollar falls too. Thus, for the CAD/HKD there is a direct dependence on global crude oil prices.

The exchange rate of the Hong Kong dollar is pegged to the U.S. dollar. The trading range of this pair is 7.75-7.85 Hong Kong dollars per U.S. dollar.

Hong Kong has one of the world’s biggest stock exchanges, which outperforms many other large European and U.S. stock markets. Currently, Hong Kong occupies a leading position among the top financial centres all over the world, being the number one stock market in Asia.

Hong Kong's economy is based on the principle of free markets, low taxation, and the policy of government’s hands-off approach to economic policy. Hong Kong is not endowed with mineral and food resources, for this reason its economy is heavily dependent from these factors. Most of Hong Kong's income comes from the service sector and re-exports of Chinese goods. In addition, the tourism sector is highly developed.

If you want to trade cross currency pairs, it is necessary to bear in mind that brokers’ spread is often higher for cross rates than for majors. Thus, you’d better read and understand the trading terms offered by the brokerна before you start your cross rate trading.

See Also

- Today, gold prices remain low but are holding above the psychological level of $3000, which serves as an important support.

Author: Irina Yanina

11:25 2025-03-24 UTC+2

1108

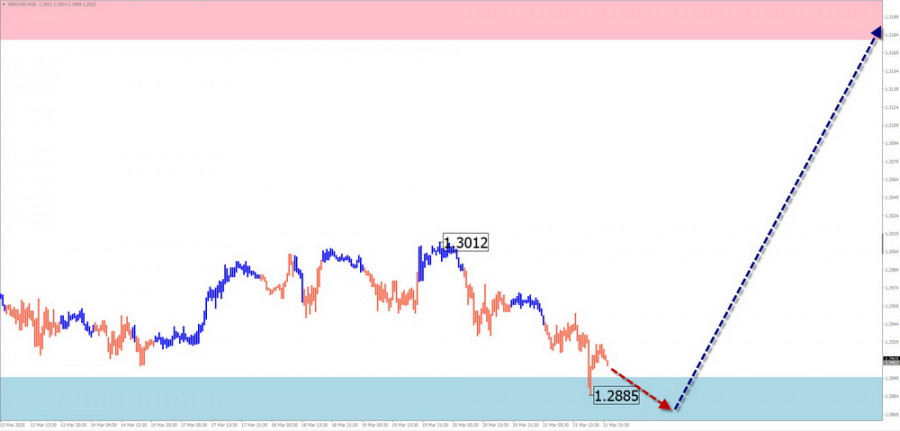

Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.Author: Stefan Doll

14:24 2025-03-24 UTC+2

1003

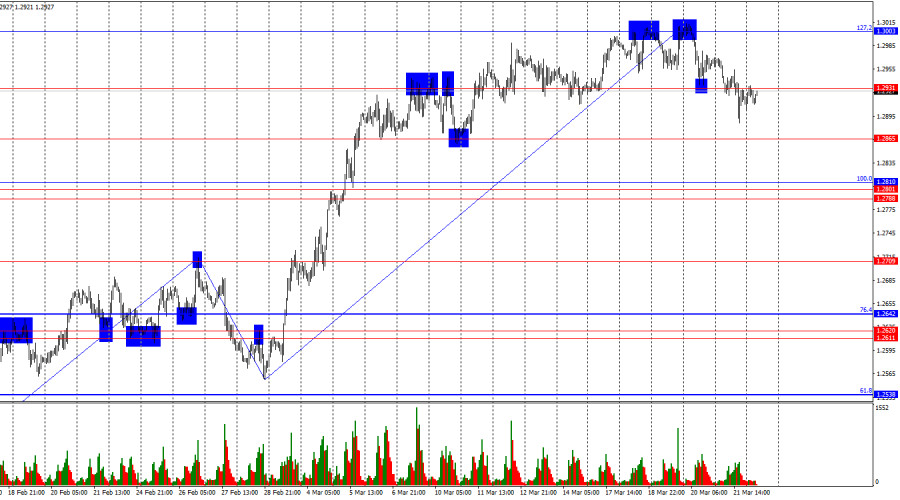

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

703

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

688

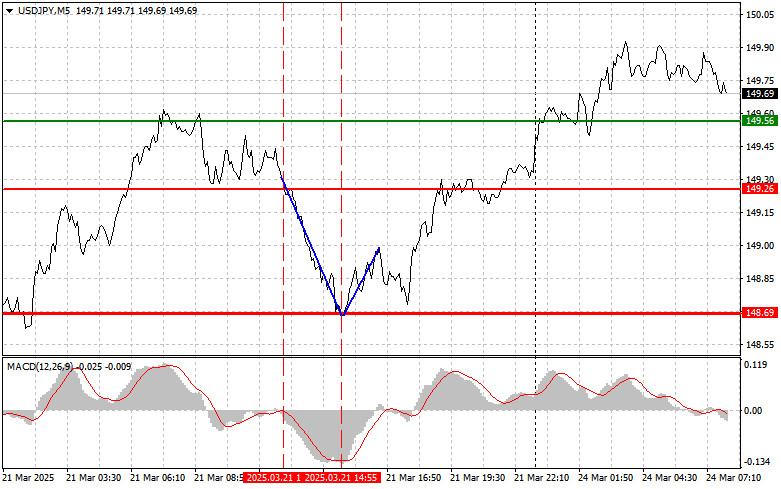

Type of analysisUSD/JPY: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:13 2025-03-24 UTC+2

658

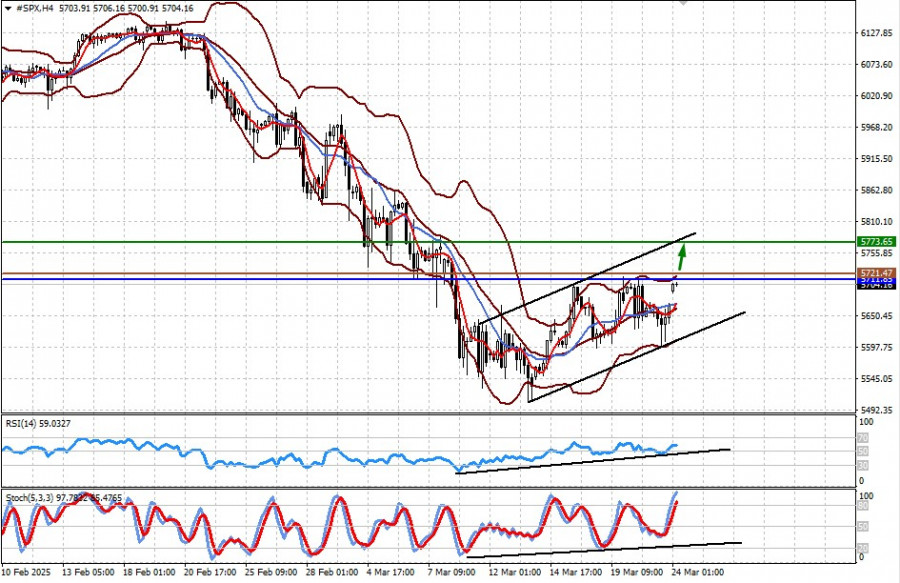

Fundamental analysisMarkets Are Tired of Falling. Investors Look for Growth Triggers (CFD contracts on #SPX and #NDX futures may rise on positive U.S. economic data)

Global financial markets continue to swing back and forth amid uncertainty over the actual impact on the economies of various countries targeted by Donald Trump's tariff hikes, which have prompted retaliatory measures in returnAuthor: Pati Gani

10:23 2025-03-24 UTC+2

643

- White House tariffs bring more pain to the U.S. than to other regions

Author: Marek Petkovich

10:23 2025-03-24 UTC+2

643

Trading Recommendations for the Cryptocurrency Market on March 24Author: Miroslaw Bawulski

09:54 2025-03-24 UTC+2

643

Wave analysisWeekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

628

- Today, gold prices remain low but are holding above the psychological level of $3000, which serves as an important support.

Author: Irina Yanina

11:25 2025-03-24 UTC+2

1108

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1003

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

703

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

688

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:13 2025-03-24 UTC+2

658

- Fundamental analysis

Markets Are Tired of Falling. Investors Look for Growth Triggers (CFD contracts on #SPX and #NDX futures may rise on positive U.S. economic data)

Global financial markets continue to swing back and forth amid uncertainty over the actual impact on the economies of various countries targeted by Donald Trump's tariff hikes, which have prompted retaliatory measures in returnAuthor: Pati Gani

10:23 2025-03-24 UTC+2

643

- White House tariffs bring more pain to the U.S. than to other regions

Author: Marek Petkovich

10:23 2025-03-24 UTC+2

643

- Trading Recommendations for the Cryptocurrency Market on March 24

Author: Miroslaw Bawulski

09:54 2025-03-24 UTC+2

643

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

628