USDSGD (US Dollar vs Singapore Dollar). Exchange rate and online charts.

Currency converter

25 Mar 2025 09:21

(0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

USD/SGD (United States Dollar vs Singapore Dollar)

USD/SGD is involved in active trading on Forex. This currency pair is also called exotic. Rate fluctuations of this trading instrument are not significant. The Singapore dollar is one of the most stable currencies around the world. The economic situation in the country is characterized by very low inflation, robust exports, and huge foreign exchange reserves in the economy.

Singapore is a developed nation with high living standards. Advantageously located at the crossroads of major shipping routes, Singapore has managed to reach such level of development demonstrating an active trading with world's largest economies. At the moment, the country sells abroad home electronics and information technology products, shipbuilding products and financial services. Thus, country's economy and national currency both hinge upon export significantly.

Singapore is listed among the group of so-called "Asian tigers" thanks to the rapid development of its economy. In such a way, the country is approaching to the major Western economies such as the USA, Germany, France, Great Britain, etc.

If you trade USD/SGD, you should pay attention to the dynamics of EUR/USD, GBP/USD, and USD/JPY. These trading instruments are indicators of USD/SGD price movements since they greatly influence the rate of the national currency of Singapore.

If you trade USD/SGD, you should focus on economic indicators of Singapore as well as the global prices for oil and other minerals required to support the Singaporean economy.

See Also

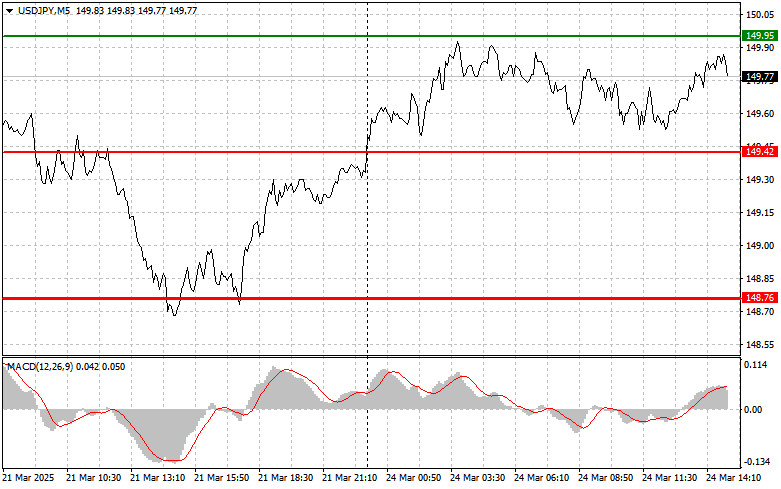

- USDJPY: Simple Trading Tips for Beginner Traders on March 24th (U.S. Session)

Author: Jakub Novak

17:13 2025-03-24 UTC+2

988

Technical analysisTrading Signals for GOLD (XAU/USD) for March 24-27, 2025: sell below $3,032 (21 SMA - overbought)

The eagle indicator is reaching overbought levels, so we believe a technical correction could occur in the coming days, before resuming its bullish cycle.Author: Dimitrios Zappas

17:44 2025-03-24 UTC+2

988

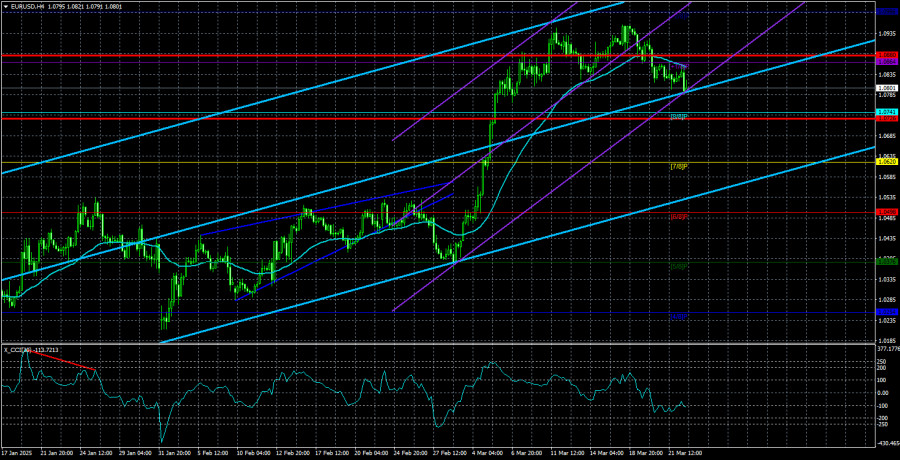

On Monday, EUR/USD traders concentrated on factors that benefitted the U.S. dollar, while negatively impacting the euro. Insider reports from U.S. media concerning the "April 2 tariffs" supported the pair's sellers.Author: Irina Manzenko

01:00 2025-03-25 UTC+2

823

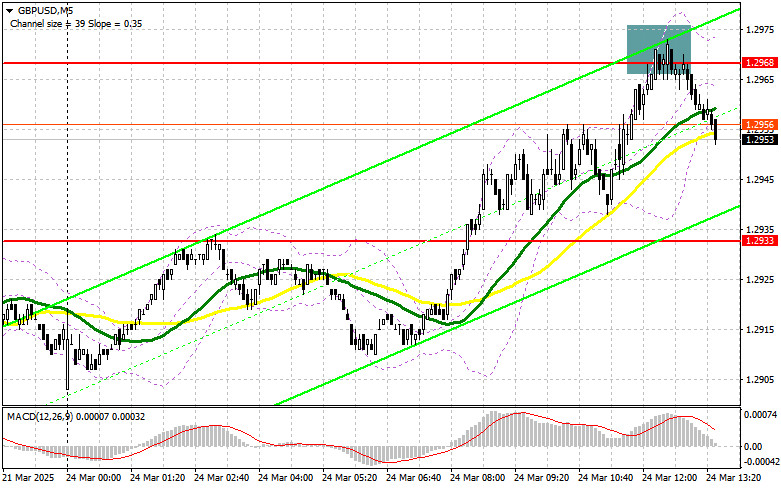

- GBP/USD: Trading Plan for the U.S. Session on March 24th (Review of Morning Trades)

Author: Miroslaw Bawulski

17:05 2025-03-24 UTC+2

808

GBPUSD: Simple Trading Tips for Beginner Traders on March 24th (U.S. Session)Author: Jakub Novak

17:10 2025-03-24 UTC+2

778

Fundamental analysisEUR/USD Pair Overview – March 25: The Euro Continues to Creep Downward in a Correction

The EUR/USD currency pair showed relatively low volatility on MondayAuthor: Paolo Greco

05:02 2025-03-25 UTC+2

733

- The Euro is Searching for a Foothold for Reversal

Author: Laurie Bailey

05:59 2025-03-25 UTC+2

733

Trading planTrading Recommendations and Analysis for EUR/USD on March 25: The Dollar Strengthened Against the Odds

On Monday, the EUR/USD currency pair initially showed an upward move, followed by a decline, making the entire trading day somewhat contradictoryAuthor: Paolo Greco

03:41 2025-03-25 UTC+2

733

Trading planTrading Recommendations and Analysis for GBP/USD on March 25: The Roller Coaster Continues

The GBP/USD currency pair managed to move both upward and downward on MondayAuthor: Paolo Greco

03:41 2025-03-25 UTC+2

733

- USDJPY: Simple Trading Tips for Beginner Traders on March 24th (U.S. Session)

Author: Jakub Novak

17:13 2025-03-24 UTC+2

988

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 24-27, 2025: sell below $3,032 (21 SMA - overbought)

The eagle indicator is reaching overbought levels, so we believe a technical correction could occur in the coming days, before resuming its bullish cycle.Author: Dimitrios Zappas

17:44 2025-03-24 UTC+2

988

- On Monday, EUR/USD traders concentrated on factors that benefitted the U.S. dollar, while negatively impacting the euro. Insider reports from U.S. media concerning the "April 2 tariffs" supported the pair's sellers.

Author: Irina Manzenko

01:00 2025-03-25 UTC+2

823

- GBP/USD: Trading Plan for the U.S. Session on March 24th (Review of Morning Trades)

Author: Miroslaw Bawulski

17:05 2025-03-24 UTC+2

808

- GBPUSD: Simple Trading Tips for Beginner Traders on March 24th (U.S. Session)

Author: Jakub Novak

17:10 2025-03-24 UTC+2

778

- Fundamental analysis

EUR/USD Pair Overview – March 25: The Euro Continues to Creep Downward in a Correction

The EUR/USD currency pair showed relatively low volatility on MondayAuthor: Paolo Greco

05:02 2025-03-25 UTC+2

733

- The Euro is Searching for a Foothold for Reversal

Author: Laurie Bailey

05:59 2025-03-25 UTC+2

733

- Trading plan

Trading Recommendations and Analysis for EUR/USD on March 25: The Dollar Strengthened Against the Odds

On Monday, the EUR/USD currency pair initially showed an upward move, followed by a decline, making the entire trading day somewhat contradictoryAuthor: Paolo Greco

03:41 2025-03-25 UTC+2

733

- Trading plan

Trading Recommendations and Analysis for GBP/USD on March 25: The Roller Coaster Continues

The GBP/USD currency pair managed to move both upward and downward on MondayAuthor: Paolo Greco

03:41 2025-03-25 UTC+2

733