See also

02.04.2025 11:17 AM

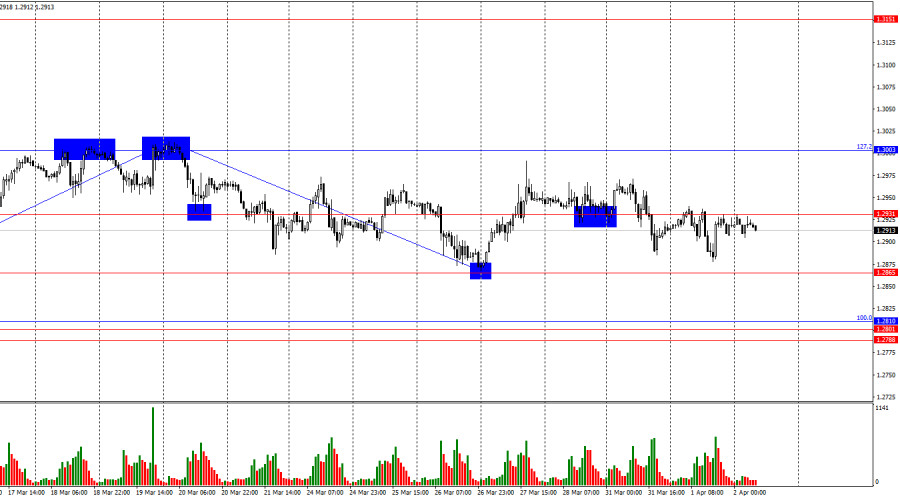

02.04.2025 11:17 AMOn the hourly chart, the GBP/USD pair continued to move sideways on Tuesday. There is currently no dominance of either bulls or bears in the market—and this has been the case for a full month. The 1.2931 level is not strong, so it's not advisable to look for trading opportunities around it. A rebound from the 1.2865 level would allow for some expectation of a pound recovery, while a breakout below this level would indicate the end of the sideways range and the beginning of a new bearish trend.

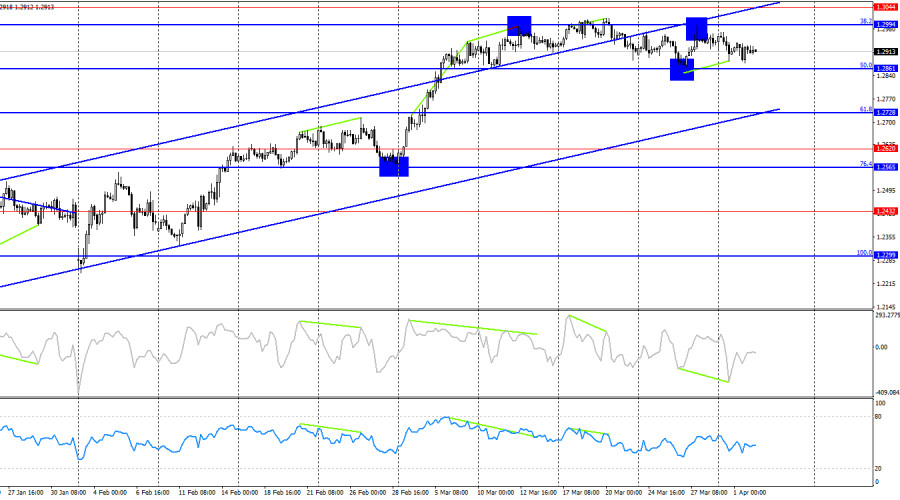

The last completed downward wave did not break the previous low, while the most recent upward wave did break the previous high. Thus, a bullish trend is still forming. Most traders remain reluctant to buy the U.S. dollar, regardless of economic data, as Donald Trump continues to impose new tariffs, which are expected to negatively impact U.S. and global economic growth in the future. For the bullish trend to shift into a bearish one, the pair would need to consolidate below 1.2865.

Tuesday's news background disappointed both bulls and bears. The UK Manufacturing PMI came in weak, ruling out hopes for significant GDP growth. The U.S. ISM Manufacturing PMI was also weak, and the JOLTS report came in even lower. Trump made no announcements regarding new import tariffs, and traders continue to wait. As a result, the only conclusion that can be drawn right now is that the pair remains in a sideways range. It's better for traders to wait for this phase to end, as the market is currently lacking momentum.

New tariffs from Trump could trigger a decline in the dollar, but I wouldn't be too certain about that scenario anymore. The market has had enough time to assess the total volume of tariffs and their potential economic consequences. Most likely, this has already been priced in. Therefore, the dollar could continue to recover—but only if bears start taking action, which so far, they haven't.

On the 4-hour chart, the pair is still in a bullish trend. I do not expect a significant decline in the pound until the pair breaks below the ascending channel. A rebound from the 38.2% Fibonacci level at 1.2994 once again worked in favor of the dollar, resulting in a slight decline toward the 50.0% retracement level at 1.2861. A bullish divergence in the CCI indicator supports the likelihood of a modest upward movement. Meanwhile, the hourly chart still shows a sideways market.

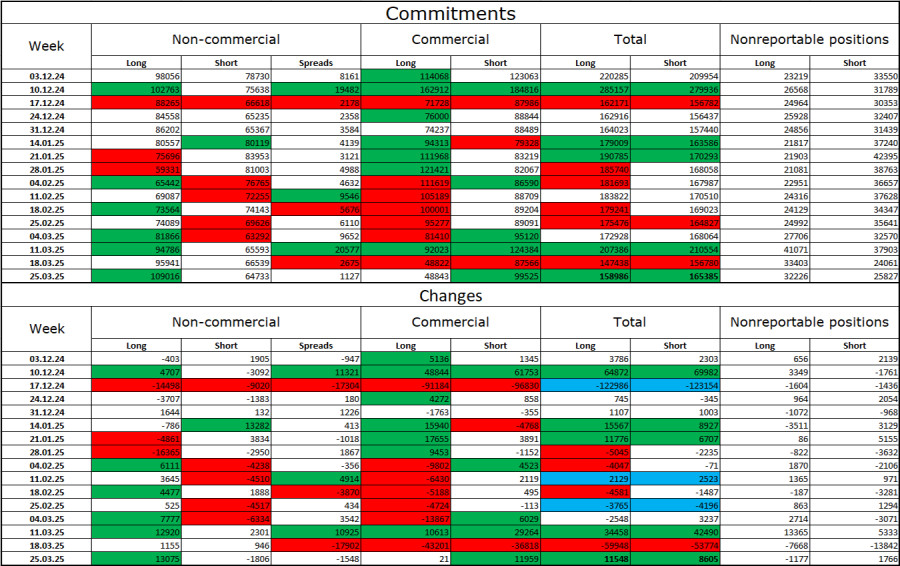

Commitments of Traders (COT) Report

Sentiment in the "Non-commercial" trader category turned more bullish in the latest report. The number of long positions held by speculators increased by 13,075, while short positions decreased by 1,806. Bears have lost their advantage in the market. The gap between long and short positions now stands at nearly 44,000 in favor of the bulls: 109,000 vs. 65,000.

In my opinion, the pound still faces downside risk, but recent events could prompt a long-term market reversal. Over the past 3 months, long positions have grown from 98,000 to 109,000, while short positions have decreased from 78,000 to 65,000. More notably, in the past 8 weeks, longs have grown from 59,000 to 109,000, while shorts fell from 81,000 to 65,000. And let me remind you—that's "8 weeks of Trump's leadership"...

Economic Calendar for the U.S. and UK

On Wednesday, the economic calendar contains only one entry, which is unlikely to help break the current range. The news background may have minimal influence on market sentiment today—unless Donald Trump breaks his silence.

GBP/USD Forecast and Trading Advice

Selling the pair will be possible after a rebound from the 1.3003 level on the hourly chart, with targets at 1.2931 and 1.2865, as the pair remains range-bound. Buying is possible after a rebound from the 1.2865 level, with targets at 1.2931 and 1.3003.

Fibonacci levels are plotted from 1.2809 to 1.2100 on the hourly chart, and from 1.2299 to 1.3432 on the 4-hour chart.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

From what we see on the 4-hour chart of the Nasdaq 100 index, there are several interesting things, namely, first, the price movement is moving below the MA (100), second

Early in the American session, gold is trading around 3,312 with a bullish bias after breaking out of the symmetrical triangle. Gold is now likely to continue rising

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

On the 4-hour chart, the USD/CAD commodity currency pair can be seen moving below the EMA (100) and the appearance of a Bearish 123 pattern and the position

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.