See also

Today, the EUR/USD pair is consolidating near the key psychological level of 1.0800, showing no intention of retreating below 1.0780 as traders and investors await the release of the U.S. PCE (Personal Consumption Expenditures) Price Index.

This data will be closely watched for clues on the Federal Reserve's next steps, which are expected to significantly influence the dollar's short-term dynamics and potentially give new momentum to the EUR/USD pair.

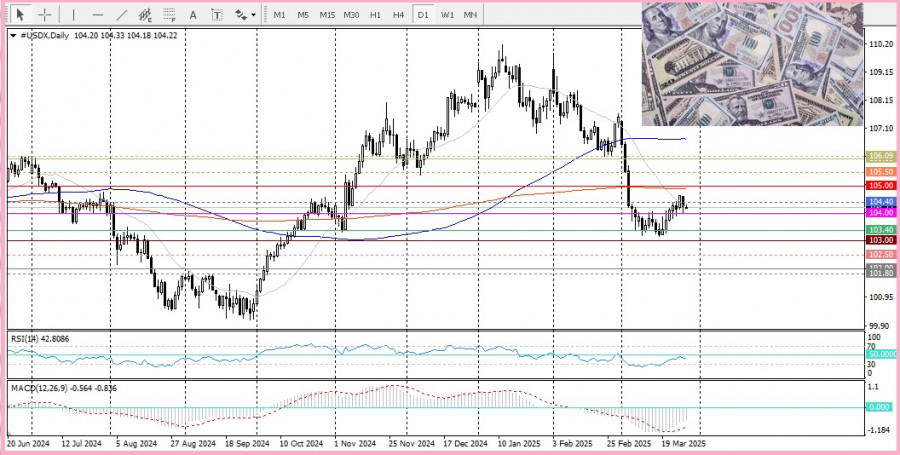

Recent developments, including the introduction of 25% tariffs on imported cars and light trucks by U.S. President Donald Trump, along with duties on all steel and aluminum, have created market uncertainty and contributed to the weakening of the U.S. Dollar Index. This, in turn, is supporting the EUR/USD pair, especially in light of the Fed's forecasts for interest rate cuts. At the same time, a slight trade shift is preventing the dollar from extending its retreat from multi-week highs, limiting EUR/USD's upward potential.

Nevertheless, a significant strengthening of the U.S. dollar appears unlikely for now, amid concerns that Trump's aggressive trade policies could slow U.S. economic growth, potentially forcing the Fed to resume rate cuts soon. Markets have already priced in the likelihood of the Federal Reserve lowering borrowing costs at its monetary policy meetings in June, July, and October. This has kept dollar bulls on the defensive, helping to contain downside pressure on EUR/USD.

It is also worth noting that the EU is preparing retaliatory measures in response to U.S. tariffs, which could further escalate trade tensions and raise the risk of a trade war between the EU and the U.S., adding more pressure on the EUR/USD pair.

From a technical perspective, if the pair holds above the 1.0780 level, it could open the door to further gains. However, the 1.0725 level or the 200-day SMA remains key support, and a break below it would likely lead to additional selling. Still, with oscillators on the daily chart holding firmly in positive territory, the path of least resistance remains to the upside—especially if prices break through the 1.0800 mark.

The current situation calls for close monitoring, particularly in light of upcoming economic data and speeches from FOMC members.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.