See also

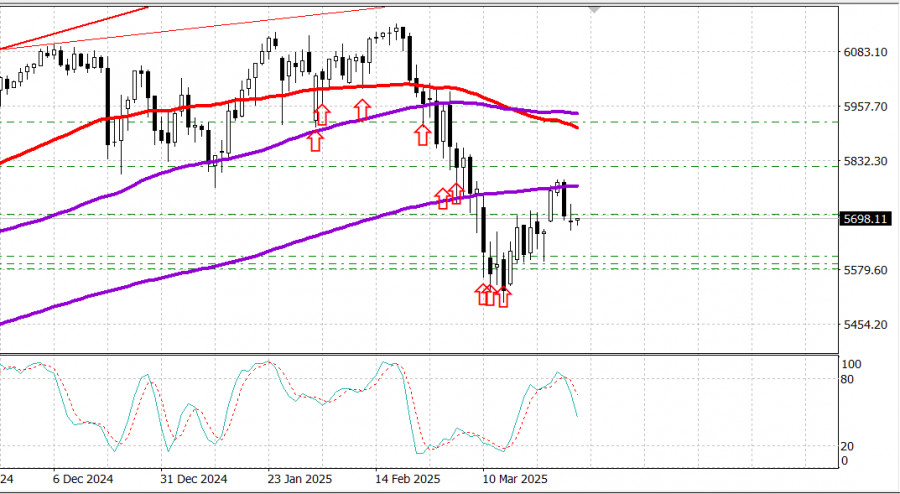

S&P500

Market update on March 28

US stock market: Trump's tariffs halt uptrend, so benchmark stock indices consolidating. PCE data on investors' radars today

Snapshot of US stock market on Thursday:

The stock market showed mixed results. The S&P 500 (-0.3%), Nasdaq Composite (-0.5%), and Dow Jones Industrial Average (-0.4%) traded both above and below the previous close.

Mixed reports on tariffs and economic data contributed to volatile market movements. President Trump's statement on Wednesday evening that a 25% tariff would be imposed on all imported cars and light trucks into the US led to a sharp drop in automaker stocks. However, he also added that the previously announced retaliatory tariffs valid from April 2 for other countries would be "mild."

Weekly unemployment claims remain below levels typical of a recession. Besides, the expanded report on international trade in goods for February still showed a significant trade deficit in goods (-$147.9 billion), although it narrowed compared to January (-$155.6 billion).

Mixed actions in the large-cap space also contributed to both upward and downward movements at the index level.

Tesla (TSLA 273.13, +1.07, +0.4%), perceived as a relative beneficiary of tariffs on imported cars, was a standout winner, while NVIDIA (NVDA 111.43, -2.33, -2.1%) performed the worst, along with other chipmakers.

Treasury bonds closed mixed. The yield on 10-year Treasuries rose by three basis points to 4.37%, while the yield on 2-year Treasuries fell by one basis point to 4.00%. As a result, the US Treasury completed its bond offering this week with a weak sale of 7-year bonds.

Year-to-date performance

Economic calendar for Thursday

The key takeaway from the report is that it shows strong growth in activity during Q4, driven by consumer spending. However, its market impact is softened by the outdated nature of the data (with just a few days left in the first quarter).

The main takeaway from the report is that initial unemployment claims, a leading indicator, remain at levels consistent with a generally stable labor market.

The key takeaway from the report is that the trade deficit in goods, though still large, narrowed due to exports being $7.0 billion higher than in January, while imports were $0.6 billion lower than in January.

Economic calendar for Friday

8:30 ET: personal income for February (consensus 0.4%; previous 0.9%), personal spending (consensus 0.6%; previous -0.2%), PCE prices (consensus 0.3%; previous 0.3%), core PCE prices (consensus 0.4%; previous 0.3%)

10:00 ET: final Michigan consumer sentiment index for March (consensus 57.9; previous 57.9)

Energy market

Brent oil is now trading at $73.90. Oil has grown by about $1 despite the weakness in the US market.

Gold reached a new historical high of $3,080 per ounce in reaction to Trump's sharp actions in international trade, which indirectly affects the status of the US dollar.

Conclusion

Despite the negative waves caused by Trump, who seems to be intent on challenging the US economy, US market growth remains realistic. Current market quotes are favorable for buying US market instruments, particularly #SPX.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.