See also

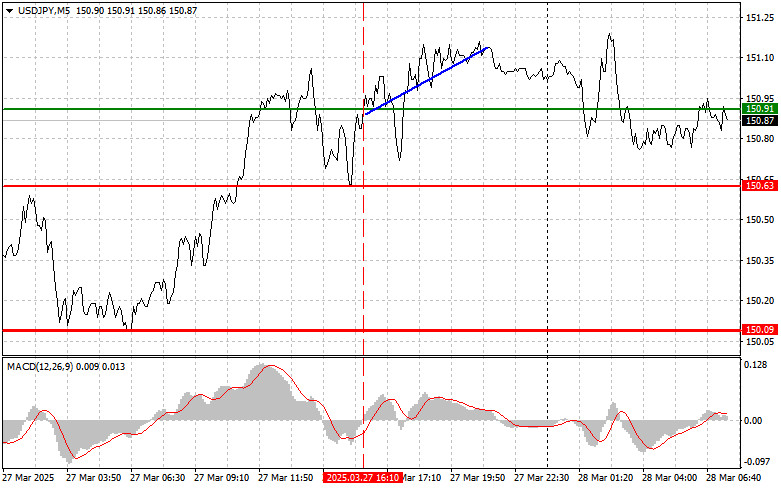

The price test at 150.91 occurred when the MACD indicator had just begun moving upward from the zero mark, confirming a valid entry point for buying the dollar. As a result, the pair moved up about 20 pips, which was the end.

During today's Asian session, the yen faced another brief selling session. News of an increase in the Tokyo Consumer Price Index, which reflects the level of inflation in Japan's capital, caught the attention of investors looking for signs of a shift in the Bank of Japan's monetary policy.

Another factor contributing to the yen's strength was the release of the summary of opinions from the BOJ's policy board members. This document, which contains excerpts from discussions on the current economic situation and monetary policy outlook, was closely scrutinized by market participants for hints of a potential shift in the central bank's approach.

For intraday strategy, I will focus primarily on implementing Scenarios #1 and #2.

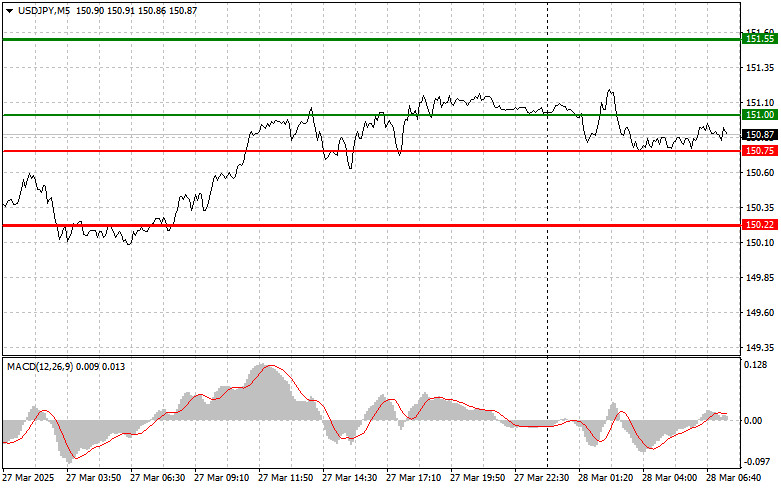

Scenario #1: I plan to buy USD/JPY today if the price reaches the entry point around 151.00 (green line on the chart), targeting a rise to 151.55 (thicker green line on the chart). Around 151.55, I plan to exit long positions and open short ones in the opposite direction (anticipating a pullback of 30–35 pips from the level). It's best to return to buying the pair during corrections and substantial USD/JPY pullbacks. Important: Before buying, ensure the MACD indicator is above the zero line and starting to rise.

Scenario #2: I also plan to buy USD/JPY today in the case of two consecutive tests of the 150.75 level when the MACD indicator is in the oversold zone. This would limit the pair's downside potential and trigger an upward reversal. A rise toward the opposite levels of 151.00 and 151.55 can be expected.

Scenario #1: I plan to sell USD/JPY today only after the 150.75 level (red line on the chart) is breached, which would lead to a quick drop in the pair. The key target for sellers will be the 150.22 level, where I plan to exit short positions and immediately open long ones in the opposite direction (expecting a 20–25 pip rebound from the level). Downward pressure on the pair could return at any moment. Important: Before selling, ensure the MACD indicator is below the zero line and starting to decline from it.

Scenario #2: I also plan to sell USD/JPY today in the case of two consecutive tests of the 151.00 level when the MACD indicator is in the overbought zone. This would limit the pair's upside potential and trigger a downward reversal. A decline toward the opposite levels of 150.75 and 150.22 can be expected.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.