See also

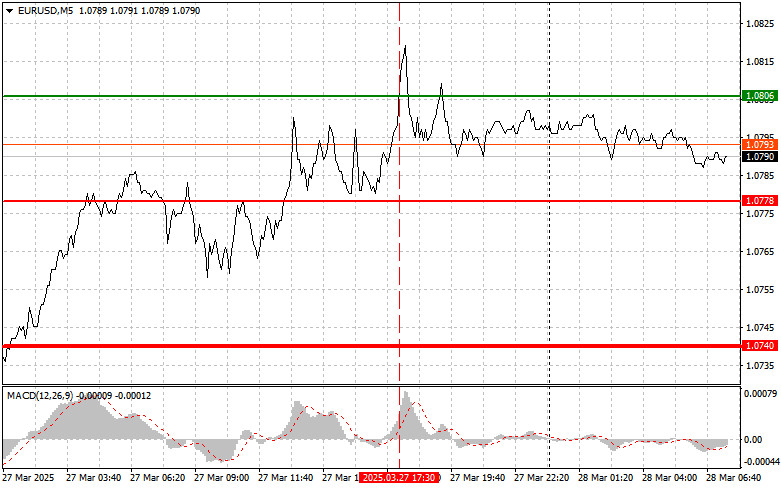

The price test at 1.0806 occurred when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upside potential. For that reason, I didn't buy the euro. By the end of the day, I didn't see any other market entry points.

The dollar gained against the euro as traders interpreted U.S. data positively, seeing it as an indication of the ongoing strength of the American economy. The upward revision of GDP indicates that the U.S. economy was stronger at the end of last year than previously expected. This may ease recession concerns and support a more hawkish stance from the Federal Reserve regarding future interest rate decisions.

Today may bring a new wave of volatility, driven by the upcoming release of key economic data from Germany. Preliminary consumer sentiment data is expected, reflecting German consumers' confidence and willingness to spend. Weak readings could signal ongoing economic challenges. The release of data on the change in the number of unemployed and the overall unemployment rate in Germany could support the euro, as the German labor market remains relatively strong. A decline in jobseekers and a decrease in the unemployment rate could significantly boost EUR/USD's upside potential toward the end of the week.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

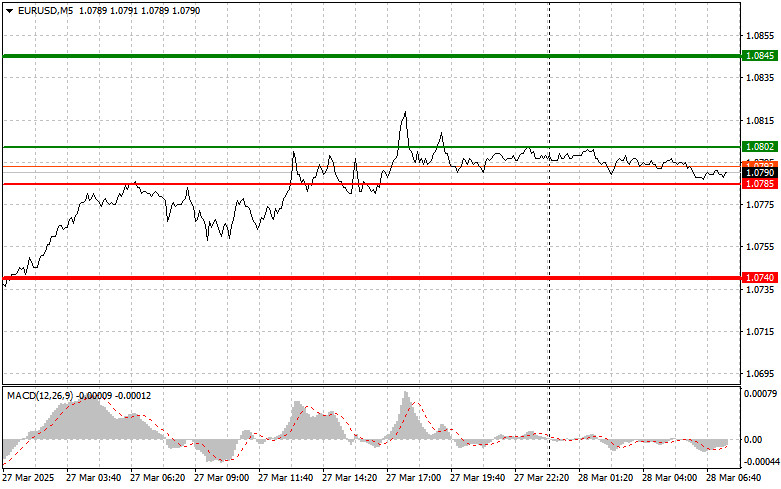

Scenario #1: I plan to buy the euro today if the price reaches around 1.0802 (green line on the chart), intending to rise to 1.0845. At 1.0845, I intend to exit long positions and open short positions in anticipation of a 30–35-pip pullback from the entry point. A rise in the euro in the first half of the day is more likely if strong German data is released. Important! Before buying, ensure the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: I also plan to buy the euro today if the pair tests the 1.0785 level twice consecutively while the MACD indicator is in the oversold area. This would limit the pair's downside potential and trigger a market reversal to the upside. A rise toward the opposite levels of 1.0802 and 1.0845 could be expected.

Scenario #1: I plan to sell the euro after the price reaches 1.0785 (red line on the chart). The target will be the 1.0740 level, where I intend to exit short positions and immediately open long positions in the opposite direction (expecting a 20–25-pip rebound from the level). Pressure on the pair will likely return if economic indicators disappoint. Important! Before selling, make sure the MACD indicator is below the zero mark and just beginning to move downward.

Scenario #2: I also plan to sell the euro today in the event of two consecutive tests of the 1.0802 level while the MACD indicator is in the overbought area. This would limit the pair's upside potential and trigger a downward reversal. A decline toward the opposite levels of 1.0785 and 1.0740 could be expected.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.