See also

13.01.2025 12:34 AM

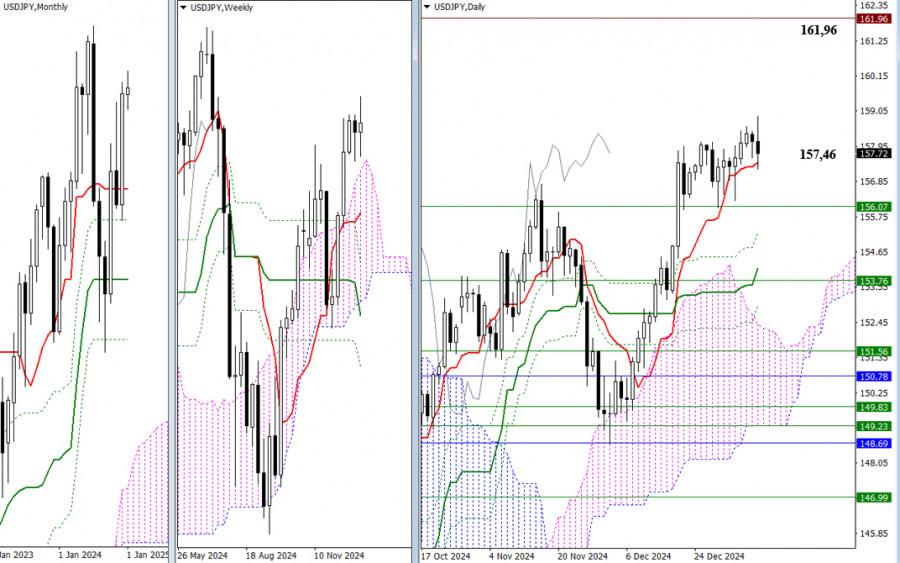

13.01.2025 12:34 AMLast year, despite monthly fluctuations that included rises, declines, and recoveries, the market closed with an overall optimistic bullish candlestick, where the upper shadow was slightly longer than the lower shadow. Based on the yearly results, a renewal of the maximum extreme of 2024 at 161.96 could restore and continue the uptrend. This level now serves as the nearest and primary target for bullish traders.

If the bulls lose support at the daily short-term trend of 157.46, a corrective decline could gather momentum, shifting market focus to testing the next support levels of the Ichimoku daily golden cross (155.26, 154.13, and 153.01) with the goal of breaking and neutralizing these levels. At the same time, bearish traders may push into the weekly cloud at 156.07 and test the weekly short-term trend at 153.76.

***

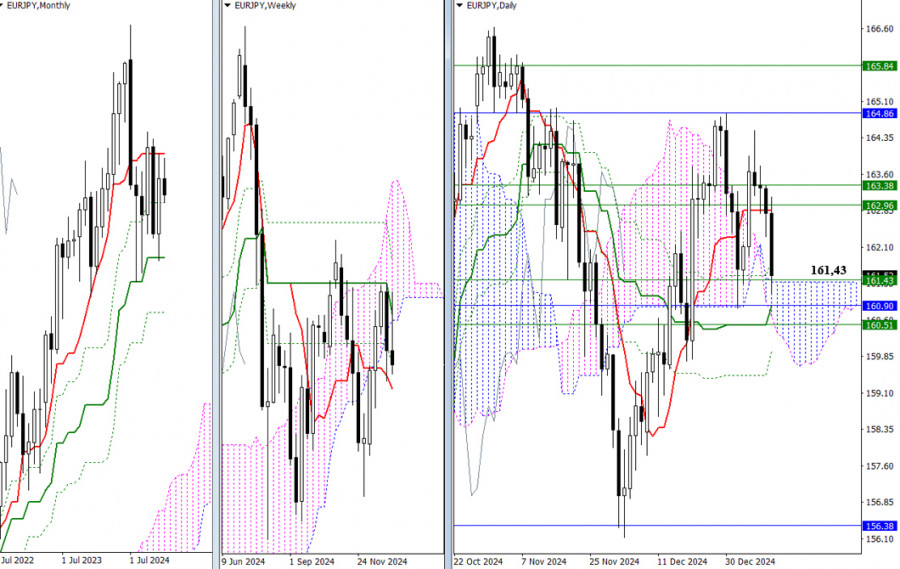

Last year, the pair left a relatively long upper shadow. In 2025, the focus will be on whether the bulls can overcome this shadow and continue the uptrend. Currently, the pair's position is uncertain, with no clear leader. The bears have a slight advantage at present but are encountering a wide support zone where any level could halt the decline and trigger a rebound.

The support zone (161.43 – 161.38 – 160.90 – 160.89 – 160.51 – 160.33 – 159.96) includes levels from various timeframes.

Similarly, the bulls face significant challenges with a resistance zone overhead (162.85 – 162.96 – 163.38 – 164.86 – 165.84), which comprises levels from multiple timeframes. If they can successfully overcome this resistance zone, the pair will be closer to the nearest maximum high at 166.63 and will meet the breakout target of the daily cloud. This scenario would be supported by a rebound from the current support level at 161.43.

***

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

From what we see on the 4-hour chart of the Nasdaq 100 index, there are several interesting things, namely, first, the price movement is moving below the MA (100), second

Early in the American session, gold is trading around 3,312 with a bullish bias after breaking out of the symmetrical triangle. Gold is now likely to continue rising

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

On the 4-hour chart, the USD/CAD commodity currency pair can be seen moving below the EMA (100) and the appearance of a Bearish 123 pattern and the position

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.