See also

Today, the EUR/USD pair has finally halted its four-day losing streak. The 14-day Relative Strength Index (RSI), a key momentum indicator, is hovering very close to the 30 level, indicating oversold conditions and the possibility of an upward correction in the near term.

However, the price remains within a downward channel, signaling a strong bearish trend for the pair. Moreover, the nine-day Exponential Moving Average (EMA) remains below the 14-day EMA, highlighting weak short-term momentum and reinforcing the overall bearish outlook.

On the other hand, the EUR/USD pair could target the psychological level of 1.0000. A decisive break below this level would intensify bearish sentiment, pushing the pair toward testing the 0.9530 level, the lowest point since September 2022.

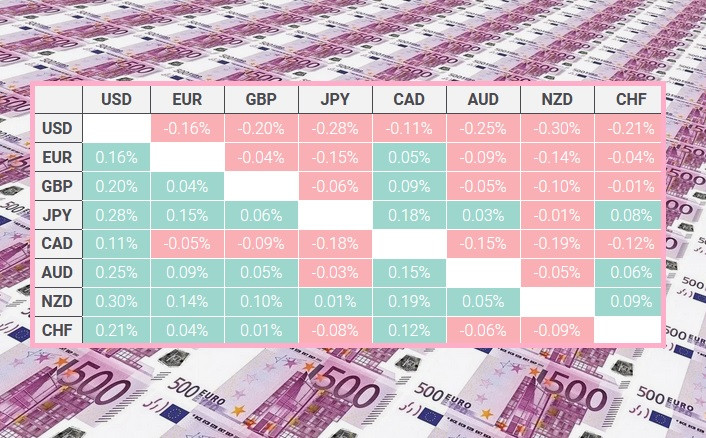

The table below shows the percentage change in the euro against the listed major currencies today:

The euro was weakest against the US dollar.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.