See also

31.12.2024 12:32 PM

31.12.2024 12:32 PMAnalysis of Trades and Trading Tips for the British Pound

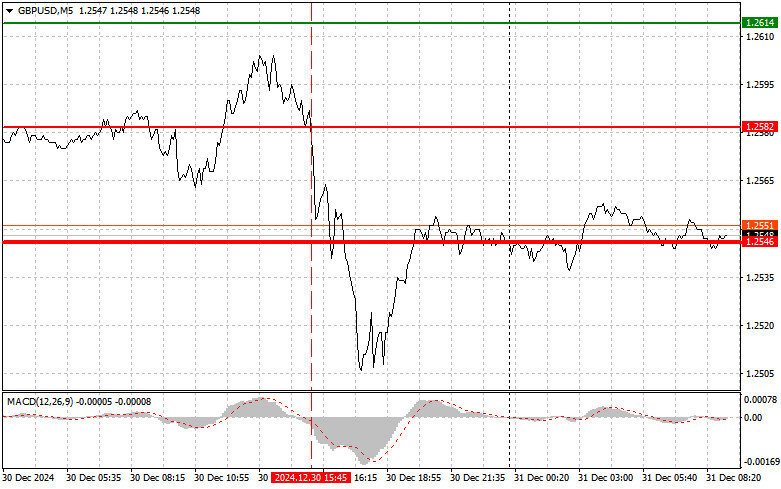

The test of the 1.2582 price level occurred when the MACD indicator had moved significantly downward from the zero mark, which, in my opinion, limited the pair's upward potential. For this reason, I did not sell the pound and missed the entire downward movement.

U.S. housing market data significantly reduced interest in the pound against the dollar, which has shown stable growth over several days. Traders did not revise their strategies, maintaining the pair within the sideways channel that we will likely observe until the end of the year. The increase in pending home sales volumes may indicate that demand for housing is gradually recovering, but this could also raise concerns about a potential inflation spike in the U.S. This, in turn, could lead to tighter Federal Reserve policies. Some economists predict that if housing market trends continue to strengthen, it could pressure the Fed to take more aggressive measures to maintain rates and control inflation, which is favorable for the dollar and negative for the pound.

For intraday strategy, I will rely more on Scenario #2.

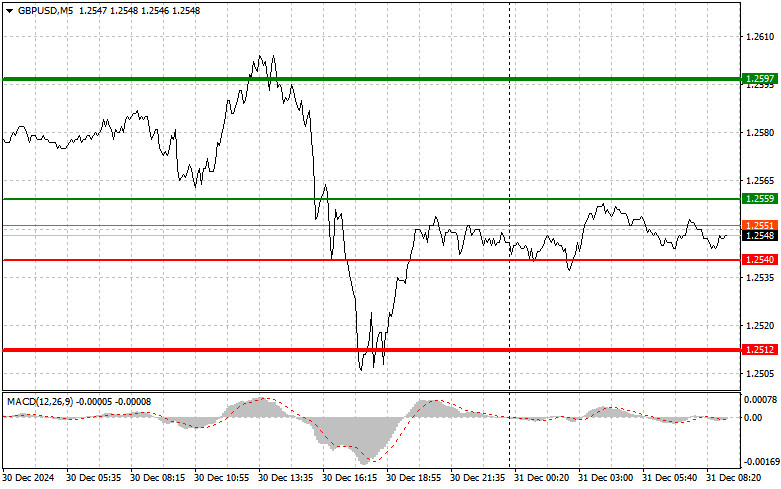

Scenario #1: I plan to buy the pound today upon reaching the 1.2559 entry point (green line on the chart) with a target of 1.2597 (thicker green line on the chart). Around 1.2597, I plan to exit the buy positions and open sell trades in the opposite direction (targeting a movement of 30–35 points in the opposite direction). Pound growth can only be expected within the channel. Important! Before buying, ensure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: Another buying opportunity arises after two consecutive tests of the 1.2540 price level, with the MACD indicator in the oversold zone. This would limit the pair's downward potential and lead to a market reversal upward. Growth can be expected toward the opposite levels of 1.2559 and 1.2597.

Scenario #1: I plan to sell the pound today after breaking below the 1.2540 level (red line on the chart), which will lead to a quick decline in the pair. The key target for sellers will be 1.2512, where I plan to exit sell trades and immediately open buy trades in the opposite direction (targeting a movement of 20–25 points in the opposite direction). Selling the pound higher is preferable, anticipating the end of the upward correction. Important! Before selling, ensure the MACD indicator is below the zero mark and just starting to decline from it.

Scenario #2: Another selling opportunity arises after two consecutive tests of the 1.2559 price level, with the MACD indicator in the overbought zone. This would limit the pair's upward potential and lead to a market reversal downward. Declines can be expected toward the opposite levels of 1.2540 and 1.2512.

Beginner forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of major fundamental reports to avoid sharp price fluctuations. If trading during news releases, always use stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially when trading large volumes.

Remember that successful trading requires a clear trading plan, such as the one presented above. Spontaneous trading decisions based on current market conditions are inherently a losing strategy for intraday traders.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The price test at 145.20 occurred when the MACD indicator moved significantly below the zero line, limiting the pair's downside potential. However, this did not prevent selling the U.S. dollar

The price test at 1.2946 occurred when the MACD indicator moved significantly above the zero line. However, the test coincided with the release of U.S. data that justified

The price test at 1.1105 occurred when the MACD indicator had already moved significantly above the zero line. However, after the release of key U.S. data, this did not prevent

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.