See also

27.12.2021 04:51 AM

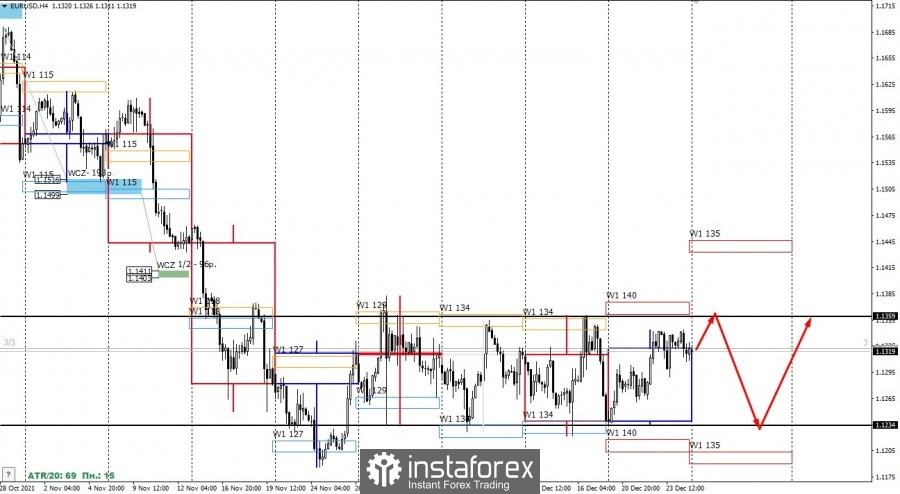

27.12.2021 04:51 AMThe EUR/USD pair has been forming a flat zone for the fifth week in a row. During this time, the price has not gone beyond the extremes formed at the end of November. Now, the task is to look for favorable prices for the sale and purchase of the instrument from the borders of the flat.

These borders can be distinguished by the levels 1.1359 and 1.1234. As long as the closing of daily trading takes place within the specified range, the flat will continue. In order to break the structure, the demand or supply must be allowed to exceed the marks and consolidate above/below the flat zone in one of the active trading sessions.

The simplest tactic to cancel a flat is to search for entry points on its borders. It will be profitable at any distance. A stop loss will always mean an exit from a flat. If we consider the decline last November, then the probability of seeing a retest of last month's low is 75%. This must be taken into account when transferring transactions in the medium term.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Thursday's Trades 1H Chart of GBP/USD The GBP/USD pair continued to trade higher throughout Thursday. Even at its peak levels, the British pound shows no intention of correcting

Analysis of Thursday's Trades 1H Chart of EUR/USD The EUR/USD currency pair continued trading within a sideways channel on Thursday, as shown on the hourly timeframe chart above. The current

The GBP/USD currency pair continued its upward movement on Thursday, trading near multi-year highs. Despite the lack of significant events in the U.S. or the U.K. (unlike Wednesday), the market

The EUR/USD currency pair continued to trade sideways on Thursday. While previously it had been moving within a range between 1.1274 and 1.1391, on Thursday, it was stuck

In my morning forecast, I highlighted the 1.3247 level as a reference point for market entry decisions. Let's take a look at the 5-minute chart and analyze what happened

In my morning forecast, I highlighted the 1.1341 level as a key point for market entry decisions. Let's take a look at the 5-minute chart and analyze what happened there

Analysis of Tuesday's Trades 1H Chart of GBP/USD Throughout Tuesday, the GBP/USD pair continued its upward movement. As we can see, the British currency doesn't need any particular reason

Analysis of Tuesday's Trades 1H Chart of EUR/USD On Tuesday, the EUR/USD currency pair pulled back slightly, which can be considered a purely technical correction. Yesterday — and generally —

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.