See also

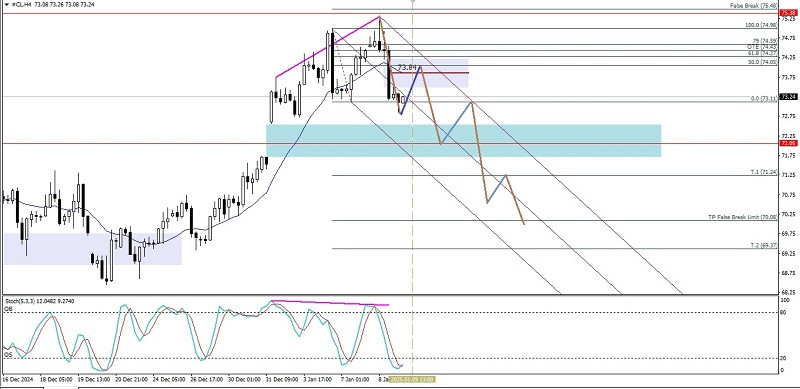

From what we can see on the 4-hour chart of the Crude Oil commodity asset, it appears that #CL is currently being corrected to weaken from the previous strengthening movement, which is confirmed by its price movement which is moving below the EMA (21) which has a decreasing slope and the formation of a Bearish Pitchfork channel which is also confirmed by the appearance of deviations between the #CL price movement which forms Higher-High while inversely proportional to the condition of the Stochastic Oscillator indicator which actually forms Higher-Low so that based on these facts in the near future #CL has the potential to weaken to the level of 72.05 if this level is successfully broken and closes below it, then #CL has the potential to continue its weakening back to the level of 71.24 and if the volatility and momentum of its weakening are strong enough, it is not impossible that the level of 70.08 will be the next target to be aimed for, but if on its way to these targets there is suddenly a significant strengthening again, especially if it breaks through and closes above the level of 75.50, then all the weakening scenarios that have been described will be invalid.

(Dsicalimer)

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.