#KHC (The Kraft Heinz Company). Exchange rate and online charts.

Currency converter

18 Mar 2025 15:36

(0.16%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The Kraft Heinz Company (#KHC) is the US biggest manufacturer of food products which appeared after H.J. Heinz Company merged with Kraft Foods Inc. This amalgamation was carried out in 2015. The corporation is the fifth largest producer of food globally and the third largest company that manufactures food and drinks in the United States.

As a result of the merger which was initiated two years ago, Heinz shareholders took the controlling stake (51%) in the integrated company while shareholders of Kraft Foods Group obtained 49%. The company’s shares are listed on the NASDAQ.

In the fourth quarter of 2016 it was reported that shares in the Kraft Heinz Company depreciated significantly last year. The net sales volume, which is a rather important indicator for the company, decreased by 3.7%. Besides, the quarterly revenue of the Kraft Heinz Company plunged by $260 million from the previous year and came in at $6.86 billion. Later on, the Kraft Heinz Company managed to surmount the crisis and increased its revenue.

In late April 2017 the shares in the giant food manufacturer posted a downward dynamic. The beginning of May was quite volatile for the Kraft Heinz Company when the quarterly report was released. From the middle of May KHC shares have recovered, returning to $93 and even reaching higher levels.

The company’s revenue for the first quarter of 2017 slumped by 3.1% in annual terms from $6.57 billion to $6.364 billion. At the same time, the operating income rose by 2.5% to $1.551 billion while the net profit shrank by 0.3% to $893 million.

The revenue report of Kraft Heinz Company was disappointing as it showed a decrease in three out of four regions (a fall of 3.5% to $4.552 billion in the US, a decline of 1.2% to $443 million in Canada, and a slump of 6.8% to $543 million in Europe). According to CEO of Kraft Heinz Bernardo Hees, the company intends to pursue the current development strategy and take measures for cost saving, despite weak results and slow growth in 2017. The company’s management plans to introduce innovative solutions, renew the range of products and expand its business. Mr. Hees is sure that these measures will help the company to increase its revenue.

In early June of 2017 KHC shares were trading with moderate volatility, adding 0.84% for a week and 1.28% for a month. Experts say that under the current conditions the price is likely to reverse downwards towards the key support at $90.50. Once this level is reached, Kraft Heinz shares are better to be bought, experts advise. At the same time, the take profit level is recommended at $96 while the stop loss should be set at $88.

See Also

- Fundamental analysis

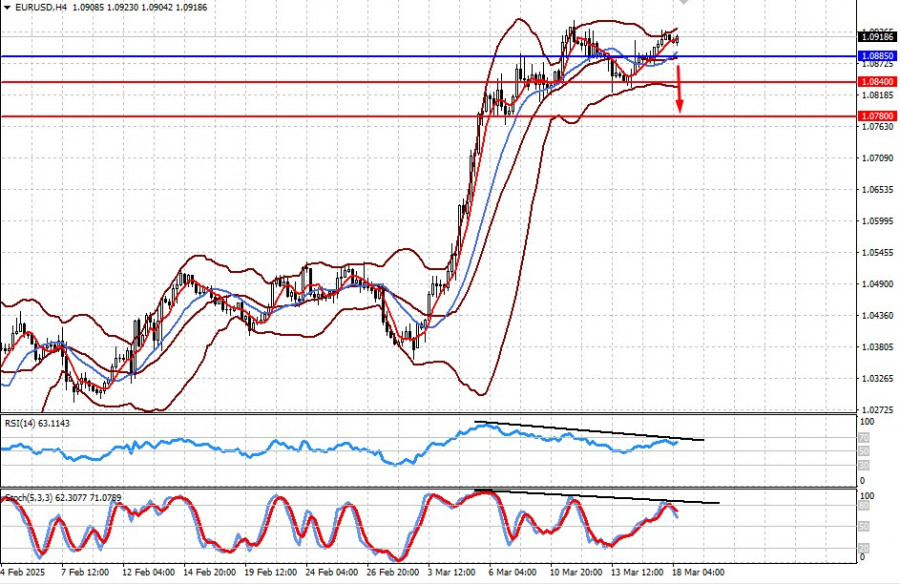

No Major Surprises Expected from the Fed Meeting (Anticipating a Sharp Drop in EUR/USD and Continued Cautious Gold Price Growth)

Markets are experiencing turmoil due to the risk of a U.S. economic recession. Although Treasury Secretary Bessent attempts to reassure investors by calling the market "correction" a healthy processAuthor: Pati Gani

09:48 2025-03-18 UTC+2

868

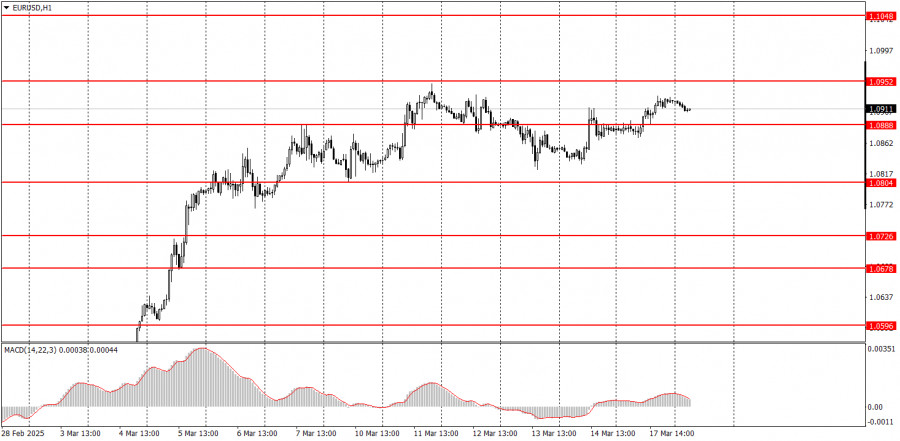

Type of analysisEUR/USD: Simple Trading Tips for Beginner Traders on March 18. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on March 18. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:00 2025-03-18 UTC+2

808

Type of analysisUSD/JPY: Simple Trading Tips for Beginner Traders on March 18. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on March 18. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:00 2025-03-18 UTC+2

778

- Technical analysis

Technical Analysis of Intraday Price Movement of Gold Commodity Instrument, Tuesday March 18, 2025.

In the 4-hour chart of the Gold commodity instrument, Convergence is visible, whichAuthor: Arief Makmur

09:17 2025-03-18 UTC+2

778

Intel rises after a report that the new CEO plans to reorganize manufacturing and artificial intelligence operations. February retail sales rise 0.2%. New York manufacturing activity fell in March. Hong Kong stocks and Kiwis rise amid a positive China outlook. Hang Seng hits a three-year high..Author: Gleb Frank

06:16 2025-03-18 UTC+2

763

Intraday Strategies for Beginner Traders on March 18Author: Miroslaw Bawulski

07:52 2025-03-18 UTC+2

748

- Fundamental analysis

What to Pay Attention to on March 18? A Breakdown of Fundamental Events for Beginners

A large number of macroeconomic events are scheduled for Tuesday, but none of them are significantAuthor: Paolo Greco

07:08 2025-03-18 UTC+2

733

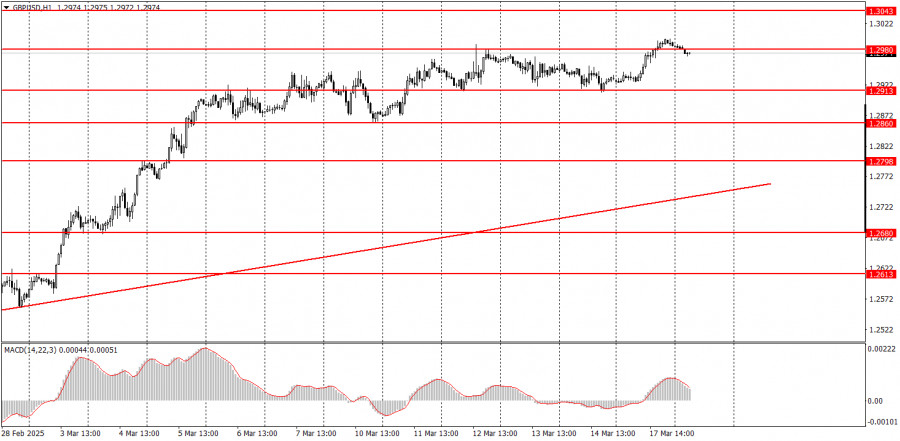

Trading planHow to Trade the GBP/USD Pair on March 18? Simple Tips and Trade Analysis for Beginners

On Monday, the GBP/USD pair also attempted to resume its upward movement and even broke through the latest local highAuthor: Paolo Greco

07:08 2025-03-18 UTC+2

718

Technical analysis / Video analyticsForex forecast 18/03/2025: EUR/USD, GBP/USD, USD/CAD, SP500 and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/CAD, SP500 and BitcoinAuthor: Sebastian Seliga

11:16 2025-03-18 UTC+2

718

- Fundamental analysis

No Major Surprises Expected from the Fed Meeting (Anticipating a Sharp Drop in EUR/USD and Continued Cautious Gold Price Growth)

Markets are experiencing turmoil due to the risk of a U.S. economic recession. Although Treasury Secretary Bessent attempts to reassure investors by calling the market "correction" a healthy processAuthor: Pati Gani

09:48 2025-03-18 UTC+2

868

- Type of analysis

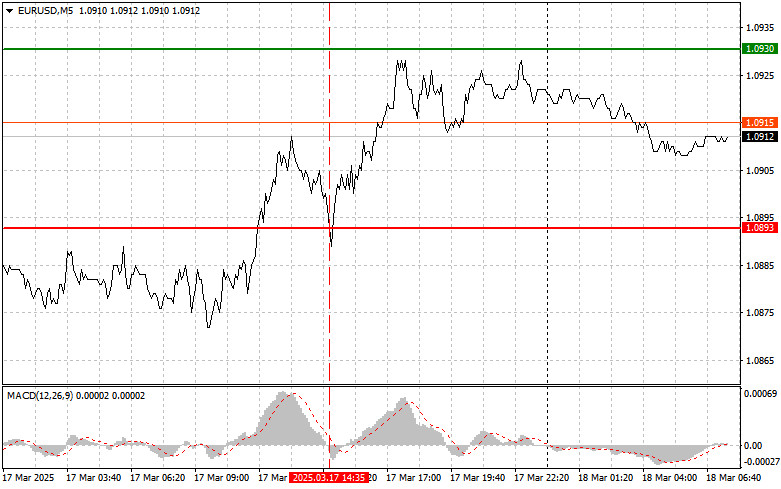

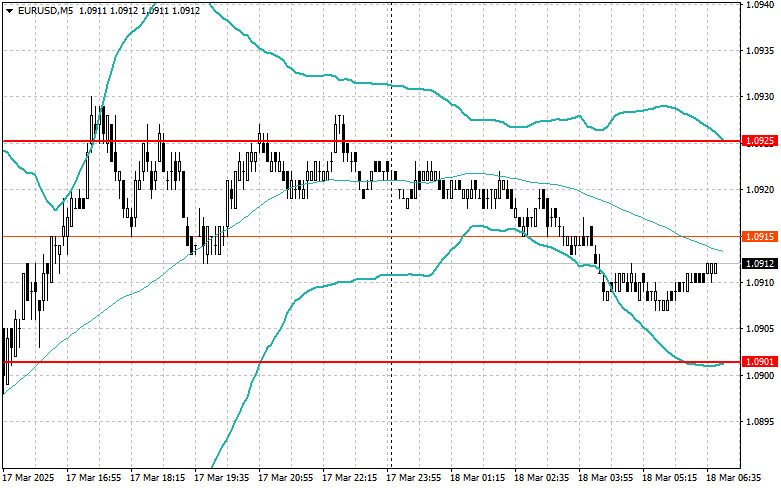

EUR/USD: Simple Trading Tips for Beginner Traders on March 18. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on March 18. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:00 2025-03-18 UTC+2

808

- Type of analysis

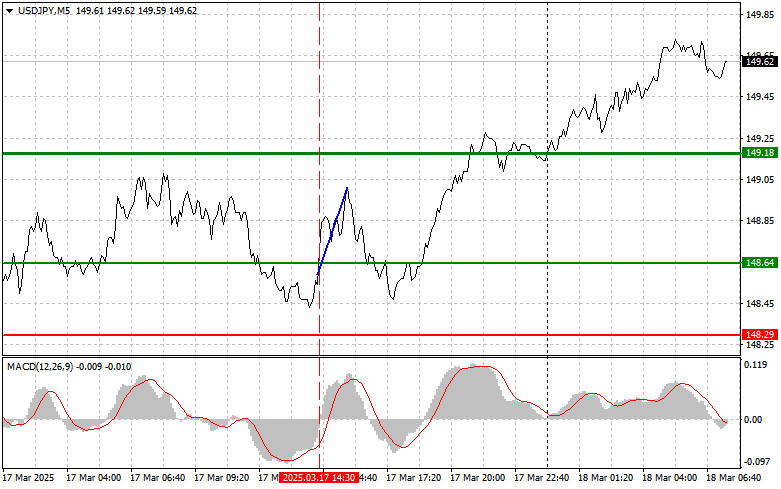

USD/JPY: Simple Trading Tips for Beginner Traders on March 18. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on March 18. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:00 2025-03-18 UTC+2

778

- Technical analysis

Technical Analysis of Intraday Price Movement of Gold Commodity Instrument, Tuesday March 18, 2025.

In the 4-hour chart of the Gold commodity instrument, Convergence is visible, whichAuthor: Arief Makmur

09:17 2025-03-18 UTC+2

778

- Intel rises after a report that the new CEO plans to reorganize manufacturing and artificial intelligence operations. February retail sales rise 0.2%. New York manufacturing activity fell in March. Hong Kong stocks and Kiwis rise amid a positive China outlook. Hang Seng hits a three-year high..

Author: Gleb Frank

06:16 2025-03-18 UTC+2

763

- Intraday Strategies for Beginner Traders on March 18

Author: Miroslaw Bawulski

07:52 2025-03-18 UTC+2

748

- Fundamental analysis

What to Pay Attention to on March 18? A Breakdown of Fundamental Events for Beginners

A large number of macroeconomic events are scheduled for Tuesday, but none of them are significantAuthor: Paolo Greco

07:08 2025-03-18 UTC+2

733

- Trading plan

How to Trade the GBP/USD Pair on March 18? Simple Tips and Trade Analysis for Beginners

On Monday, the GBP/USD pair also attempted to resume its upward movement and even broke through the latest local highAuthor: Paolo Greco

07:08 2025-03-18 UTC+2

718

- Technical analysis / Video analytics

Forex forecast 18/03/2025: EUR/USD, GBP/USD, USD/CAD, SP500 and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/CAD, SP500 and BitcoinAuthor: Sebastian Seliga

11:16 2025-03-18 UTC+2

718