#ASX200 (Australia 200 Index). 汇率和在线图表。

货币转换器

24 Mar 2025 12:15

(0.01%)

前一天收盘价

开盘价。

最后一个交易日的最高价。

最后一个交易日的最低价。

在过去52周的价格区间高点

在过去52周的价格区间低点

See Also

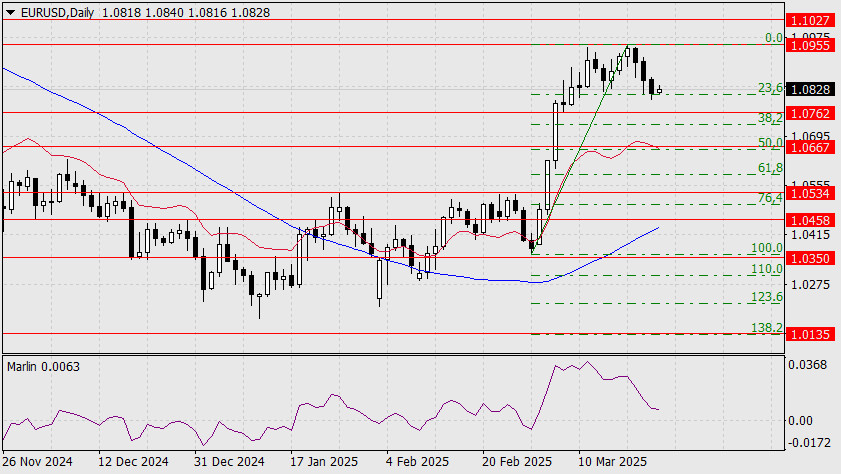

- The euro is eyeing the 1.1027 level.

Author: Laurie Bailey

05:20 2025-03-24 UTC+2

1378

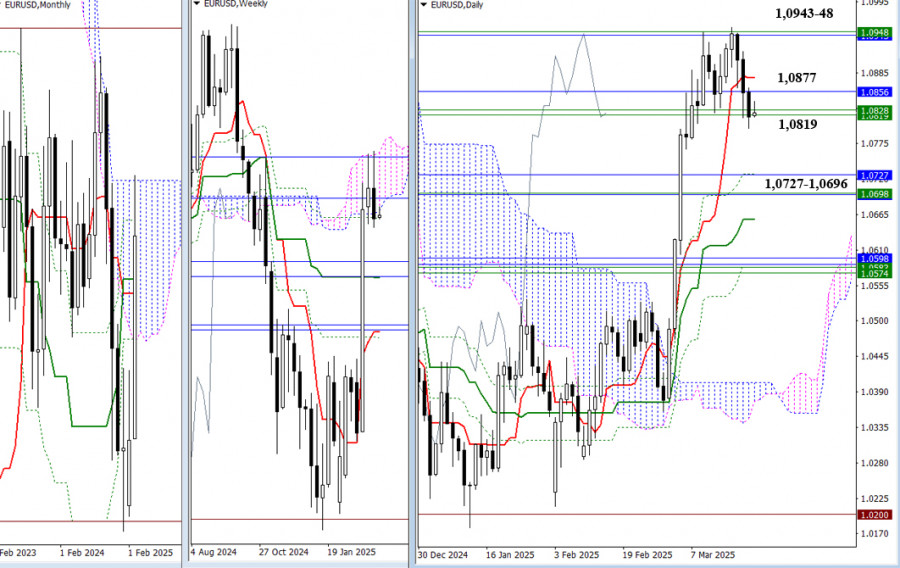

Recently, the pair has been testing resistance levels from the weekly Ichimoku cloud (1.0946–1.0825) and monthly levels (1.0943–1.0856). Last week, sellers initiated a rejection and closed below these resistance zones. As a result, the main task for the bears now is to confirm and extend this.Author: Evangelos Poulakis

08:55 2025-03-24 UTC+2

838

Fundamental analysisWhat to Pay Attention to on March 24? A Breakdown of Fundamental Events for Beginners

Eight macroeconomic events are scheduled for MondayAuthor: Paolo Greco

07:08 2025-03-24 UTC+2

778

- Technical analysis

Technical Analysis of Intraday Price Movement of Natural Gas Commodity Instrument, Monday March 24, 2025

From what is seen on the 4-hour chart, the Natural Gas commodity instrument appearsAuthor: Arief Makmur

08:09 2025-03-24 UTC+2

763

Technical analysisTechnical Analysis of Daily Price Movement of USD/IDR Exotic Currency Pairs, Monday March 24, 2025.

On the daily chart, the exotic currency pair USD/IDR appearsAuthor: Arief Makmur

08:09 2025-03-24 UTC+2

748

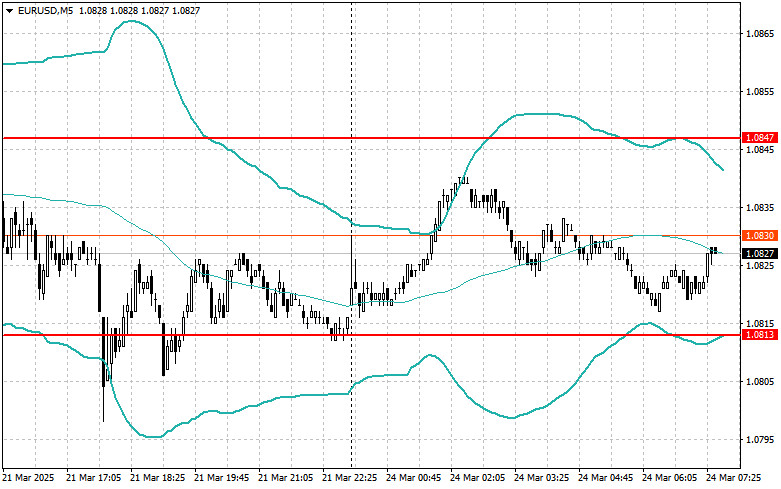

Trading planHow to Trade the EUR/USD Pair on March 24? Simple Tips and Trade Analysis for Beginners

The EUR/USD currency pair continued a sluggish downward movement on FridayAuthor: Paolo Greco

07:08 2025-03-24 UTC+2

733

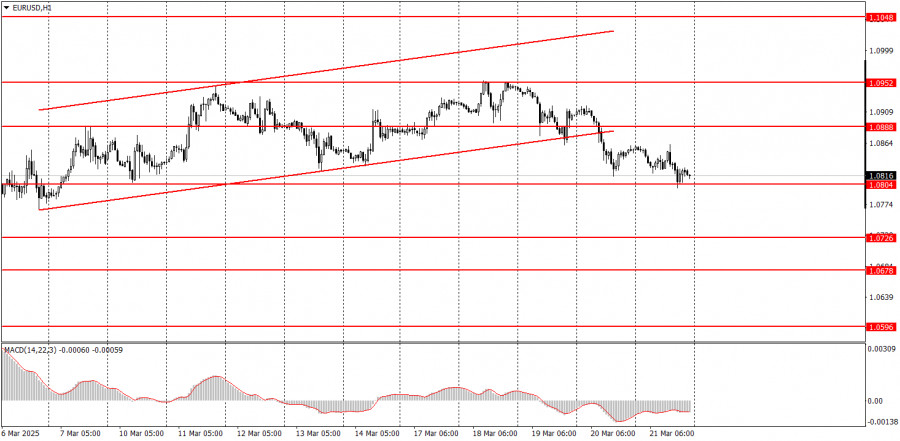

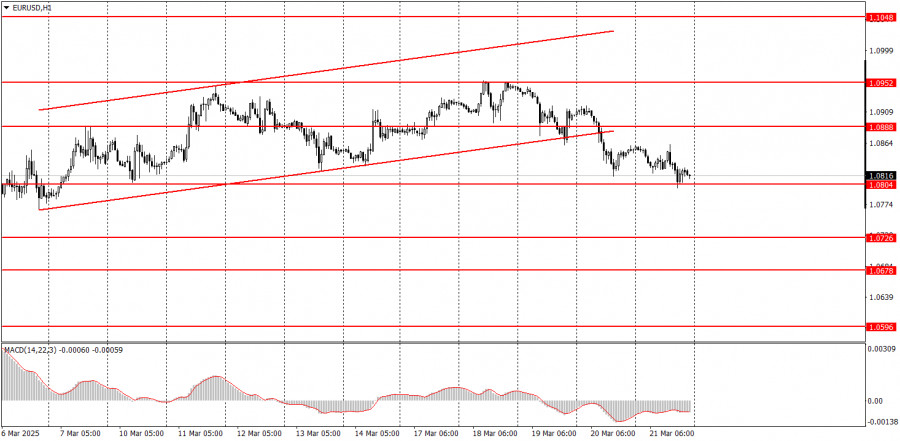

- The upcoming week's economic calendar is packed with important fundamental events. Macroeconomic reports will either help EUR/USD sellers consolidate within the 1.07 range or enable buyers to hold above the 1.0800 target.

Author: Irina Manzenko

07:52 2025-03-24 UTC+2

733

Intraday Strategies for Beginner Traders on March 24Author: Miroslaw Bawulski

08:22 2025-03-24 UTC+2

688

Trading planHow to Trade the GBP/USD Pair on March 24? Simple Tips and Trade Analysis for Beginners

The GBP/USD pair continued its downward movement on Friday, which was fully justified by both the technical picture and the prevailing market situationAuthor: Paolo Greco

07:08 2025-03-24 UTC+2

643

- The euro is eyeing the 1.1027 level.

Author: Laurie Bailey

05:20 2025-03-24 UTC+2

1378

- Recently, the pair has been testing resistance levels from the weekly Ichimoku cloud (1.0946–1.0825) and monthly levels (1.0943–1.0856). Last week, sellers initiated a rejection and closed below these resistance zones. As a result, the main task for the bears now is to confirm and extend this.

Author: Evangelos Poulakis

08:55 2025-03-24 UTC+2

838

- Fundamental analysis

What to Pay Attention to on March 24? A Breakdown of Fundamental Events for Beginners

Eight macroeconomic events are scheduled for MondayAuthor: Paolo Greco

07:08 2025-03-24 UTC+2

778

- Technical analysis

Technical Analysis of Intraday Price Movement of Natural Gas Commodity Instrument, Monday March 24, 2025

From what is seen on the 4-hour chart, the Natural Gas commodity instrument appearsAuthor: Arief Makmur

08:09 2025-03-24 UTC+2

763

- Technical analysis

Technical Analysis of Daily Price Movement of USD/IDR Exotic Currency Pairs, Monday March 24, 2025.

On the daily chart, the exotic currency pair USD/IDR appearsAuthor: Arief Makmur

08:09 2025-03-24 UTC+2

748

- Trading plan

How to Trade the EUR/USD Pair on March 24? Simple Tips and Trade Analysis for Beginners

The EUR/USD currency pair continued a sluggish downward movement on FridayAuthor: Paolo Greco

07:08 2025-03-24 UTC+2

733

- The upcoming week's economic calendar is packed with important fundamental events. Macroeconomic reports will either help EUR/USD sellers consolidate within the 1.07 range or enable buyers to hold above the 1.0800 target.

Author: Irina Manzenko

07:52 2025-03-24 UTC+2

733

- Intraday Strategies for Beginner Traders on March 24

Author: Miroslaw Bawulski

08:22 2025-03-24 UTC+2

688

- Trading plan

How to Trade the GBP/USD Pair on March 24? Simple Tips and Trade Analysis for Beginners

The GBP/USD pair continued its downward movement on Friday, which was fully justified by both the technical picture and the prevailing market situationAuthor: Paolo Greco

07:08 2025-03-24 UTC+2

643