AUDSGD (Australian Dollar vs Singapore Dollar). Exchange rate and online charts.

Currency converter

17 Apr 2025 02:52

(0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

AUD/SGD can hardly be called the most popular currency pair among forex traders. Additionally, this is a cross-rate pair. In other words, this is a currency pair that does not involve the US dollar. Despite this fact, the US dollar still has a significant impact on the pair’s trajectory. So, when comparing the AUD/USD and USD/SGD charts, one can get a more or less clear picture of AUD/SGD movements.

Main features

AUD/SGD is considered an exotic pair. This is why its fluctuations are extremely small. The exchange rate of this pair is quite stable as inflation in Singapore is quite low. Besides, the local economy is an export-oriented one (its top exports are consumer electronics, pharmaceuticals, shipbuilding, IT software solutions as well as financial services.

Singapore is well-known around the world for its high standard of living and a healthy economy. It is the most developed country in East Asia. This is why it is part of the Four Asian Tigers.

The AUD/SGD pair is low-liquid compared to major currency pairs such as EUR/USD, USD/CHF, GBP/USD, and USD/JPY.

How to trade AUD/SGD

As mentioned above, this is a low-liquid pair. Therefore, when predicting its price movement, it is crucial to pay attention to currency pairs tied to the US dollar. Traders should take into account important US macroeconomic indicators such as GDP, the key rate, unemployment rate, labor market figures, etc.

Notably, the Australian and Singapore dollars react to the release of US economic data at a different speed. This is why the AUD/SGD pair can serve as an indicator of the swings in the rate of both currencies.

If you want to start trading cross rates, please carefully read the trading conditions of your broker. Usually, spreads for these instruments are higher than for the main currency pairs.

See Also

- Gold continues to draw investor attention, particularly in times of heightened uncertainty in financial markets.

Author: Irina Yanina

11:50 2025-04-16 UTC+2

1273

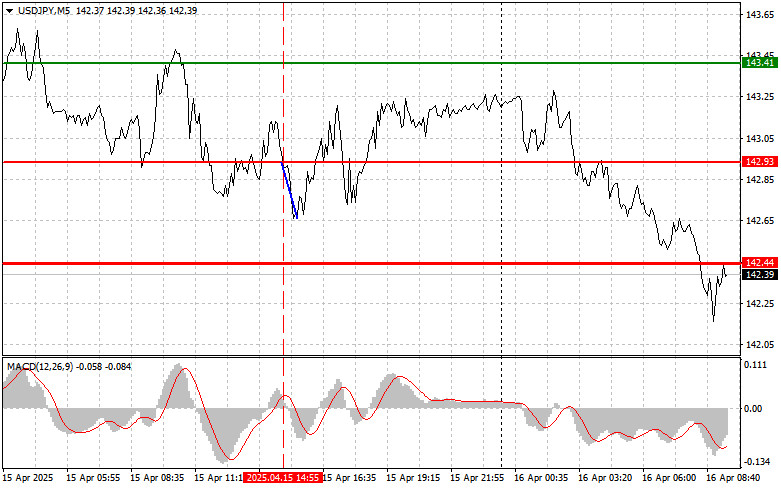

Type of analysisUSD/JPY: Simple Trading Tips for Beginner Traders on April 16. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 16. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:46 2025-04-16 UTC+2

1123

Technical analysis / Video analyticsForex forecast 16/04/2025: EUR/USD, GBP/USD, USD/CAD, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/CAD, Oil and BitcoinAuthor: Sebastian Seliga

09:55 2025-04-16 UTC+2

1108

- USD/CHF. Analysis and Forecast

Author: Irina Yanina

11:41 2025-04-16 UTC+2

958

Trading Recommendations for the Cryptocurrency Market on April 16Author: Miroslaw Bawulski

09:01 2025-04-16 UTC+2

958

Wall Street ended the session in the red. Shares of giants Boeing and Johnson & Johnson took the biggest hit as uncertainty around tariff policy continues to weigh on investor sentiment. While the banking sector posted gains, buoyed by strong earnings from major players, it was not enough to.Author: Ekaterina Kiseleva

11:12 2025-04-16 UTC+2

928

- Fundamental analysis

Confrontation Between the U.S. and China Will Negatively Impact Markets (Potential for Renewed Declines in #NDX and Litecoin)

Confrontation Between the U.S. and China Will Negatively Impact Markets (Potential for Renewed Declines in #NDX and Litecoin)Author: Pati Gani

11:34 2025-04-16 UTC+2

883

US stock market on April 16: the S&P 500 and NASDAQ resume their slideAuthor: Jakub Novak

12:22 2025-04-16 UTC+2

778

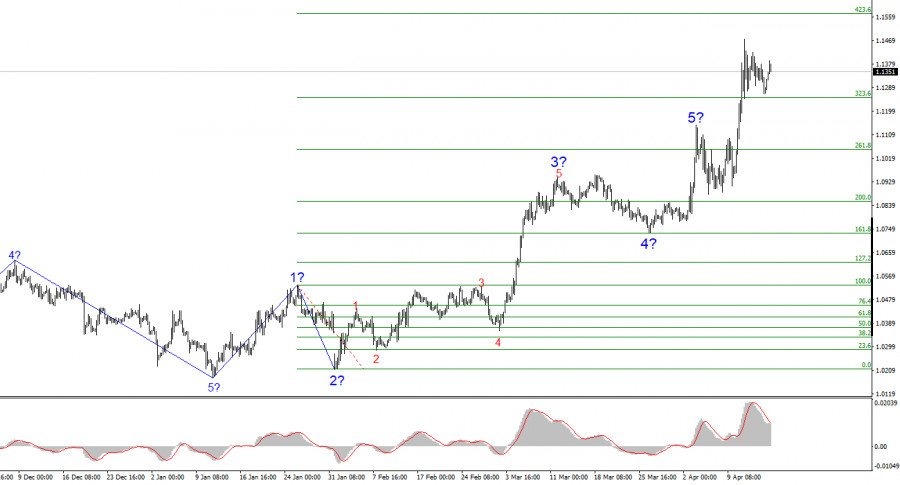

The EUR/USD pair rose by several dozen points during Wednesday's session.Author: Chin Zhao

18:56 2025-04-16 UTC+2

763

- Gold continues to draw investor attention, particularly in times of heightened uncertainty in financial markets.

Author: Irina Yanina

11:50 2025-04-16 UTC+2

1273

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on April 16. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 16. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:46 2025-04-16 UTC+2

1123

- Technical analysis / Video analytics

Forex forecast 16/04/2025: EUR/USD, GBP/USD, USD/CAD, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/CAD, Oil and BitcoinAuthor: Sebastian Seliga

09:55 2025-04-16 UTC+2

1108

- USD/CHF. Analysis and Forecast

Author: Irina Yanina

11:41 2025-04-16 UTC+2

958

- Trading Recommendations for the Cryptocurrency Market on April 16

Author: Miroslaw Bawulski

09:01 2025-04-16 UTC+2

958

- Wall Street ended the session in the red. Shares of giants Boeing and Johnson & Johnson took the biggest hit as uncertainty around tariff policy continues to weigh on investor sentiment. While the banking sector posted gains, buoyed by strong earnings from major players, it was not enough to.

Author: Ekaterina Kiseleva

11:12 2025-04-16 UTC+2

928

- Fundamental analysis

Confrontation Between the U.S. and China Will Negatively Impact Markets (Potential for Renewed Declines in #NDX and Litecoin)

Confrontation Between the U.S. and China Will Negatively Impact Markets (Potential for Renewed Declines in #NDX and Litecoin)Author: Pati Gani

11:34 2025-04-16 UTC+2

883

- US stock market on April 16: the S&P 500 and NASDAQ resume their slide

Author: Jakub Novak

12:22 2025-04-16 UTC+2

778

- The EUR/USD pair rose by several dozen points during Wednesday's session.

Author: Chin Zhao

18:56 2025-04-16 UTC+2

763